A new report by Citi Bank forecasts that banks in the United States and Europe will cut 1.7 million jobs over the next decade due to FinTech innovations that will oust market share and/or replace the worker’s positions with a new approach.

The report was authored by Ronit Ghose, Citi's Global Head of Bank Research, who, according to coverage by the FT, said: “Obviously the biggest take out will happen in countries that have been through a crisis or are tech savvy,"

The number forecasted would be 30% of the currently employed staff count across the U.S. and Europe, where there has already been a reduction of over 700,000 staff since peak levels according to the report.

Last year Citi Bank held $301 billion in deposits, and had $391 billion in average assets including $281.3 billion in average loans, according to its 2015 annual figures.

Lending and Payments were two areas that accounted for nearly half of the almost $20 billion that had gone into FinTech related companies in the past six years, according to the report.

The Citi Bank report said the two drivers for forecasted cuts included the need for banks to decrease expenses and become leaner amid increasing competition, coupled with the move towards automation of in-branch services (i.e. teller, deposits,etc..).

The world’s largest money manager, Blackrock, was also said to lay off nearly 3% of its workforce or 400 people, according to sources cited by Bloomberg coverage.

Will the same trend appear in Asia?

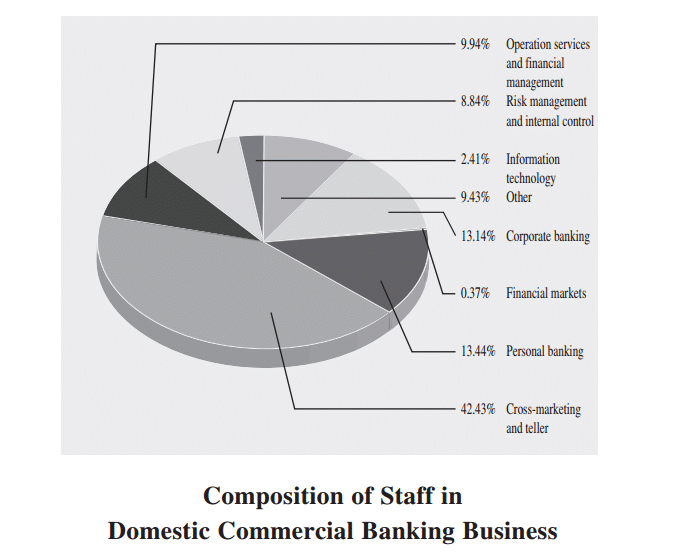

A similar forecast was made by PwC with regard to the shift in market share to FinTech firms, as noted by Finance Magnates in a related post this week. Today, S&P revised China's credit rating down to negative, and after the country's fourth-largest bank, Bank of China, reported financial results yesterday. An excerpt from BoC's 2015 results highlight its workforce distribution:

Source: Bank of China 2015 annual results

As the last trading day of the first quarter (Q1) is underway this Thursday, cost-cuts and slashes to dividends may also be expected for banks in Europe, as the sector is poised to be the worst performer in Europe so far in 2016. Conversely, a number of exchanges across Europe had reported higher figures thanks to the year-to-date volatility.

In terms of some of the firms that stand to benefit from future FinTech growth, and with regard to the payments and lending segments, a study earlier this month supported by a number of universities highlighted trends in alternative finance across parts of Asia, where China leads the region.

FinTech Reforms

Australia has also shown increased interest in FinTech initiatives and reform, following a detailed paper released by its government earlier this month.

The Financial Stability Board (FSB) meeting in Tokyo today included the organization reviewing major areas of FinTech innovation, including distributed ledger technology such as Blockchain , and proposed a framework for categorising them and assessing any related financial stability implications, according to an FSB press release.

According to the study, titled 'Harnessing Potential', China is the world’s largest online alternative finance market by transaction volume, registering $101.7 billion in 2015 (converted from RMB values), on the basis that alternative finance were activities conducted outside of traditional banking venues.

"In developed markets banks may be seeking to cut jobs because of their own internal cost pressures arising from regulatory changes, inter-bank competition and their failure to move earlier to innovate their legacy systems and banking models," said Luke Deer, one of the authors of the Harnessing Potential report, in response to questions by Finance Magnates.

Mr. Deer added, "In developing markets like China, growth is higher and the financial system is expanding overall, so the employment situation is different. Alternative finance providers are actually creating jobs where no existed previously and typically based on previously unmet financing needs."

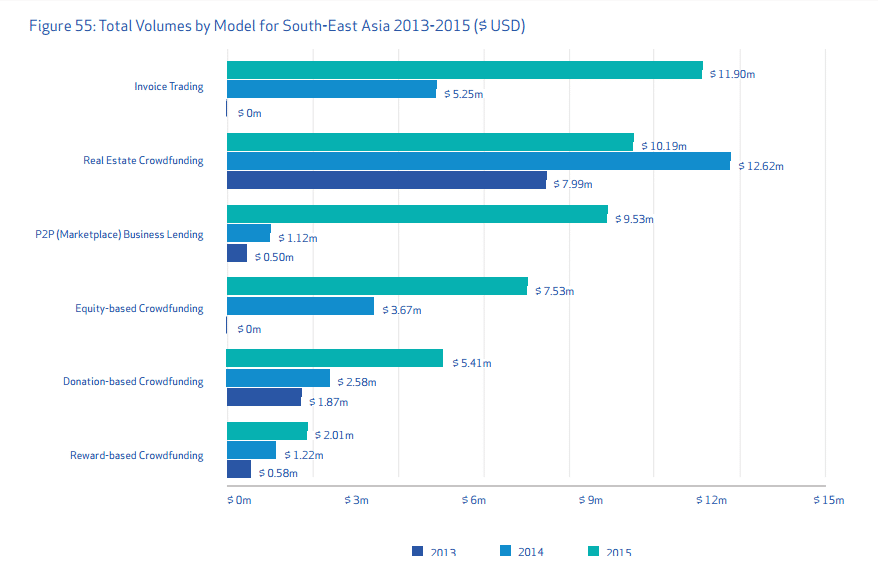

An excerpt from the report included alternative finance company’s surveyed, seen here below for the South East Asia region:

Source: Harnessing Potential - the Alternative Finance Benchmarking Report