While Silicon Valley remains the hub for Venture Capital (VC) firms, New York is the place to be for FinTech startups, according to Matt Harris, Managing Director of Bain Capital Ventures (BCV), which - along with Bain Capital - oversees nearly $76 billion worth of businesses through its portfolio group of companies, speaking at the Empire Startups FinTech conference in the big apple yesterday.

The new world of Online Trading , fintech and marketing – register now for the Finance Magnates Tel Aviv Conference, June 29th 2016.

Finance Magnates attended the event as media on Tuesday, and it kicked off with a keynote from Bain Capital's Harris, who brought an interesting perspective on how fintech has evolved and explained some key trends including the amount of funding that has risen in recent years into emerging startups.

A copy of the presentation used during the keynote was obtained by Finance Magnates, courtesy of Mr. Harris, several excerpts of which can be seen below, along with highlights from his live talk yesterday.

We have dramatically under-indexed on lending companies.

Source: Bain Capital Ventures

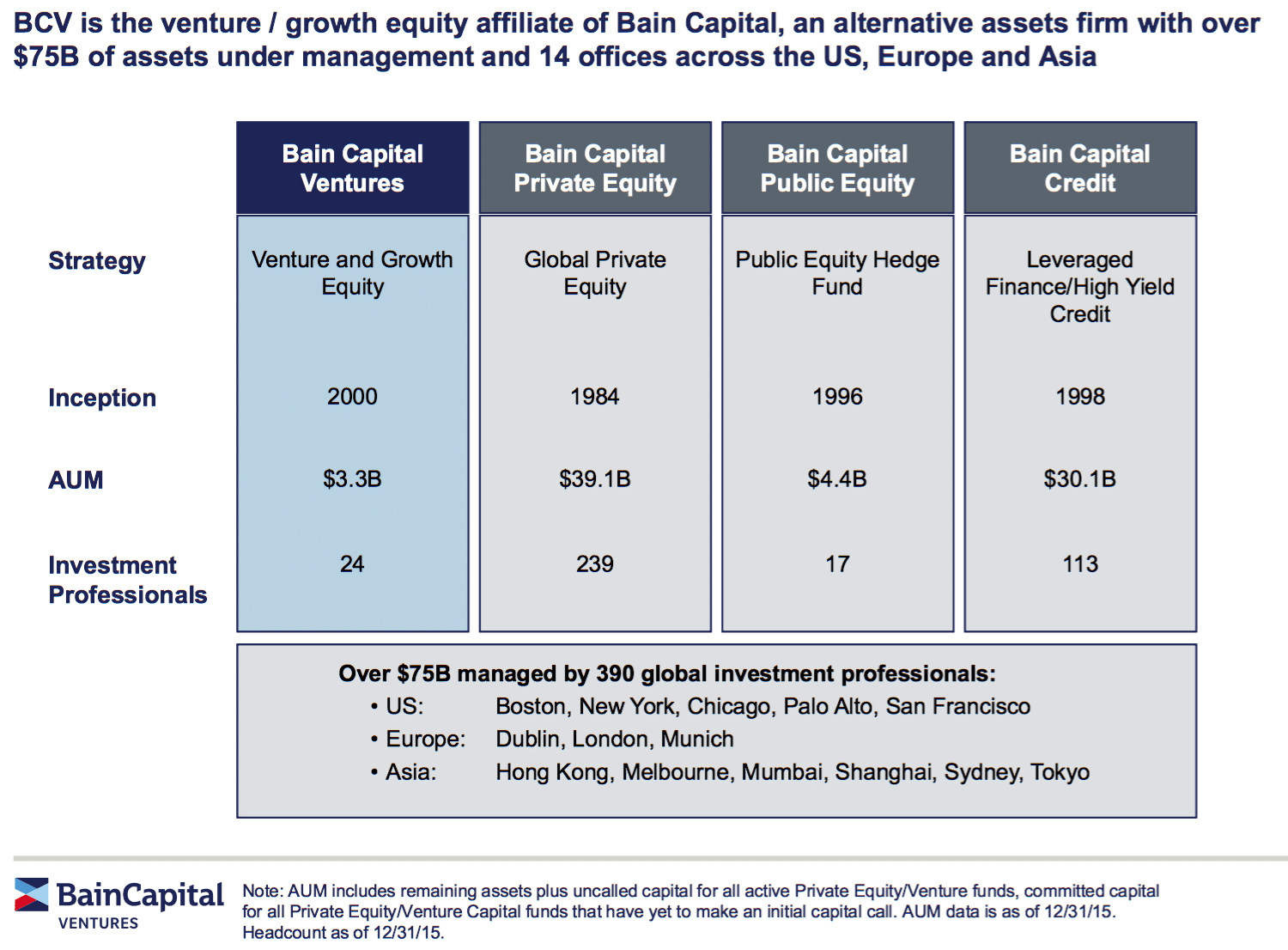

As a VC expert that owns 100's of multi-billion-dollar revenue generators, including the three largest payment businesses in Europe, along with a large portfolio of Payments companies including insurance, credit lending, capital markets and commercial merchant firms, Mr. Harris has the expertise to speak as a leading expert on fintech investments and managing portfolios of related companies across these industries.

IEX and fintech

Matt Harris

source: LinkedIn

