During an exclusive interview with Germany-based FinTech Group AG, a publicly-traded company on the Frankfurt Stock Exchange (FLA:GR), with deep roots in financial technology as its name implies, Finance Magnates spoke with the group's CEO Frank Niehage on related developments.

In this edited interview, we recap recent deals and the road ahead and broader fintech trends that were discussed during the call yesterday.

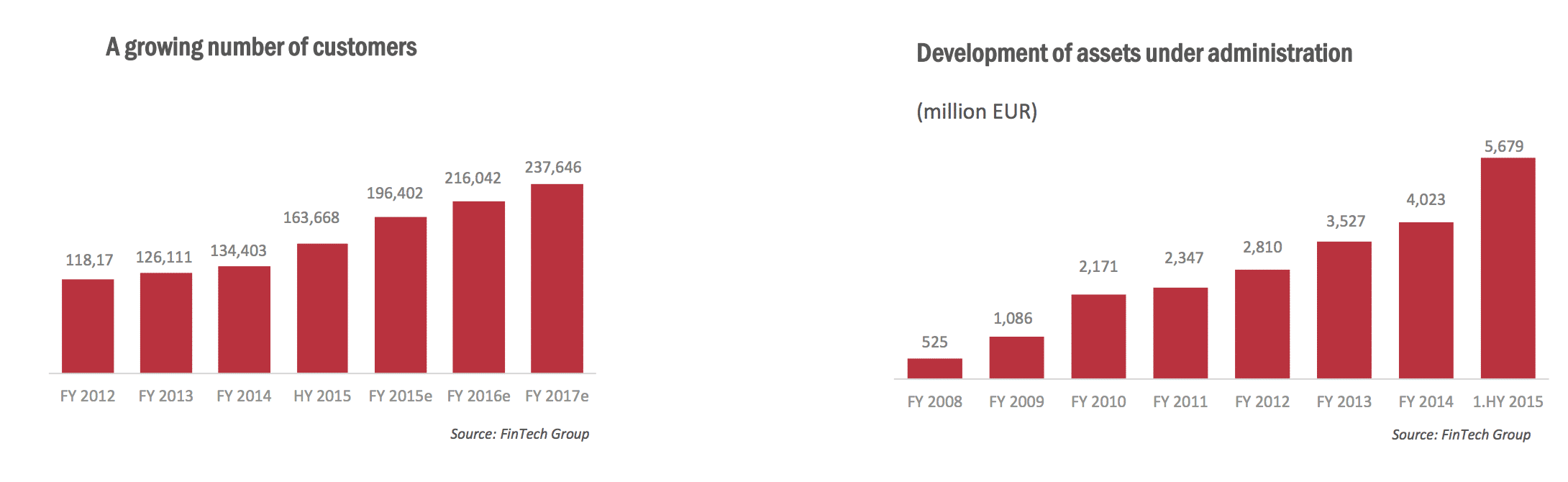

Assets under administration

As background, FinTech Group has nearly 5.68 billion euros in assets under administration and serves some 200,000 clients through the banks and brokerages that it provides technology solutions to across the financial services.

FinTech Group AG has a current market capitalization of €235 million based on its share price today of roughly €14 per share, with just over 18 million shares outstanding.

For its 2015 full year results, FinTech Group AG reported group-wide revenues of €75.2 million and EBITDA of nearly €19.7 million. It confirmed 2016 guidance and a positive outlook for 2017.

