With the rise of altenrative investments, and specifically new funding platforms such as for real estate Crowdfunding and marketplace investing, Millennium Trust Company is launching a network for investors to tap multiple offerings on one solution. Called the Millennium Alternative Investment Network (MAIN), it provides a unified platform for investors to analyze their portfolio and see new investments from participating alternative investment providers.

The product launch occurs as investment aggregation solutions and investment marketplaces have become more commonplace across all asset classes. For financial advisors, the solutions provide them with a holistic overview of understanding their client’s current wealth and provides an efficient interface for future planning. In addition, even asset managers and brokers have begun to feature tools where their customers can integrate account details of portfolios at competitor firms in order to provide their clients with greater overall control of their investments.

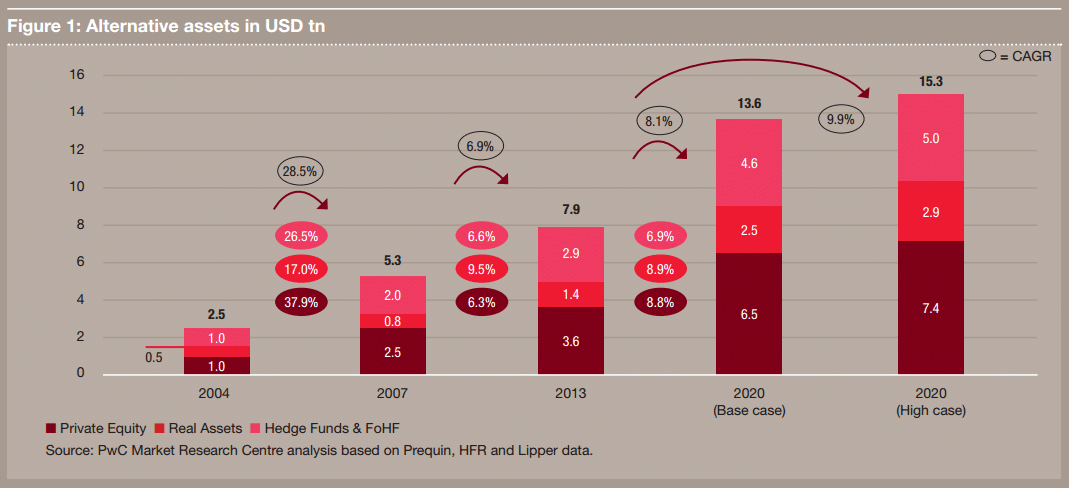

In terms of alternative investments, which include investments in hedge funds, real estate and private equity funds, according to a report from PwC, alternative assets are expected to grow to as much as $15.3 trillion by 2020. This compares to the $7.9 trillion in assets that was calculated as of 2013.

Part of the growth is expected to occur due to the role of Fintech in investing. As a result of marketplace technology, real estate crowdfunding has made it more cost efficient for a wider group of investors to participate in the asset class.

According to Millennium, the need for such a solution in the alternative investment market comes as the asset class' client correspondence has predominately been offline. Scott McCartan, CEO of Millennium Trust Company, explained: “Investing in alternatives has historically been a cumbersome, paper-centric process and we are committed to using technology to change that.”

According to McCartan, the firm also believes that MAIN will provide an opportunity for investors to not just review multiple offerings in one solutions, but also learn about new investment types. Regarding this, he stated: “Not only does MAIN provide individuals and advisors with access to a range of investment platforms and alternative assets they may not have previously been aware of.” In this regard, Millennium is teaming up with many alternative asset providers to integrate their solutions within MAIN.