A new report published by KPMG, entitled “Meet Eva - Your Enlightened Virtual Assistant and the Future Face of the Invisible Bank”, has predicted that by 2030 technology will cause a fundamental shift in banks and banking, making it completely invisible to customers.

This 'invisible bank' will be buried within a broader, more digital, more connected way of life whereby consumers will interact with a personal digital assistant.

The FM London Summit is almost here. Register today!

Perhaps of most interest in such a model is the disappearance of large parts of the traditional bank including customer service call centres, branches and sales teams. This transition would be painful and costly, while leaving the future of today's banks unclear.

The winners, therefore, are likely to be those who are able to make best use of their data, drive down costs, build effective partnerships with third parties, and build strong cybersecurity.

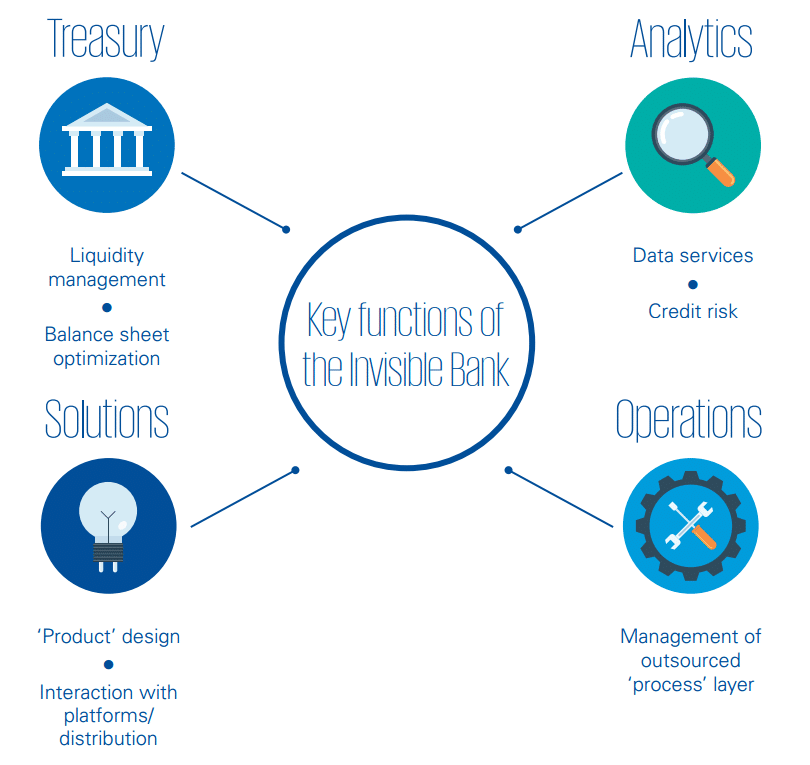

Key functions. A slide from the report. Source: KPMG

A Day with EVA

A typical example of a day with EVA involves the assistant approaching the customer after accessing their payment data and noticing an increase in spending on junk food. Taking into consideration data that has been collected from the customer's wearable device, EVA suggests a yoga class prior to booking and paying for it.

When the customer asks about their finances, the assistant explains that it has "shifted some savings around to get you a better interest rate and there was an unexpected charge from the USA which I have arranged a refund for".

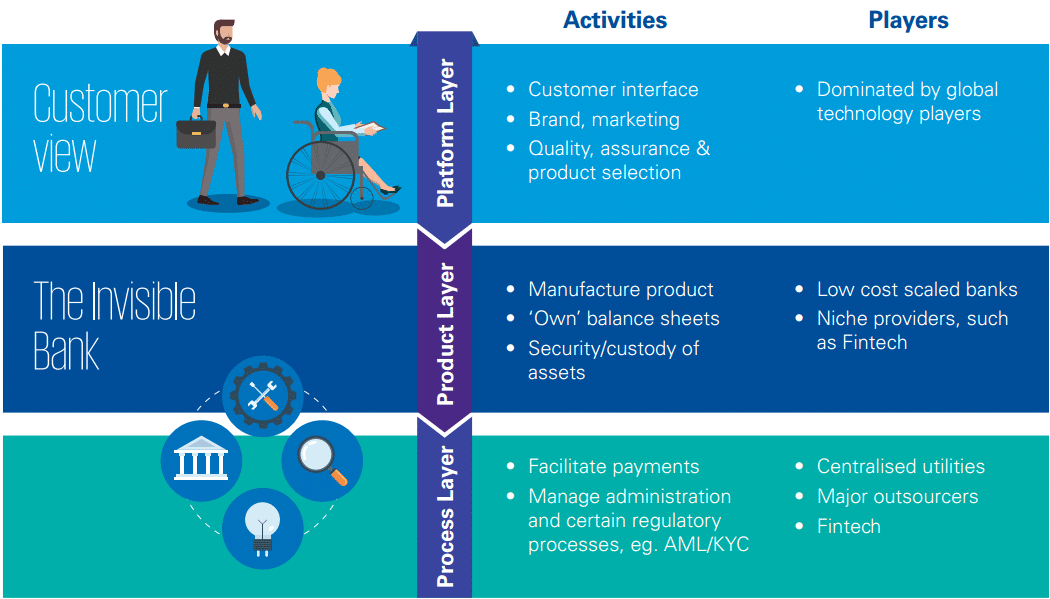

With the EVA vision, there is no 'banking app' as such, with access to money being interwoven with health, time management, leisure and other parts of daily life suggesting that the 'platform layer', or customer interface, will probably be provided by global technology players like Google, Apple and Facebook.

Banks can own the product layer - product, balance sheets, security and custody of assets - but a new wave of utilities - outsourcers, fintechs and existing giants such as Visa - will emerge to win the process layer, facilitating things like Payments , client onboarding and KYC.

Regulation

However, the report points out that as banking becomes fundamentally different, so too must the regulatory context which will be challenging for financial services regulators as it does not fit or comply with much of the current regulatory requirements.

To date, regulators have been reluctant to express even informally their comfort regarding the use of artificial intelligence. If EVA books and pays for a yoga appointment that Luca didn’t want, is that grounds for complaint? Who will be responsible for the error - the platform, the payment agent or the hardware provider?

Conclusions

Warren Mead, fintech lead at KPMG, commented: "Banks are making efforts to improve customer service through use of exciting technologies like robotics, artificial intelligence and Blockchain , but the pace of change is slow and in reality, I’d say banks are only 10% of their way through their digital transformations.”

Nevertheless, the report concludes that building an invisible future technology is an unstoppable driving force in society. Banking has only just commenced its journey of change and in reality we can only guess what that change will look like by 2030.