E*TRADE customers are receiving a new feature to help them with their stock analysis as the broker has announced the integration of an analysts rating tool, TipRanks. A service that rates recommendations from stock analysts, TipRanks aggregates information from thousands of individuals including professional analysts and advisors on financial trading sites.

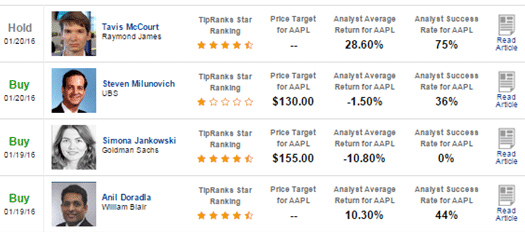

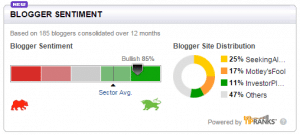

Among the novel introductions of the product was the availability of Wall Street forecasts for both real time and historical data to retail customers. With TipRanks, users are able to choose individual stocks and review the track record of analysts that are covering the stock. They can also drill down individual analysts to analyze their overall forecasts as well as view the sentiment of specific stocks.

Growth through partnerships

For TipRanks, E*TRADE is the largest broker to launch their solutions and is part of their growing B2B business. Launched as a retail facing company, TipRanks has gained interest from brokers as their interface and tools have been found to increase user engagement and trading volumes. According to TipRanks Co-Founder and CEO, Uri Gruenbaum, the firm expects all partnerships to compose 25% of revenues in 2016.

Gruenbaum explained to Finance Magnates that when the company first launched, “it wasn’t in our DNA to be a B2B company”. Based in Israel, Gruenbaum added that even as they worked on integrating the product with local firm Bank Hapoalim, which offered it their US stock trading investors, TipRanks had no expectations that it would become popular.

Despite their low expectations, according to Gruenbaum the solution immediately caught on. Gruenbaum cited several reasons they believe TipRanks appealed to both investors and brokers. Among them was the product’s uniqueness as he explained that “most brokers give the same info, but we are trying to replace that”. In addition, Gruenbaum cited the visual interface which is intuitive and Leads to further clicking and user engagement.

Beyond analysis of stock recommendations, TipRanks has recently incorporated ratings for corporate insider selling as well as portfolio changes from hedge funds. Both these features are aimed at spotting buying and selling trends that could have large impacts on a stock.

As for future releases, Gruenbaum stated that TipRanks has plans to soon launch a ‘smart dashboard’ that will allow users to import portfolios from any broker to have it reviewed. In addition, the firm is reviewing expansion plans to cover stock markets beyond the US such as the UK and Australia.