If the iPhone is responsible for the phrase 'there is an app for that', perhaps we can thank eBay for 'there is a marketplace for that'. Breaking boundaries between supply and demand, online marketplaces which had initially been dominated by products have now migrated to services. Among startups in this fields, companies such as Airbnb and Thumbtack have grown their service oriented marketplaces to billion dollar valuations.

Aiming to crack another major industry with the formation of a marketplace for quantitative analysts is Quantiacs. Speaking with CEO Martin Froehler, he explained to Finance Magnates that their goal is “to disrupt the hedge fund industry”, of which Quantitative Trading based firms represent $300 billion of funds under management.

To disrupt the hedge fund industry

To do this, Quantiacs has created a marketplace for quantitative analysts to backtest and share their strategies. These strategies can then be licensed by institutional investors who are only charged if they are profitable, with the standard 20% performance fee which is split between the quant and Quantiacs.

Martin Froehler, CEO, Quantiacs

Froehler explained that a problem in the hedge fund industry is that it is very inefficient in utilizing its manpower. As such, while there may be over 100 qualified candidates for open quantitative positions at leading hedge funds like Renaissance Technologies or Citadel Securities, the job is only filled by one lucky applicant. According to Froehler, the result is “lots of potential great quants, but they don’t have companies to work for.”

With their marketplace, Quantiacs is aiming to provide a platform for any great quant to showcase its strategies and be used by institutional investors. For investors, Froehler explained that Quantiacs provides an opportunity for them to tap a wide ranging group of quantitative developers. As such, the product is being marketed to multiple types of institutional investors including hedge funds and asset managers seeking to add quantitative strategies to their existing portfolios and quant funds looking to integrate third party ideas.

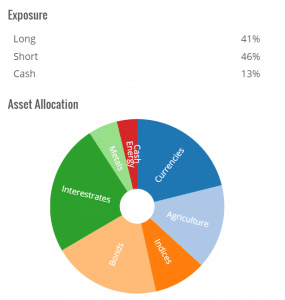

Among the requirements to be listed on the marketplace are quantitative strategies with long term performance horizons. In contrast to high frequency trading where the strategies need to be continually tweaked and evolved, Quantiacs prefers systems that don’t require ongoing maintenance. Froehler explained that this is because they want to attract highly scalable strategies that trade futures, have multiple years of backtested data and can be relied upon to perform well for a multi-year timeframe.

Since launching the marketplace a year and a half ago with a trading competition of Stanford student quants, the marketplace has attracted over 700 trading strategies. The oldest ones on the system are those from the initial Stanford competition.

Currently, strategies on the system are being used to manage funds provided by a group of private investors, including participants in Quantiacs' funding rounds. In the near future though, Quantiacs expects to launch the marketplace publicly to external institutional investors.