For over a year we’ve heard from developers that commission-free broker, Robinhood, was in discussions about possibly launching integrations with its brokerage offering. For third-party developers, integrating with Robinhood would provide a solution for them to offer free brokerage services directly from their finance and trading apps and platforms. For its part, Robinhood has publicly stated on social media that they had plans to release an API but withheld from providing any timeframe on an official release.

Finally going public with its plans, Robinhood has recently announced integration with several third parties. The initial integrations were made with four firms, Openfolio, Quantopian, StockTwits and Rubicoin. With the integration, users of the third-party platforms will be able to integrate Robinhood accounts for trading directly from its products. Among the initial batch partners, the addition of Quantopian is worth watching as it has made its algorithmic Trading Platform available for free trading.

With the launch of third-party integration, Robinhood adds to a growing list of brokers who have launched API versions for developers. Among them include Tradier, whose business model is based on a brokerage API to provide connections to partners, as well as Interactive Brokers. In addition, Tradable has recently launched Tradable Embed, an open API version of its platform to connect both brokers and developers using its technology.

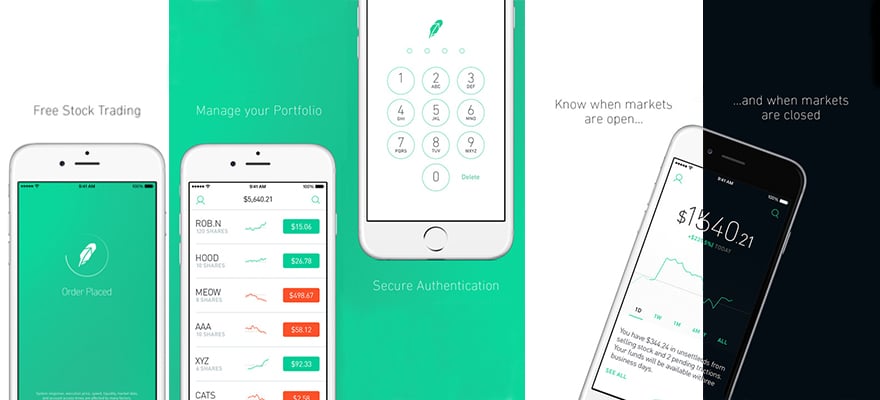

In regards to Robinhood, the broker has taken a mobile approach, with its platform being limited to iOS and Android devices. While this approach is simple and user friendly for customers, mobile apps are limited in their trading features. As such, third-party integrations provide the firm an opportunity to widen the available front-end platforms that can be used to analyze the market and trade with the broker, as well as appeal to a larger group of traders.