A new report from NY-based software firm CB Insights has found that financial services industry startups raised $33.9 billion in 2019--and that nearly half of that money was was concentrated on 83 ‘mega-rounds’, which CB defines as rounds worth $100 million or more.

According to the report, 2019 also saw a record of 24 Unicorn births, 8 of which occurred in Q4’19--bringing a total of 66 VC-backed fintech unicorns worth a combined $243.6B. Next Insurance, Bight Health, Flywire, High Radius, and Ripple were all added to the unicorn roster last year.

Overall decline in funding points to industry maturation

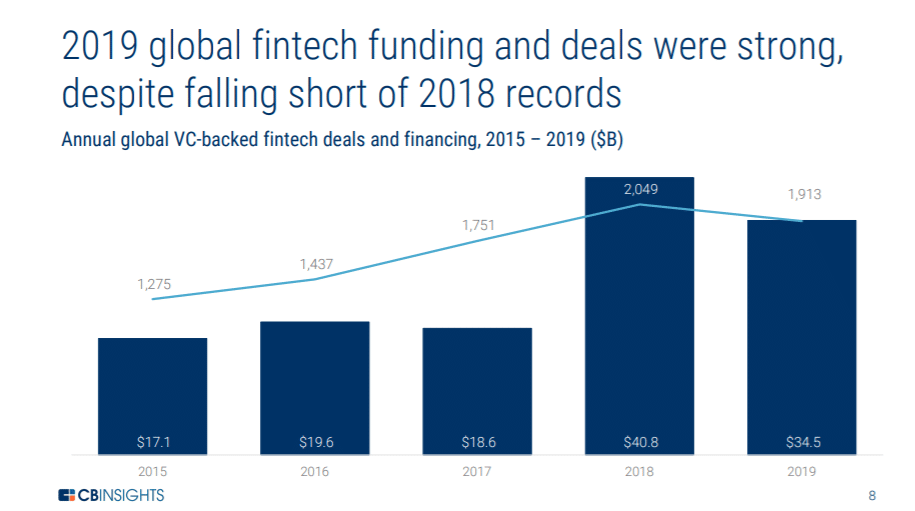

However, the total amount of funding raised in the fintech industry during the year 2019 was roughly 17 percent lower than the $40.8 billion raised in the year prior. The number of fundraising deals also fell from 2,049 to 1,912.

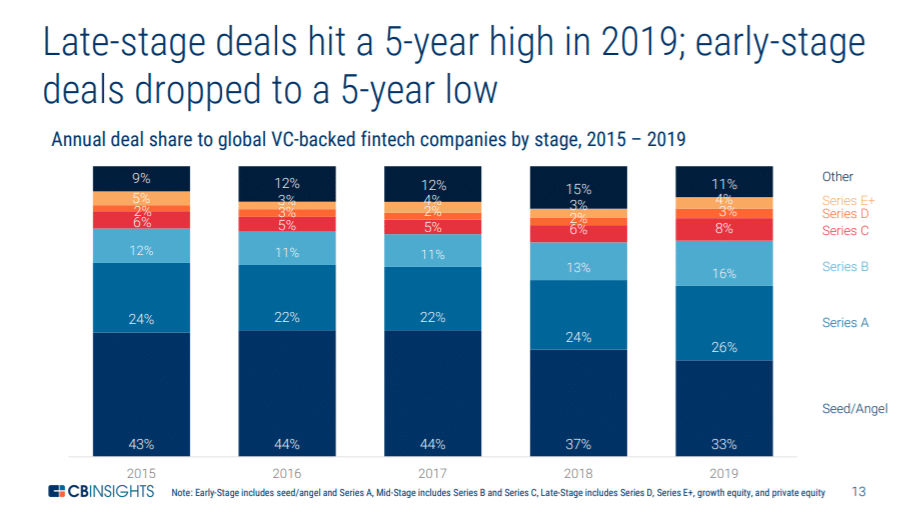

The decrease in funding seems to be associated with a shift by VC firms away from early-stage startups and toward companies in later stages of development. Indeed, financing for startups attempting to close Series A or Seed rounds saw a five-year-low in 2019, while fundraising for startups in Series B or beyond reached a five-year-high.

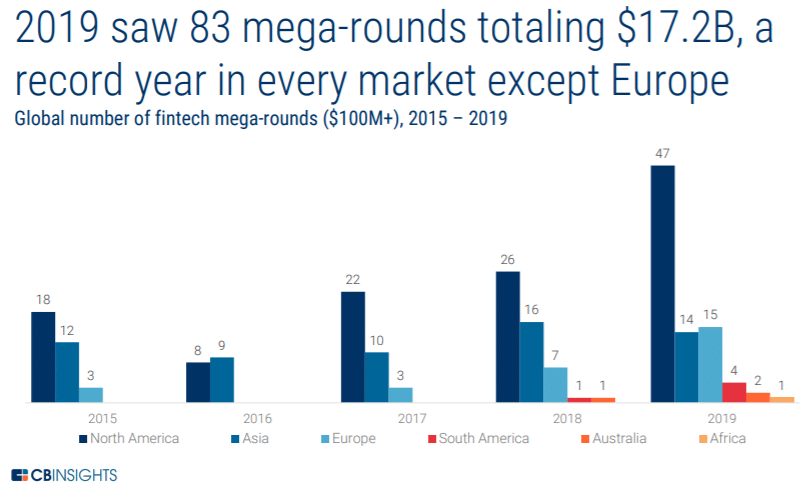

2019 also saw a geographical shift in funding. According to the report, developing and frontier markets were received quite a bit of attention: Africa, South America, Southeast Asia, and Australia hit new record-highs last year.

Asia takes the lead over Europe, Germany emerges as a possible fintech hub

Asia also stepped out over Europe in terms of capital raised and the number of deals completed in the second half of the year: $1.8 billion was raised in 157 deals in Asia during Q3 of 2019, while European startups raised $1.6 billion through just 95 deals. The trend continued in Q4, when 100 fundraising rounds held by European startups raised just $1.2 billion, while $2.14 billion was through 125 deals in Asia.

Specifically, Southeast Asia (SEA) raised $993 million across 124 rounds in 2019 in what was the region’s best year yet.

Interestingly, however, much of the funding that took place in Europe was concentrated on Germany, pointing to the industry as a possible emerging fintech hotspot: 65 deals in the country brought $1.79 billion in fundraising--more than double the $757 million raised through 56 deals in 2018.