Nasdaq-listed digital infrastructure company, Equinix announced the completion of MainOne’s acquisition today. Last year, Equinix announced that the company will acquire the Lagos-headquartered firm for an enterprise value of $320 million.

The acquisition will boost Equinix’s presence in the growing market of Africa. MainOne’s strong network in Africa will help Equinix reach a broader market. The latest news from Equinix came on the back of a series of announcements regarding its global expansion.

Last month, the financial technology services provider confirmed its plan for expansion in Latin America through the acquisition of 4 data centers from Empresa Nacional De Telecomunicaciones in a deal worth nearly $705 million. The deal is expected to close in the second quarter of 2022.

Equinix highlighted that the rising number of internet users in Africa will play an integral part in the digital transformation of the region.

“Equinix believes MainOne, headquartered in Lagos, to be one of the most exciting technology businesses to emerge from Africa, and Lagos is rapidly becoming a key connectivity hub for the wider West Africa region. Founded by Funke Opeke in 2010, the company has enabled connectivity for the business community of Nigeria and now has digital infrastructure assets, including three operational data centers, with an additional facility in Lagos expected to open in April 2022,” the company explained.

Assets of MainOne

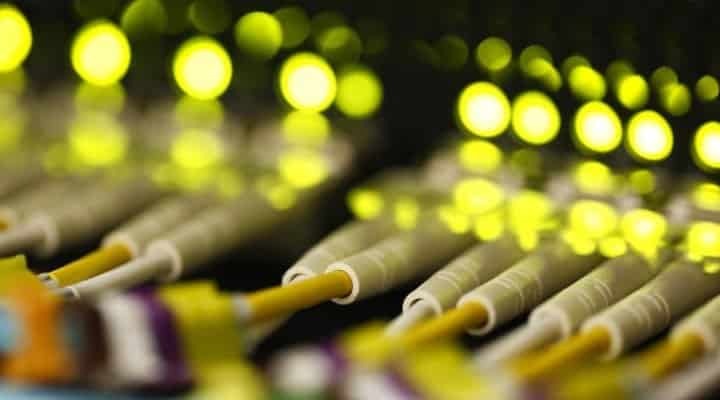

MainOne is a prominent name in Africa’s technology sector. The company’s assets include 4 operational data centers and an extensive submarine network. MainOne has a team of approximately 500 employees.

“An estimated 800+ business-to-business customers, including major international technology enterprises, social media companies, global telecommunications operators, financial service companies and cloud service providers. Globally, Platform Equinix is comprised of 240 data centers across 66 metros and 27 countries on 6 continents, providing data center and interconnection services to 10,000+ companies including more than 50% of Fortune 500 companies,” the fintech firm added.