The worldwide fintech sector saw a massive growth in recent years, and the expansion is far from over, according to a newly-published report by the London Stock Exchange Group along with TheCityUK.

The report named “Finance for Fintech” explores the scale, ambitions, and barriers to international growth faced by global fintech companies.

According to the study, which includes interviews over 400 fintech companies across Australia, Germany, Hong Kong, Israel, Singapore, Turkey, the UK, and the USA, cross-border expansion is a key growth factor, with 72 percent of the participating companies planning to expand their businesses into new countries.

The US (33 percent), China (30 percent) and the UK (24 percent) are the top three markets for businesses looking to expand internationally, according to the report.

“The cross-border ambitions of innovative fintechs are transforming the global financial services sector," Dr. Robert Barnes, Global Head of Primary Markets and CEO of Turquoise and London Stock Exchange Group, commented. "But in order to thrive, these innovators need access to long term growth capital and a supportive global regulatory environment. The UK offers both. Today’s report shows that the UK is one of the top three global markets for fintechs considering raising finance and expanding internationally. UK-based fintechs overwhelmingly see the process of raising public market funding as most straightforward compared to peers.”

“Sitting at the heart of UK’s financial ecosystem, London Stock Exchange Group is the natural funding partner to a sector that is reshaping the global financial services landscape. We are proud to support these businesses throughout their growth journeys, offering them access to deep liquid pools of international investor capital for the long-term,” he added.

The goals of fintech firms are also worth noting as over the next three years, they are aiming to achieve an average revenue growth of 80 percent. This number jumps to 320 percent for companies with series D funding or higher.

However, many firms are skeptical about the existing markets and technologies as 73 percent of the participating firms believe that they need to move into or even develop new market sectors to fulfill their ambition for growth. A similar number of firms believe that they will need to develop new technology to drive at least part of their expected growth.

Market Sectors by Growth, Finance for Fintech

To a major chunk of the fintech firms, raising capital is the top priority before R&D, international expansion or sales and marketing. However, 85 percent of the surveyed firms are likely to raise funds on the public market via equity and debt instruments within next three years. New York remains at the apex of equity and debt issuing markets followed by London and Hong Kong.

Dominance of the UK

The scene on the UK market for fintech firms is very bullish as they are looking to achieve 88 percent growth in the next three years - an individual average higher than the average of the eight surveyed countries combined. Moreover, 43 percent of UK-based firms consider the US as their priority market compared to 35 percent of US-based firms, which identifies the UK as their primary international market.

TheCityUK’s COO Marcus Scott said: “The UK has positioned itself at the forefront of the fintech revolution. Its success is underpinned by the strength and heritage of the UK’s world-leading financial and related professional services ecosystem, helping to make Britain one of the best places in the world to start, grow and scale a fintech company. However, global competition is fierce and it is incumbent on industry, government and regulators to remain agile and work collaboratively to ensure the UK maintains this leadership position into the future.”

Barriers remain

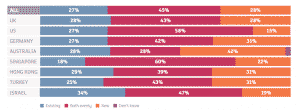

However, there are many barriers in the way of the growth trajectory of these fintech firms. One of the primary barrier is competition, a sentiment to which 43 percent of surveyed firms agree. Economic confidence is another major resistance to these firms. Moreover, government-controlled factors also play their role as 66 percent of the firms consider at least one such factors including Regulation , access to skilled staff, and costs to business as a barrier to growth.

John Glen, Economic Secretary to the Treasury and City Minister, commented: “Our fintech sector contributes £6.6 billion to the UK economy each year, and employs over 60,000 people across 1,600 companies. As this report shows, we’re a global leader in fintech not by accident, but by design – our outstanding expertise, robust regulation and fair taxation gives us an edge above the rest, and we’re committed to ensuring that it stays this way.”

eToro’s CEO Yuni Assia said: “The acceleration in user growth has been led by increased customer awareness and demand. That demand has been powered particularly by Generation Y waking up to investing in general and in asset classes that interest them – namely Cryptocurrencies and stocks. But we have 18 to 80-year-olds on our platform. We don’t compete directly with traditional investment managers – their customers have different demographics.”