Fintech funding across Europe and Asia slumped visibly in 2022, according to the newest industry data from Innovative Finance. The latest report focused on the UK's fintech industry showed an 8% slump in overall funding on the Island and 30% worldwide.

Fintech Funding Goes Down in the UK

According to the press release from Monday, the fintech sector in the UK attracted $12.5 billion in 2022, compared to $13.5 billion reached a year earlier. The decade-long rapid growth of the industry backed by venture capital has been halted by rising interest rates and market shocks caused by the war in Ukraine.

The $10.2 billion alone went to fintech companies located in London. Although the number is 5% lower than in 2021, it shows the City's clear dominance as the country's primary financial technology hub .

"London's fintech industry has consistently proven itself to be both robust and ambitious in the face of economic challenges. As businesses brace for a turbulent 2023, fintech firms can play a vital role. Our industry can and will bounce back quickly, driving growth, job creation and enabling businesses to reach their full potential," Khalid Talukder, the Co-Founder of DKK Partners, said.

Despite declines in fintech funding in the UK, depreciation was far less painful than in other parts of the world. Global support for the industry shrank by about 30% to $95 billion. The total number of completed investments fell from 6,146 to 5,263.

Not a Good Time for Fintechs?

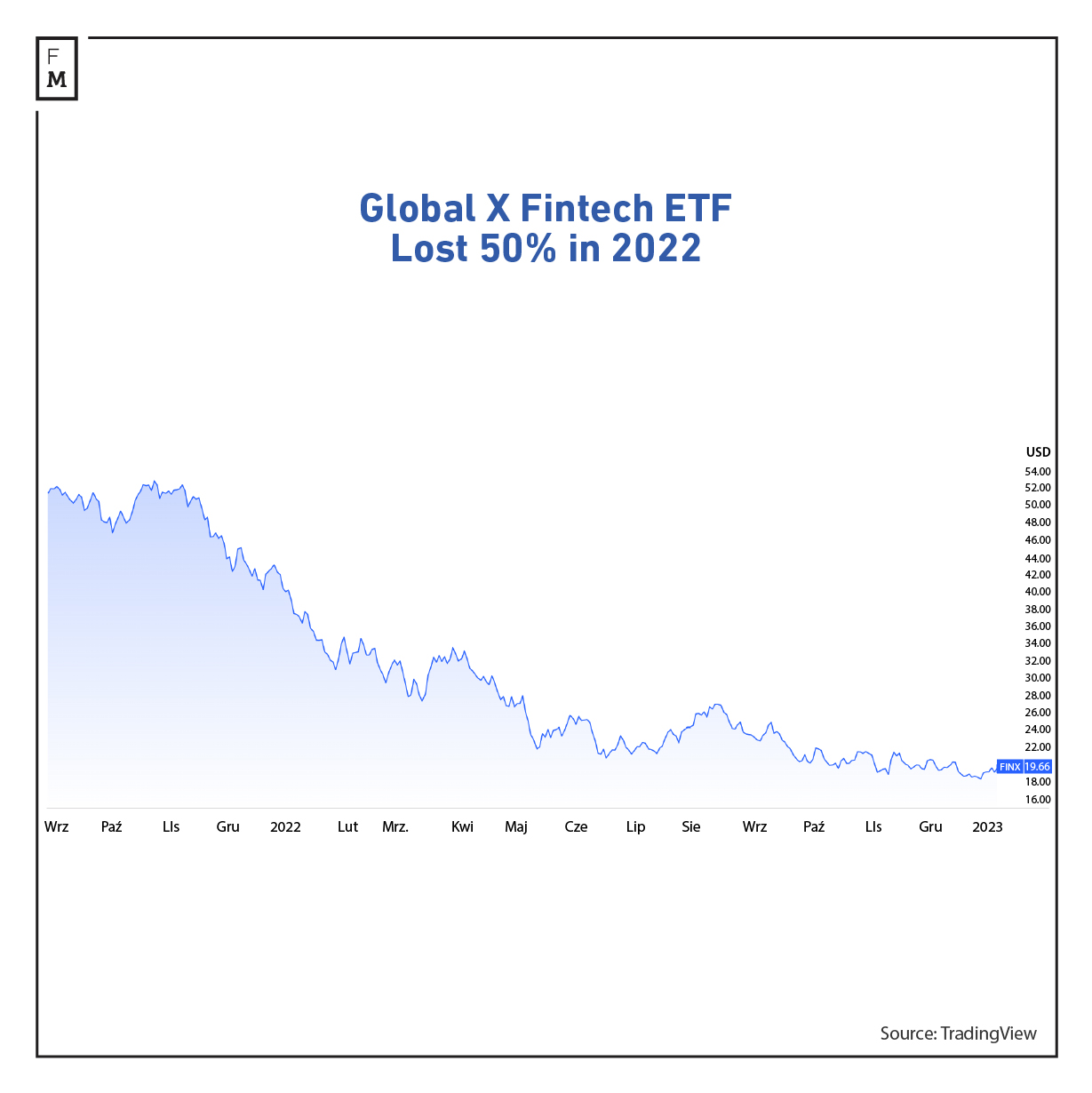

In addition to falling investment numbers, deteriorating conditions for the fintech industry is visible on the stock market charts. The sector fared worse than finance and tech companies, looking miserably against an already weak 2022.

Greater sensitivity to higher interest rates, a shift away from excessive risk and the fallout from pandemic-era catalysts have meant that investors are no longer looking at the financial innovation industry as a potential money-maker.

The Global X Fintech ETF, which tracks companies such as Adyen and Block, is down 52% year over year (YoY). By comparison, the financial sector of the S&P 500 Index slid 12% and the Nasdaq Composite Index, the benchmark for technology companies, fell 33% YoY.

According to the Wall Street Journal, other indexes and funds focused on the fintech industry looked even worse. Fund manager Cathie Wood 's ARK Fintech Innovation ETF fell 65% YoY, and the F-Prime Fintech Index gave up 71% of its value.