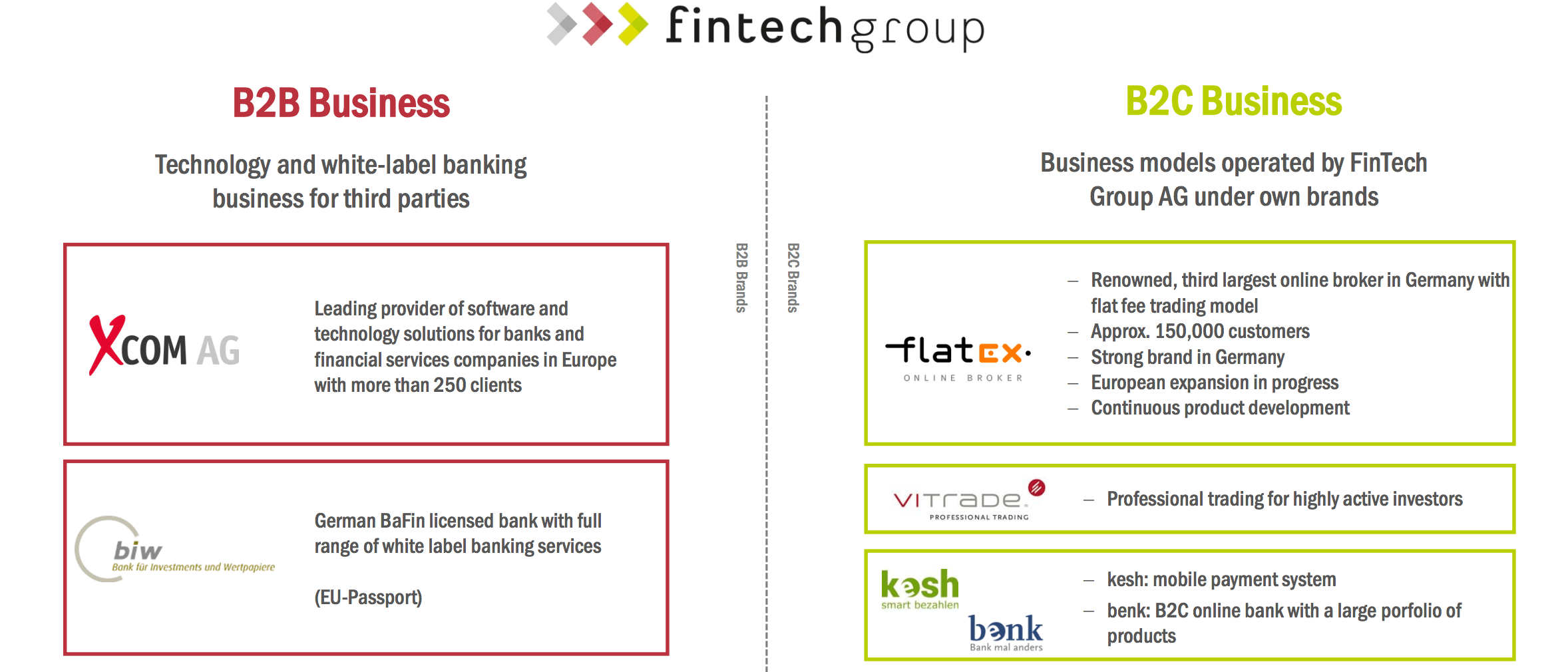

The firm provides business-to-business (B2B) and business-to-customer (B2C) solutions across its business divisions as seen in the excerpt below from FinTech Group's 2015 H1 results released in April 2016 - before its 2015 full year results were released on May 31st 2016.

Source: FinTech Group AG 2015 half year results

Frank Niehage CEO Profile

In addition to his role as CEO, Mr. Niehage serves as chairman of the group’s bank, and technology firm. Together his group employs over 500 staff, and has over 1 billion euros in capital on its balance sheet.

As an ex-Goldman Sachs managing director, and leveraging regional CEO expertise from private banking roles, as well as prior positions with Commerzbank, Credit Suisse and UBS – including being located in Singapore in the late 90’s, Mr. Niehage brings a diverse skill-set to FinTech Group AG.

He obtained a Master of Law from the University of Houston Law Center with a focus on international economics, and was admitted to the bar in Germany. He worked at the international law firm Beiten Burkhardt earlier in his career.

...what I can do as a CEO is control cost and that is why we put our money on proprietary technology.

Local fintech scene

During the call yesterday, Mr. Niehage explained that the company processes 10 million transactions in securities markets across its related B2B and B2C fintech products and already has many large financial services companies as clients in Germany, as the firm looks to expand further within Europe.

Frank Niehage

Source: FinTech Group AG

The firm had made a number of acquisitions in recent years and had 4 banking licenses at one point. It has implemented a reorganization to consolidate some of its redundancies which was in its final stages recently, as reported by Finance Magnates.

“We want to grow by acquisition, there are companies that have either B2B or B2C offerings in fintech yet can’t control the costs as much as we can,” said Mr. Niehage during the call.

99% proprietary

In response to questions related to combing in-house development with acquired businesses, Mr. Niehage explained about an older investment made after the company acquired a platform from E*Trade - after it had exited one of its products from the local market in Germany.

FinTech Group had since built upon that platform and its other product lines, including a number of products obtained via acquisitions, and this way doesn't need to rely on third-party providers.

“I’d always prefer to take over non-listed companies because they mostly enjoy lower multiples, and then incorporate them into our business - which is listed and enjoys a higher multiple, so its part a ‘multiples play’ and growing partly by acquisition and organically.

