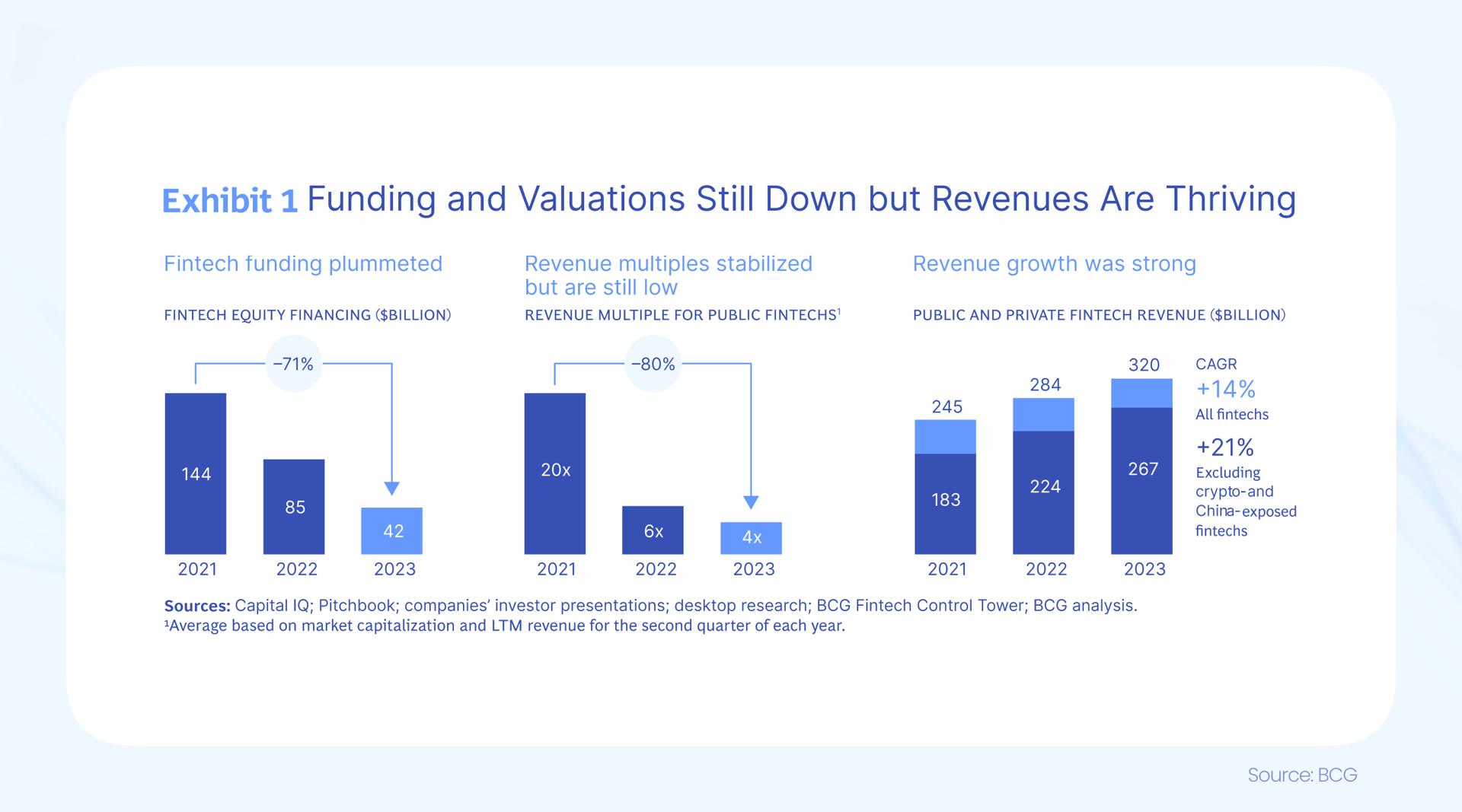

The global fintech industry continues to show resilience, with revenues growing 14% annually from 2021 to 2023 despite a sharp decline in funding and valuations, according to a new report from Boston Consulting Group (BCG) and QED Investors.

Fintech Sector Sees Revenue Growth despite Funding Crunch

The report, titled "Global Fintech 2024: Prudence, Profits, and Growth," reveals that while fintech funding has plummeted by 70% since 2021 and valuation multiples have dropped from 20 times to 4 times revenue, the sector's top line has remained robust. When excluding crypto-related and China-exposed fintechs, revenue growth reaches 21% annually.

Future forecasts are also satisfying. By 2030, the entire global fintech sector is expected to grow fivefold to $1.5 trillion in revenue over the next six years.

"Profitability and compliance are now the cornerstones of fintech success," said Deepak Goyal, BCG Managing Director and Senior Partner. "They are essential for attracting continued investment, scaling operations, and building lasting, valuable companies."

While fintech funding has significantly declined over the past few years, the authors of the report assert that there is no shortage of capital in the industry. The year 2021 was simply record-breaking and brought an "overabundance.”

"It has been a sobering three years for fintechs," the report reads. "However, we believe these challenges are part of the short-term correction - a tempering of investor enthusiasm - we discussed in last year’s report and that those challenges are now beginning to abate."

An independent report from KPMG, highlighted by Finance Magnates in February, revealed that 2023 experienced the poorest fintech funding results in five years. Global fintech investment decreased to $113.7 billion in 2023, marking a substantial decline from $196.3 billion in 2022.

4 Key Trends for Fintech Future

The study, which drew insights from interviews with over 60 global fintech CEOs and investors, identifies four key trends shaping the industry's future:

- Embedded finance is projected to become a $320 billion market by 2030, with the small and medium-sized business segment accounting for nearly half of that figure.

- Connected commerce is emerging as a potential game-changer for banks, offering new revenue streams and increased customer loyalty.

- While open banking continues to be relevant, it is expected to have a more significant impact on advertising than on traditional banking services.

- Generative AI is delivering immediate productivity gains in areas such as coding, customer support, and digital marketing , with product innovation expected to follow.

Nigel Morris, Managing Partner at QED Investors, emphasized the industry's potential, stating, "With an annual global profit pool of $3.2 trillion on a base of $14 trillion of total revenue, the financial services industry is both massive and ripe for innovation."

According to the report, the fintech market should see a significant uptick in IPO activity, especially in the UK, as investors return to the market in 2024, following a very weak 2023. Data from BCG indicates that the number of investments in fintech companies this year has already surpassed the total investments of the previous year.