NAGA Group AG has formally been listed on the Frankfurt Stock Exchange , following a successful initial public offering (IPO). The group was listed in the SME segment scale on the Exchange with a total issue volume of $2.86 million (€2.51 million) and an initial price of ($4.1) €3.60 per share.

The London Summit 2017 is coming, get involved!

NAGA Group’s inclusion represents the first company from Deutsche Börse’s Venture Network to be available for trading on the Frankfurt Stock Exchange. The Venture Network caters specifically to small and medium size enterprises (SMEs) seeking equity financing options. Today’s successful listing follows recent regulatory approval by Germany’s Federal Financial Supervisory Authority (BaFin), which green lighted NAGA’s inclusion on the Frankfurt stock exchange earlier this year.

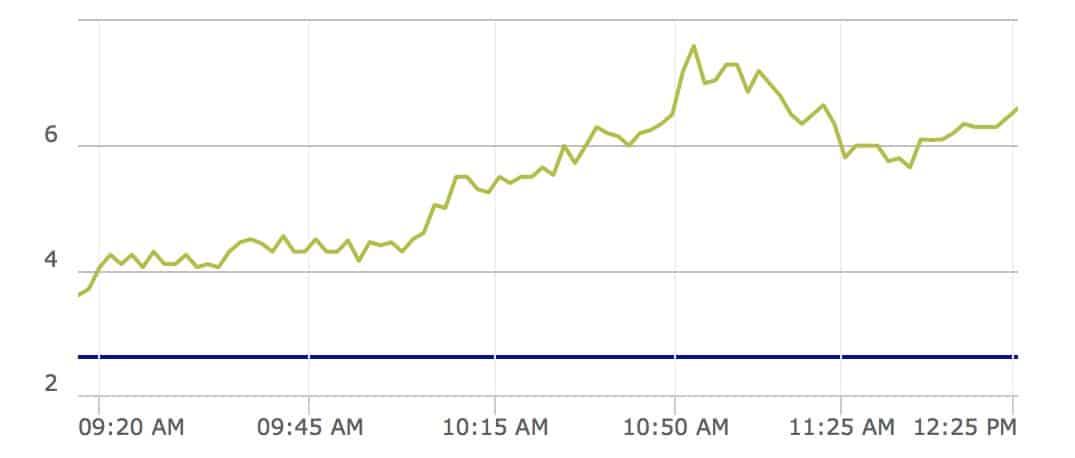

Deutsche Börse - NAGA share trading 10/7/2017

Since June 8 NAGA has been offering upwards of 1.0 million new shares of $2.96 (€2.60 each) through subscription. Hamburg-based NAGA Group is a provider of disruptive financial technology and innovation incubation. The company is the owner of SwipeStox, a popular mobile-centric app for social trading. SwipeStox has been one of the fastest-growing entities over the past year, having been integrated and utilized by several leading brokerages. The mobile app is currently providing services to over seven brokers, including names such as One Financial Markets and ThinkMarkets.

Leading up to the IPO, NAGA had also led a successful investment round back in March 2017. The group managed to secure one of the largest FinTech Series A investments in all of 2017 from FOSUN, a global Chinese investment group, helping advance its agenda and growth trajectory. The $14.2 million (€12.5 million) funding round helped serve as an eventual impetus for the group’s IPO plans, which had been targeting a July listing for months.