A huge advantage of our group, is 99% of what we do is proprietary, so I have my 250 techies and 250 financial services people, and I can control the cost and not rely on any service provider.

You cannot control clients' behaviour or the market, we can’t control interest either as we are in a low-interest rate environment now, but what I can do as a CEO is control cost and that is why we put our money on proprietary technology."

Morgan Stanley deal

Earlier this year, FinTech Group made a deal with Morgan Stanley for a long-term partnership to bring structured products and warrants to the German market, with a planned launch through the company’s Flatex subsidiary and offered out as an Exchange Traded Product (ETP).

Mr. Niehage explained regarding his prior year volumes: “Out of the 10 million securities transactions we process, 2.5 million are related to options and ETPs which we call certificates or warrants here in Germany, which is a huge market here. Out of the €70 billion traded in this market, we have a share of about €10 billion, based on the average trade size and number of trades we process.”

Earlier this month some of those products went live with Morgan Stanley and will be co-branded through FinTech Group, following a similar deal the that the company successfully made with Avanza in Sweden which served as a blueprint.

Germany/Korea synergy

Earlier this month, FinTech Group announced a major synergy with Korean fintech company Finotek, where a cross-border deal was established with two new entities to be created as part of a joint-venture for fintech.

Finotek, based in Seoul, employs a number of ex-managers from technology conglomerate Samsung which is also based in Korea and a leading innovator for relevant fintech channels such as mobile smartphones.

As part of that deal, aimed to foster fintech innovation between Germany and Korea, FinTech Group AG will have 51% for the European venture and Finotek will have the remaining 49%, whereas, Finotek will retain 51% for the Asian venture with FinTech Group holding the remaining 49%.

Joint Venture with Finotek

According to people familiar with the deal, FinTech Group AG may be close to providing its products to a number of banks in the region that could reach tens of millions of underlying customers in Korea, thanks to the synergy with Finotek.

Finotek will introduce one of FinTech Group’s Payments products which will be white-labeled by Finotek in Asia, as part of the initial plans as explained in the company’s announcement.

The ‘Kesh’ mobile-payments solution from FinTech Group will allow a peer-to-peer (P2P), point of sale (POS), and other related mobile wallet solution including online payments for financial institutions in Korea.

We are building a credit book for our bank out of Germany and will use the onboarding process from Finotek to speed up the application process for the offering within Europe.

Made in Germany appeal

Having lived in Asia for a number of years while working for Commerzbank in the late 90’s, Mr. Niehage explained that his understanding of the local and cultural differences - applicable to business as well – helped to solidify the deal with the Koreans.

However, he explained that the major selling points to the Korean side was the appeal of German-engineering. Conversely, Seoul is a major city with the fastest internet in the world and is much larger in population compared to Singapore, for example.

He explained that 'made in Germany' really matters in Korea. Meanwhile, Korea and other parts of Asia are far ahead of Europe in certain segments within fintech in terms of payments and lending innovations. This is where Finotek's solutions will help FinTech Group in Europe, as explained below.

Payments and brokerage space

FinTech Group’s Kesh payments product was developed in the past few years and received regulatory approval in Germany, and is expected to be presented to Korean banks.

This comes amid larger technology companies like Apple, Google and Samsung aiming to acquire even more of a share of the payments space while lacking background experience in financial services and related regulatory compliance for more advanced brokerage solutions.

These firms dominate on low margins and high transaction volumes, but don’t yet pose a threat to emerging fintech companies and certainly not to FinTech Group’s business.

This is also because payments represent a tiny fraction of FinTech Group’s business. Its major focus and expertise is on the brokerage side of financial services. The payments business had incidentally grown for FinTech Group following its acquisition XCOM which it now fully owns, along with other stakes across its related businesses.

Source: FinTech Group AG 2015 full year results

e-Signatures in Europe

Mr. Niehage explained a new directive that is coming into effect in Europe that will require new rules to be drafted on the use of digital signatures, as in parts of Europe many online solutions are still not fully digital in their signup process.

For example, clients might sign up for a service in 5 minutes online, yet have to go off-line to find documents or scan signed agreements and then email them or upload the scanned hardcopies online.

Finotek, as one of the first fintech companies listed in Korea, has a number of solutions such as its e-signature product, and Know Your Customer (KYC) ) verification tools for checking client identities and related details applicable under Anti-Money Laundering (AML) rules applicable to fintech firms.

Mr. Niehage added regarding the road ahead: “We are building a credit book for our bank out of Germany and will use the onboarding process from Finotek to speed up the application process for the offering within Europe.”