In the wake of the Covid-19 pandemic, we have seen a widespread IPO frenzy dominate the world of investing. The second half of 2020 produced a record-breaking number of debuts as companies began to go public in a bid to cash in on a global push towards digital transformation. However, not everybody across the investing ecosystem had a ticket to the party.

Initial public offering volumes continued to rally into 2021, but much of the action was reserved for institutional investors, as opposed to the burgeoning retail investor landscape, despite similarly record-breaking numbers of new individual investors arriving on the market over the same time frame.

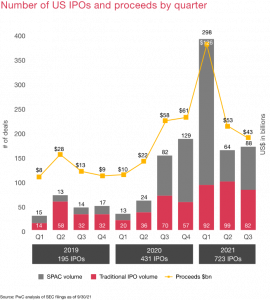

(Image: PwC)

As the chart above shows, in the first three quarters of 2021 alone, the total number of IPOs eclipsed that of the past two years in their entirety. Additionally, the value of the proceeds taken in 2021 far exceeded those of 2019 and 2020, respectively.

With landmark IPOs like Robinhood, Rivian, Coinbase and DiDi Global all going public in 2021, there has been no shortage of major arrivals on stock exchanges all around the world. So, why are retail investors finding it so difficult to take part? Let’s take a deeper look at an investment ecosystem that still suffers from an inclusivity problem.

An Exclusive Club for Institutional Investors

Alongside the rise of IPO volumes, we have seen significant growth in the number of retail investors who are taking to the market.

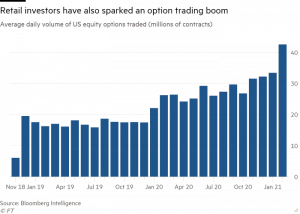

(Image: Financial Times)

As data from the Financial Times shows, retail investor growth has led to a significant increase in the US equity options that were traded, moving into 2021.

There are two key reasons for the increasing numbers of retail investors on the market. Firstly, the zero-commission payment-for-order-flow business model that was adopted by Robinhood and followed by a range of other online brokerages in late 2019 became a draw for new investors to take their first steps on the market. Secondly, the emergence of the Covid-19 pandemic provided individuals with more government stimulus packages and the spare time they needed to fully embrace stock market investing.

However, these increasing numbers of retail investors have not been reflected across IPO investing, which is a side of the industry that is overwhelmingly dominated by institutions.

Maxim Manturov, the Head of Investment Research at Freedom Finance Europe, explains that IPOs have long been the vocation of institutions. “Historically, institutional investors get around 90% of all shares, with only around 10% left for retail trades. This is where allocation comes from: when the demand is high, the broker will have to reduce order amounts so as to at least partially fill all of them. The allocation ratio, meanwhile, depends on the investor trading activity and volume,” Manturov noted.

Dmytro Spilka, CEO and Founder of Solvid.

This highly skewed distribution is because the IPOs of most companies are generally offered to the public via an underwriting syndicate. These syndicates are comprised of underwriters who purchase the shares from the issuer to sell on. However, there is only a very limited number of brokerages that are invited into the syndicate as underwriters, and even then these brokers may not open the shares up to retail investors.

These underwriters also decide on the terms and structure of the IPOs before trading begins, and this includes the percentage of shares that go to institutions and those allocated to retail investors. Typically, underwriters target more institutional investors because they’re far more resourceful and thus capable of buying significantly large volumes of shares in one single transaction, making it far easier for underwriters to sell their allocation of shares.

However, in recent years, many companies, and particularly fintech companies, have sought to Bridge the inclusivity gap between institutions and retail investors when it comes to initial public offering participation. However, significant disadvantages still exist.

The Limitations of Today’s Retail IPO Services

The most notable move to generate a greater level of inclusivity among retail investors came in the form of Robinhood’s recent product, IPO Access.

IPO Access was developed as a portal to allow initial public offering participation among Robinhood’s large userbase. As part of the platform’s commitment to the democratization of finance, retail investors had the ability to participate in a number of IPOs regardless of their account balance or the volume of shares they were buying.

Robinhood not only offered up shares in its own company’s IPO as part of the service but that of edtech Unicorn , Duolingo, and many other promising tech initial public offerings.

Nevertheless, access to IPOs via Robinhood comes with restrictions that risk undermining the innovative product.

Dmytro Spilka, CEO and Founder of Solvid.