The fintech sector has been steadily growing over the past several years--and it is expected to keep going.

Indeed, projections on the future of the industry wager that it will be worth anywhere from $309.9 billion to $26.5 trillion by 2022. While it's impossible to know the future, we can take a gander at the past.

Indeed, Netherlands-based multinational professional services network KPMG reported in early 2019 that global fintech investment rockets to a record of $111.8B in 2018.

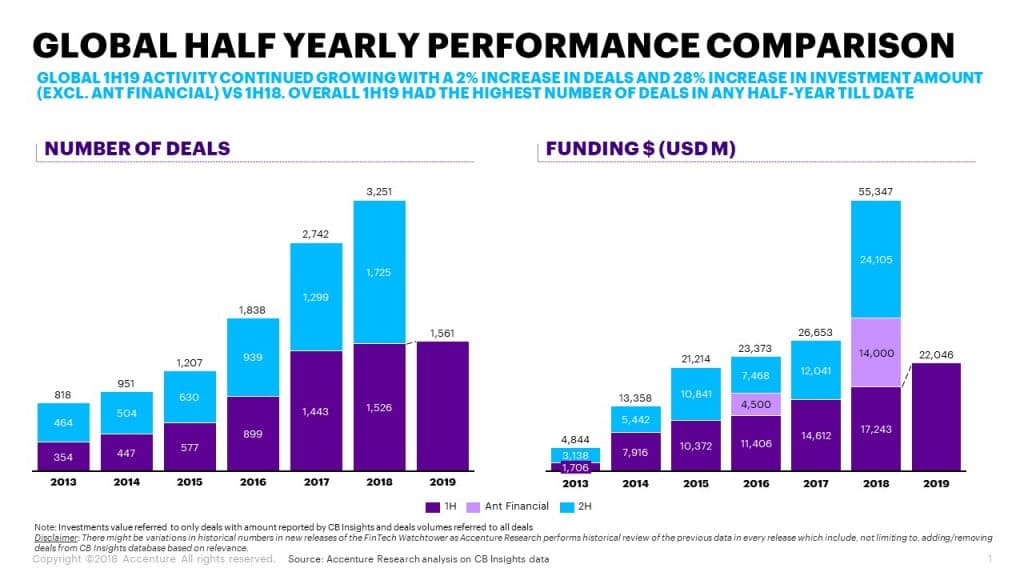

Then, in August of 2019, Ireland-based professional services company Accenture found that the total value of fintech deals globally in the six months ended June 30 was US$22 billion, compared with US$31.2 billion in the same period of 2018, a decline of 29%."

However, "the drop was due mostly to the lack of a giant deal like Ant Financial's record US$14 billion fundraising in May 2018. Discounting that transaction, global fintech investments would have climbed 28% in the first half of 2019 over the same period last year.

Source: Accenture

In other words, it seems that there's plenty of potential for continued growth--but what will this growth look like?

Finance Magnates asked the experts. Here, without further ado, are the top five fintech trends to watch throughout 2020.

1. The rise of decentralized finance

Andrus Steiner, an information security expert at smart arbitrage systems firm ArbiSmart, told Finance Magnates that one of the most important trends that we will see this year is the rise of 'DeFi,' or "decentralized finance."

As DeFi has continued to become more popular over the course of the last year, the term has become a bit of a buzzword--but in an interview with Finance Magnates conducted earlier this year, BlockFi chief executive Zac Prince explained that "conceptually... 'DeFi' is going after this idea that finance should be as open as the internet.

In other words, "it doesn't matter where you're from or how much money you have, you should be able to access the same product that someone who's in a different place with a lot more money is also accessing."

Mr. Prince said that functionally, Defi platforms are characterized by two things: first, "they've built the core part of their technology platform using a Blockchain -based infrastructure," and second, "they don't do KYC (know-your-customer) [checks]."

Andrus Steiner, information security expert at smart arbitrage systems firm ArbiSmart.