One of Bain Capital’s investments is in IEX, the Alternative Trading System (ATS) which he described as a "great NY FinTech company" and one that competes with NYSE to clear equity trades in a way that prevents speed-traders or high-frequency traders (HFT) that employ latency-based approaches.

He also mentioned how the SEC is deciding right now if IEX can become a National Market System (NMS) which could help the company attract more trading volumes and grow from the 2% of US capital markets share that it controls as a dark pool.

Tech disruptors

The awaited decision for IEX's application has been written about extensively in the media, including by Finance Magnates, as it could potentially be a game-changer as a speed-bump is introduced to purposefully help level the playing field by slowing down all the incoming orders with a standardized amount of latency.

Later in the day at a subsequent panel, IEX’s Chief Market Policy Officer, John Ramsay, spoke alongside a group of speakers about regulatory technology (RegTech), including with Adrienne Wilson from the White House who serves as a special assistant to the President for Economic Policy and works on many fintech related policy issues. The increasing complexity of financial markets products was also a recurring theme during the event.

New York as fintech hub

During the speech, Mr. Harris said fintech had become a dominant sector in our industry and has become a thermometer of what is going on in NY, and added how Silicon Valley dominates in venture capital as the place to be but that's not true in fintech as many important companies have a number of incumbent advantages in New York.

