The global fintech company Broadridge has released its annual survey, highlighting the adoption of artificial intelligence (AI) among financial advisors in North America. Dubbed the Fifth Annual Broadridge Survey, the findings show that 56% of Canadian advisors use or plan to use generative AI in digital marketing, while the figure stands at 43% for US advisors.

Additionally, the survey shows that financial advisors who communicate quarterly exhibit a confidence level of 68%, surpassing their counterparts communicating annually or less frequently at 51%. Personalized content marketing also emerged as a key success factor, with 71% of those engaging in it expressing confidence in achieving their goals.

Advisor AI Usage and Perceptions

Next-generation technologies, particularly generative AI, play a pivotal role in reshaping marketing efforts. Advisors leveraging AI reported higher success rates in converting social media leads to clients, spending more time on marketing, and generating more website leads.

With generative AI being a crucial tool, advisors are exploring its potential for developing personalized content and marketing campaigns, automating tasks, and segmenting clients.

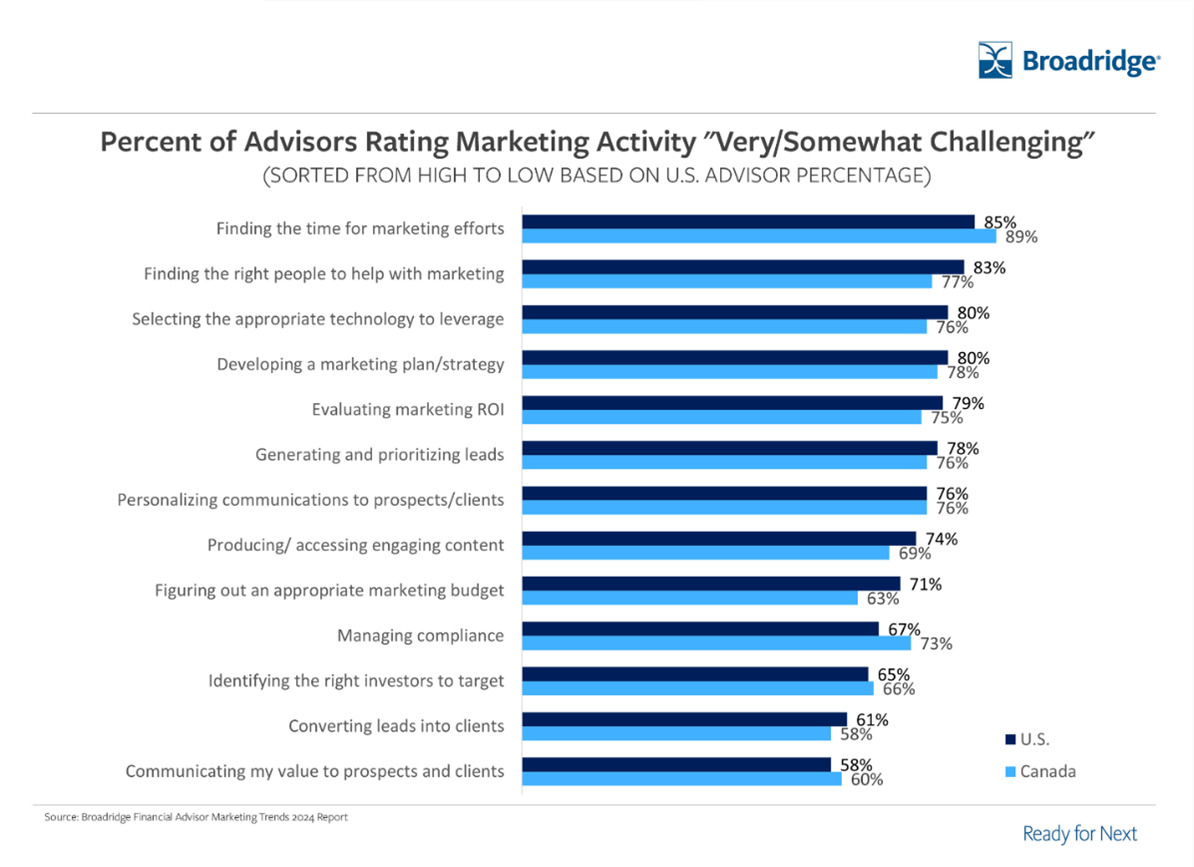

While marketing challenges persist, the survey revealed a decline in advisors with a defined marketing strategy. Only 20% of financial advisors in the US and 21% of Canadian financial advisors reported having a defined strategy. Financial advisors with a strategy demonstrated significantly higher confidence levels at 83% for advisors in the US and 89% for those in Canada.

Kevin Darlington, the General Manager and Head of Broadridge Advisor Solutions, mentioned: "Many concerns and questions remain around the technology, so advisors should understand the risks and opportunities to leveraging generative AI in a digital marketing strategy to remain compliant while attracting prospects."

"Similarly, social media has become a popular tool to attract the next generation of potential clients and should be harnessed effectively for lead generation."

Social Media

Social media also takes center stage, with 57% of Canadian advisors investing or planning to invest, indicating a focus on attracting younger clients. LinkedIn and Facebook emerged as the top platforms for lead conversions.

Financial institutions now leverage social media platforms to offer access to services directly through users' accounts. Major collaborations like Facebook's integration with PayPal and Twitter's partnership with Square Cash highlight the growing trend of social media becoming a conduit for financial transactions, Finance Magnates reported.

Additionally, financial services companies can embrace decentralized technologies like blockchain to empower users with data ownership while exploring incentive-based models to encourage data sharing.