Andrus Steiner, Info Security Expert at ArbiSmart, explained to Finance Magnates that in 2020, DeFi platforms would primarily be used by customers who wish to "take loans easily and instantly, without the credit and background checks as it has been for decades with the bank."

Steiner also pointed to the rise of interest-bearing crypto accounts on these platforms: "DeFi also can help people who hold crypto earn interest on their holdings by depositing it in the DeFi platforms," he said. "It is mutually beneficial for the platform and the user as the user gains interest and the platform enjoys higher Liquidity and bigger revenue possibilities."

Many crypto lending platforms have already seen massive growth. For example, New York-based trading firm Genesis, which lends both cash and crypto, reported last month that loans increased by 21 percent during the fourth quarter of 2019 to $545 million--more than 10 times the amount of growth in loans by JPMorgan, the United States' largest, where loan balances increased by just 2 percent.

2. More inclusive banking platforms and practices

The rise in popularity of DeFi platforms could also be reflective of a larger trend toward more inclusive baking--that is, more financial services for unbanked individuals who are usually left out of traditional financial service spheres.

Bill Phelan, chief executive of PayNet, a commercial lending credit and analytics company, told Finance Magnates to be on the lookout for "tech for inclusive banking" this year: "more bank branches are closing and their is a renewed focus on the unbanked and underserved - rural, low income and minority populations," he said.

Indeed, a number of banks are closing their brick-and-mortar locations in favor of more advanced mobile services. The Guardian reported in November of 2019 that in the UK and the EU, "RBS Group (including NatWest) has closed 1,085 of its branches since 2015, and now has just 846 left. HSBC is down to 624 from 1,066 four years ago." TSB, a retail and commercial bank in the United Kingdom, has plans to close 86 branches this year.

Branch closures have also been rampant in the United States, though Bloomberg reported that big banks are much more likely to shutter branch locations in poorer neighborhoods: indeed, "a 2014 study by an MIT economist found that, even with other banks nearby, branch closures in low-income and minority neighborhoods made it harder for local businesses to get loans," the report said.

Bill Phelan, chief executive of PayNet, a commercial lending credit and analytics company.

The void left by the closures of some of these banks could also be a reason for the rise of DeFi and other financial platforms: "challengers and alternative lenders have an opportunity to fill the void left by large banks," said Bill Phelan, adding that they could also bring "alternative data sources, new credit models and checks on bias" with them.

The global conversation on inclusive banking picked up momentum with the dawn of Facebook's Libra project last year. Andrus Steiner said that while Libra is currently dealing with regulatory delays and scrutiny from the private sector, the social media giant--and others--are likely to continue striving to create more inclusive platforms.

And although Facebook has painted Libra in a very humanitarian light, the real reasons that companies may be driven to create more inclusive platforms likely has more to do with profits: "there are more than 2 billion people unbanked worldwide," Mr. Steiner said. "Making banking easy, possible, simple and accessible to 25% of the world can bring a great revenue stream to the company that does it successfully."

3. Data-based "hyper-personalization"

However, in order for any fintech platform--inclusive or exclusive--to be successful in 2020, most experts agree that "hyper-personalization" is key.

Indeed, "customer [data], artificial intelligence (AI), and hyper-personalization will transform the UX on fintech platforms," said Maarten Verweij, chief executive and founding partner at Hong Kong-based legal consultancy firm Origin X, adding that data will be increasingly used "to determine customer behaviors and give the customers what they want."

What will this "hyper-personalization" look like? According to Aaina Bajaj, digital marketing specialist at Signity Solutions, financial institutions are increasingly using customers' browsing data and purchasing patterns to customize the services they offer them.

Maarten Verweij, chief executive and founding partner at Hong Kong-based legal consultancy firm Origin X.

"The real-time omnichannel integration of these insights delivers a personalized one-to-one marketing experience for their customers," Baja said; thereby, these institutions can provide products and services at times when they are the "most relevant and useful."

This kind of personalization could also improve the user experience (UX) on many fintech platforms, which Andrus Steiner described as "awful": "[many] fintech companies know how to come up with a great idea, a solution and execution, but when it comes to UX, they are lagging."