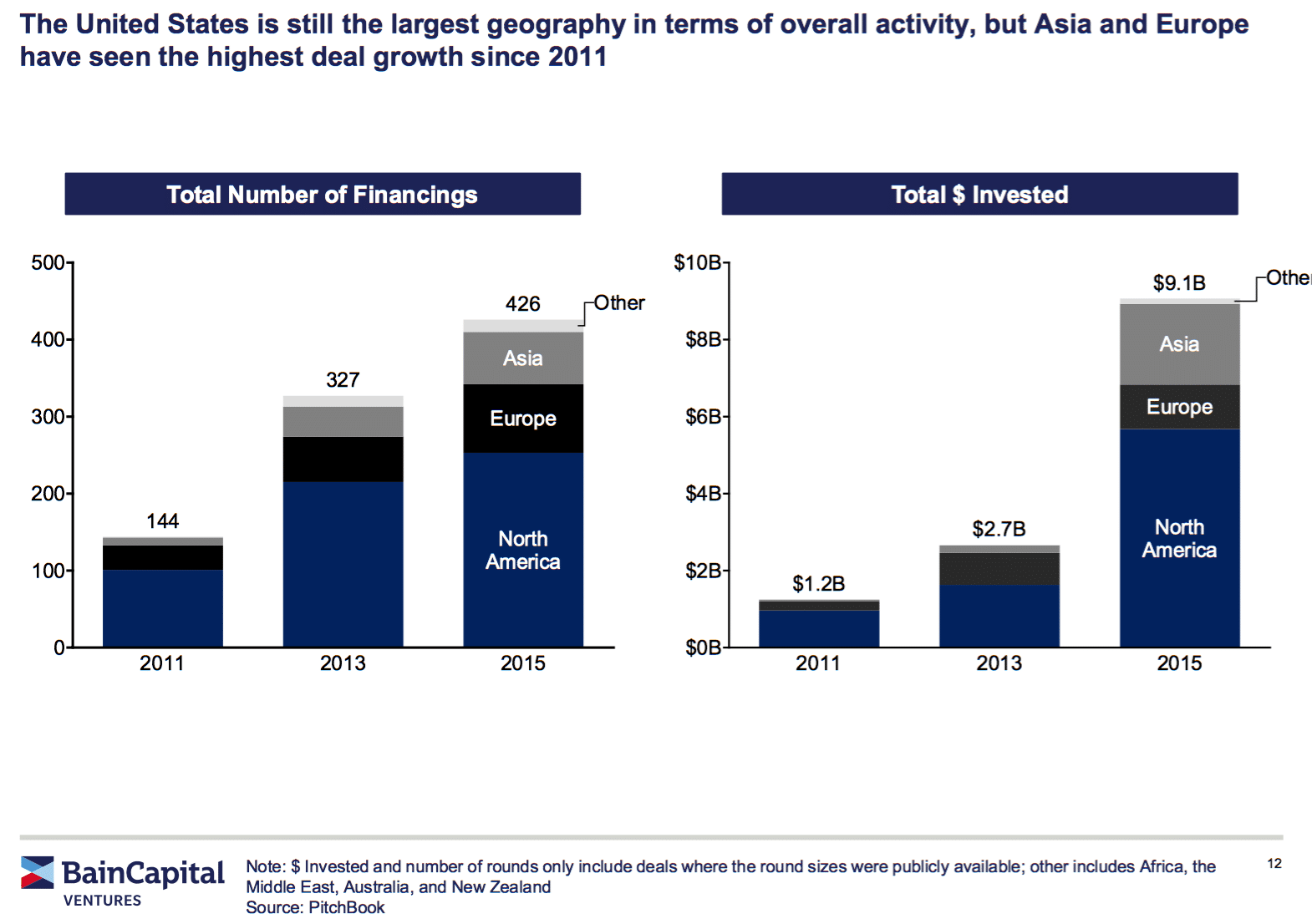

A series of slides were shown during the presentation that depicted the growth across the number of deals, and funding amounts that firms in the US received, as well as compared to other parts of the world, and a breakdown of the type of firms that were receiving capital investments from VC firms and other investors.

20% of all economic activity in the US was described as being within financial services, and fintech was a small portion of VC funding in 2003 representing less than 1% and now represents nearly 10% of VC business.

