Emerging Seattle-based Fintech startup Kavout has just launched its new investment platform, driven by artificial intelligence (AI), for clients to find trading opportunities using tools powered by machine learning and big data, and with a beta-version of the platform made available to investors.

As robo-advisors and automated trading products continue to emerge on the retail side, following the use of algorithmic trading and A.I.-driven technology by institutional firms, Kavout’s announcement today appears to reflect the growing related interest from the market for such products.

...the scale and complexity of data available to analyze investments can be daunting.

Kai Score

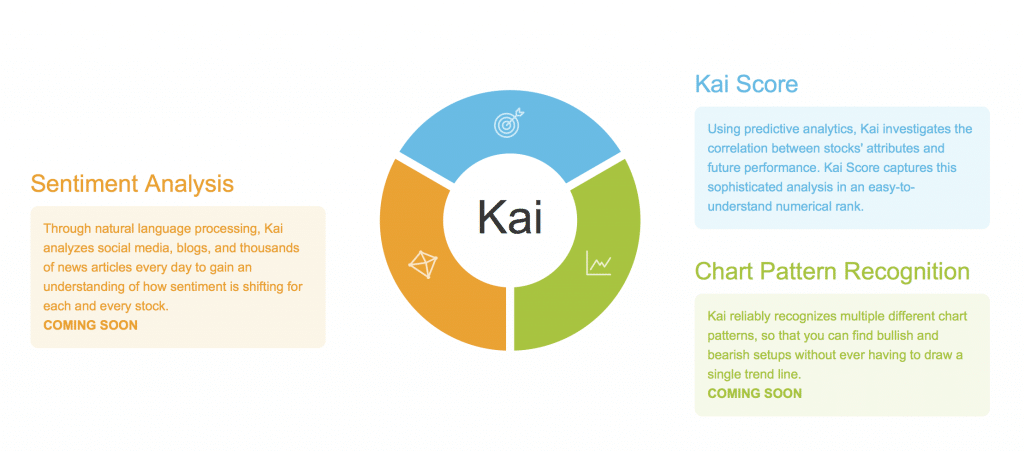

Kavout uses what it calls Kai, the core AI and machine learning process that fuels Kavout’s main attributes and functions, including scanning historical SEC filings and stock quotes and examining millions of points of data ever second while analyzing stocks using an objective approach.

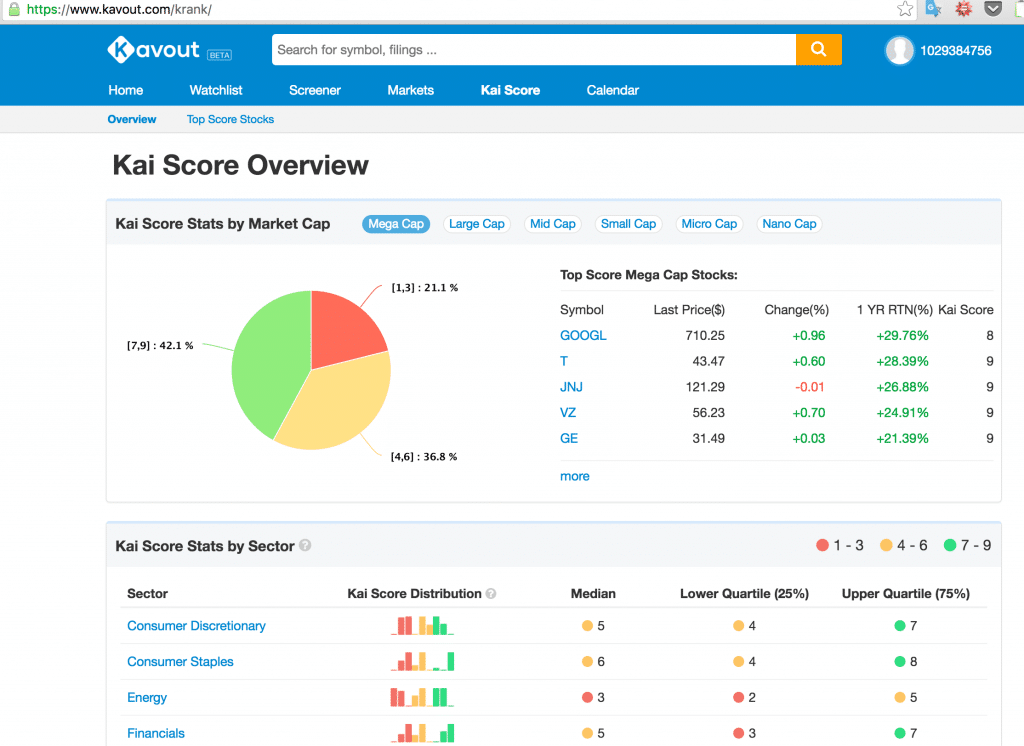

There is also a Kai Score feature within the platform that provides a predictive analysis ranking reflecting data Analytics processed for each security, and based on a stock’s future performance related to its valuation, growth, momentum and other qualities.

An excerpt of the platform as seen below, upon logging into the beta-version of Kavout, shows one of the Kai Score features.

Source: Kavout.com

CEO comments

Commenting in an official corporate announcement, Kavout’s CEO and co-founder Alex Lu said: “On Wall Street, you’ll see that many hedge funds and investment banks are hiring top talent in artificial intelligence and machine learning.”

Mr. Lu further opined regarding industry trends: “Today, Goldman Sachs has more engineers than Facebook. None of this is a coincidence. The big players know that there is much more to be gained in the markets by investing in artificial intelligence and machine learning. Our aim is to make those technologies available to all investors.”

“Whether you’re an experienced trader, a long-term investor or just started investing, the scale and complexity of data available to analyze investments can be daunting,” added Mr. Lu.

Alex Lu

Source: LinkedIn

“That’s why companies hire teams of data scientists and analysts. But with Kavout, all investors can easily and quickly identify stocks on their own using data that is incredibly deep and comprehensive in scope.”

Predictive analytics and machine learning

The Kai Score feature scans over 7,600 stocks, where a high Kai Score implies a higher probability of a stock outperforming the S&P500, for example, and conversely a lower score implies a lower probability against the same benchmark.

In addition, many of the features within the platform are wrapped around a screener that enables users to perform various analyses using the Kai Score features to evaluate securities by sector, market cap, and other easy-to-use filters coupled with a watch-list.

The screener uses 130 fundamental and technical criteria, including Kai Score data, earnings data, insider activity and the firm’s guru sentiment indicator, and other proprietary methods.

During our beta period, we are asking our first set of users to tell us what would make Kavout even better for them because ultimately it’s about providing users with the tools that the top investors on Wall Street are already using.

Background in A.I.

Mr. Lu brings years of programming experience in the field of machine learning, including prior work for Microsoft where he was involved with projects related to AI, and after holding a number of roles with Google, as per a LinkedIn profile description.

In addition to other positions throughout his extensive career in technology, Mr. Lu had joined Baidu as an engineering director for a two-year period through 2014, before becoming CTO of DZH in China.

Mr. Lu added regarding the new beta version of the platform: “Artificial intelligence has never been so accessible to the individual investor. During our beta period, we are asking our first set of users to tell us what would make Kavout even better for them because ultimately it’s about providing users with the tools that the top investors on Wall Street are already using.”

Kavout was launched in January of 2015, and has offices in Seattle, New York, Shanghai, and Beijing, and over a dozen programmers across its operations. An excerpt from the company’s website reveals two new products that Kavout is preparing to bring to market, following today’s announcement.

source: Kavout.com