As such, Alan Grujic, founder and chief executive of All of Us Financial, believes that "developers will play a pivotal role" in the coming year.

"Financial interfaces must change, and fast," Mr. Grujic said. "As more upstarts enter the market poised to challenge incumbents, user experience and user interface will be a critical differentiator."

"Consumers are looking for a balance of technical ease delivered with a human experience; they want things to work seamlessly but they also want to have an empowering relationship with their financial company, whether it's a bank or a brokerage."

The shift toward mobile and online services also means that fintech customers will have a different set of needs that customers of traditional financial institutions. Mr. Grujic said that "trust and security" will be challenged in the year ahead "amid ongoing data breaches or hacked technology."

"Banks and financial services companies that deliver transparent, immediate responsiveness in the wake of crisis, as well as those who can provide digital experiences that delight customers, are the ones who are going to come out on top," he said.

lan Grujic, founder and chief executive of All of Us Financial.

4. Robotic Process Automation: the increased integration of "software roots" on fintech platforms

An important part of improved user-experience will be the development of robotic process automation (RPA) on fintech platforms--in other words, AI-enabled "software robots" will increasingly be used to handle repeatable tasks that would have previously been completed by humans.

In fintech, these tasks can include things like customer service requests and sending invoices, as well as "onboarding, verification, risk assessments, security checks, data analysis, reporting, and compliance processes," according to Aaina Bajaj. RPA can also be used for fraud detection.

Anthony Macciola, chief innovation officer at ABBYY, a digital intelligence company, pointed out that in addition to streamlining UX, the development of RPA systems in fintech could allow for more effective human-to-human contact.

"Many manual tasks such as reviewing forms and data input will be undertaken by AI, allowing loan processors to concentrate on more important jobs like ensuring the process is kept on track and improving customer experience," Mr. Macciola explained.

The rise of RPA could also help to eliminate human error from the fintech space as Process Intelligence (PI) is developed: "Process Intelligence (PI)will enable financial organizations to streamline applications and other consumer credit offerings," he said.

Anthony Macciola, Chief Innovation Officer at ABBYY.

"Onboarding new customers for different products often follows a different business process and requires specific supporting documentation for verifying employment, assets, income and identity. Any delay or error in these onboarding processes could significantly impede transactions resulting in lost revenue, higher-processing costs or negative consumer experience.

"It is only by understanding the entire process end-to-end that organizations can identify problems and correct them – machine learning through PI will do this and will become a huge growth area in 2020."

5. Consolidation and collaboration

The development and growth of RPA across fintech platforms will be enabled by another important trend in the fintech industry in the coming year--collaboration and consolidation.

Specifically, David Blumberg, founder and managing partner of SF-based early-stage venture capital firm Blumberg Capital, said that "in 2020, we'll likely see more partnerships form between fintech startups and large financial institutions."

Blumberg pointed to several examples of this that have occurred in the recent past: Wells Fargo's decision to start a venture fund, as well as "Goldman Sachs leading Trulioo's Series C financing (also funded by Citi, Santander and existing investor AMEX)."

It seems as though established financial institutions are increasingly aware of the advantages that startups have to offer them; startups can also benefit from traditional financial institutions, leading to the formation of symbiotic relationships: "traditional banks value startups for their speed and ability to deliver innovative solutions," Blumberg said to Finance Magnates.

At the same time, "startups benefit from the credibility, scale, resources and regulatory compliance offered by established financial firms."

Kanchan Kumar, recently told Finance Magnates that "the early days of fintech were the 'unbundling of the banks'", meaning that "young startups [were] looking to tackle problems very singular in focus."

Now, however, the industry seems to be moving toward integration: "we'll soon begin to see feature sets specifically designed for brand affinity and user dependency, such as data visualization, stronger accounting, and budgeting features, personalized customer service, and democratization of 'luxury' business features," Kumar said.

Indeed, "the future of finance is one of collaboration."