Fintech was previously payments space

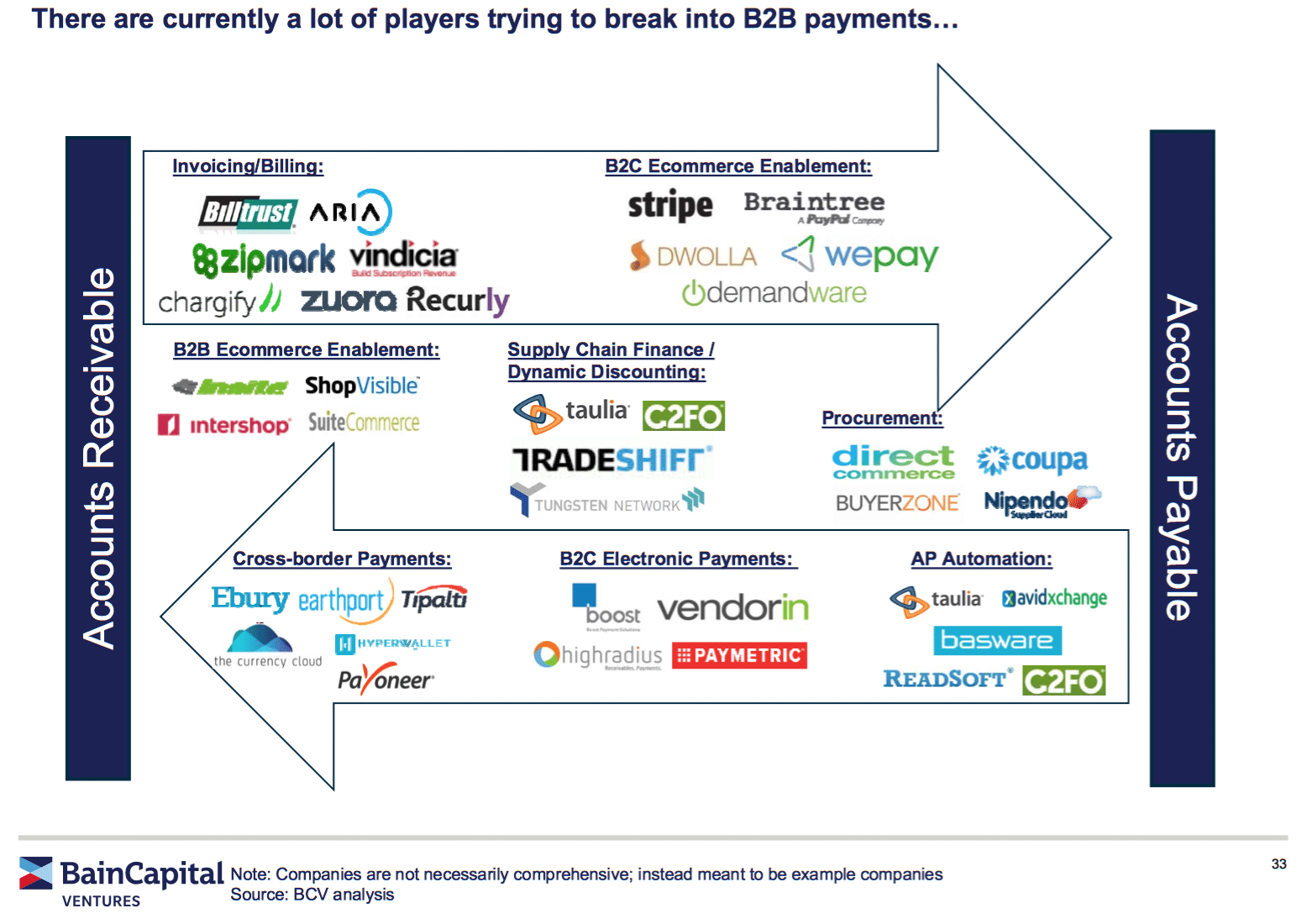

He also noted that the fintech space circled around payments, or in other words, 10 years ago the fintech space was actually the payments space - although recently lending has come to the forefront.

Therefore, although the fintech buzzword may be something new in recent years, it represents an underlying space that has been driving innovation for nearly a decade already and in many of the same fields that are still in focus today, including payments, banking and via mobile, among other fields of interest and industries.

Eight of the ten largest rounds last year were to lending companies, with socialfinance seeing the largest amount over the $1 billion threshold. And with regard to Unicorns or private companies that have passed the $1 billion valuation mark, there was a total of 93 of them in the United States as of April 2016, with a combined market cap of more than $326 billion, according to data from CB Insights and Pitchbook.

While the US has the largest overall funding activity, other parts of the world including Asia and Europe are seeing the highest growth compared to prior years, and as seen in the slide below.

Source: Bain Capital Ventures (BCV)

US financing rounds on the rise

The total number of financing rounds had reached 426 in 2015, up from 327 in 2013, according to data from pitch book that was presented in a slide.

From these number of deals, the total amount of money invested was $9.1 billion in 2015 and most of that had gone into later stage rounds with companies that were born in 2011, with the majority of the deals in the +$25 million range, and a roughly a sixth of that amount was in the $5 million-$25 million range.

Overall, there were 712 late-stage deals completed in the technology sector for a total of $27.6 billion raised, with late stage defined as series B through Z+ rounds.

From lending to payments

During his keynote at the event, Mr. Harris said: "We have dramatically under-indexed on lending companies." He added: "Lending is a fundamentally risky business and the notion that marketplace lending - this idea that you can sell your loans to someone else removes the risk from the business - I think is a faulty notion. And, that technically underlines my critique about the lending business."

Thanks to fintech innovation in recent years and the rise of popularity in microfinance, including microlending and microinsurance, a new wave of products are set to continue to build alongside traditional finance, and from new providers.

An example of the startups competing to acquire market share in the business to business (B2B) payments space can be seen below.

Source: Bain Capital Ventures (BCV)