Well, folks, 2020 has officially rolled over into Q4: we are nearing the final chapters of this annus horribilis, though the end of the pandemic and the economic fallout that it created are not anywhere in sight.

In fact, as the ‘second wave’ of the pandemic seems to be hitting in many places in the world, lockdowns are beginning (or have already begun) again. At the same time, many governments around the globe are continuing to send stimulus Payments to their citizens; in the United States, another round of stimulus payments may be around the corner.

As people and governments have navigated a COVID-ridden world throughout the year, fintech platforms have played an increasingly important role in the global economy.

A large number of financial service interactions that previously would have taken place in person were moved onto mobile platforms; government loans and stimulus payments were distributed through fintech companies to increase efficiency. Even fintech platforms that did not play a role in stimulus distribution were saddled with waves of new clients who, stuck at home, were exploring the fintech world for the first time.

As such, the scalability of many fintech platforms was tested (and with mostly positive results). For the most part, the responsibility of distributing stimulus payments and loans was carried without incident.

However, as the hard tech aspects of these fintech platforms were battle-tested, there was another part of these fintech services that played an increasingly important role: empathy.

After all, the global financial crisis and personal financial hardship have marked 2020. In the US, even if the second round of stimulus will not be sent out any time soon (or indeed, at all), fintech companies are still supporting customer bases partially comprised of people whose financial lives have been negatively affected by COVID.

Therefore, as the pandemic spring and summer transition into a pandemic fall, and the darkly-anticipated 'second wave', empathy, as part of fintech user experience (UX), will stay in the spotlight.

What Is Empathy, Really?

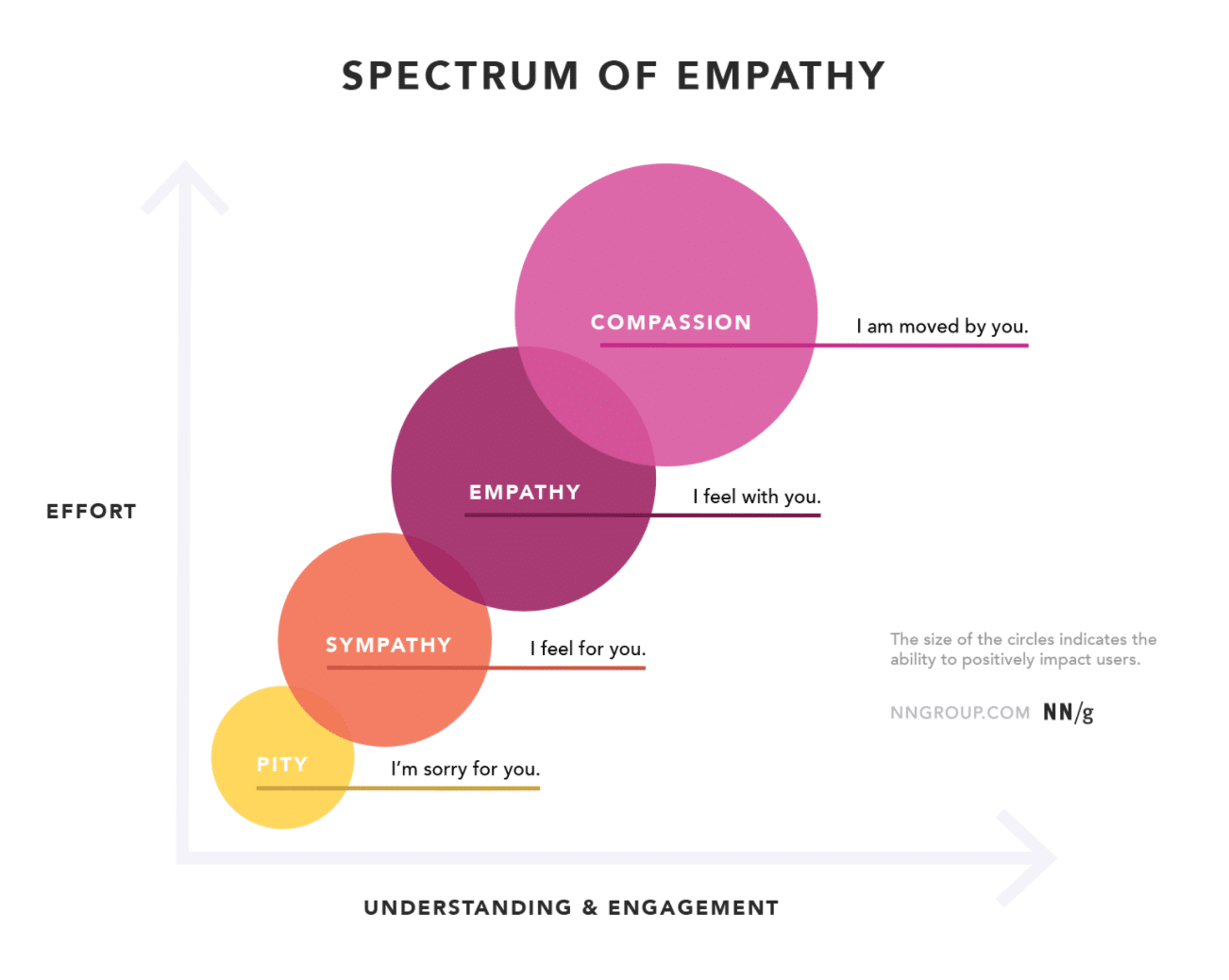

In the dictionary sense of its meaning, the word empathy means “the ability to understand and share the feelings of another”.

Between human beings, empathy is the phenomenon that even if someone has not walked a mile in your shoes, that they can imagine what it may be like to do so. Therefore, they have an increased understanding of your needs and motivations. In 2019, Nielsen Norman Group Chief Designer, Sarah Gibbons wrote that empathy in UX is “the ability to fully understand, mirror, then share another person’s expressions, needs, and motivations.”

This is different from sympathy, which includes an element of empathy, but adds the "formal expression of pity or sorrow for someone else's misfortune.” Sarah Gibbons wrote that in UX, sympathy means “acknowledging that users are going through a difficult scenario, task, or journey.”

While it is true that users are not necessarily better served by platforms that show concern for them, Gibbons argues that some sympathy is better than none.

Sarah Gibbons is Nielsen Norman Group's Chief Designer.

Still, while fintech platforms do not necessarily need to show compassion for their users, users are almost certainly better-served by platforms that can demonstrate an intelligent understanding of who they are and what their specific needs may be, in other words by empathetic platforms.

“In UX, empathy enables us to understand not only our users’ immediate frustrations, but also their hopes, fears, abilities, limitations, reasoning, and goals,” Sarah Gibbons explained.

“It allows us to dig deep into our understanding of the user and create solutions that will not only solve a need but effectively improve our users’ lives by removing unnecessary pain or friction.”

“The Key Is to Think about Ways to Create an Interactive Experience That Flows Naturally and Takes into Consideration Emotion.”

This is the reason that empathy as an aspect of fintech user experience has always been a part of the fintech UX conversation to a certain degree.

However, the role of empathy in the fintech world has never been as important as it is in 2020. This is not only because users are relying on mobile services in the absence of brick-and-mortar interactions; it is also because of the global economic fallout, and myriad personal financial hardships, brought about by COVID.

Miron Lulic, chief executive and founder of SuperMoney.com.

In many cases, designing an empathetic platform means adding a 'human touch'. This can be accomplished by using artificial intelligence or other means, including actual humans, to communicate, problem-solve, and generally provide services to their users.

“Surface level things, such as using a human avatar to represent your product, doesn't really do anything to humanize the experience,” said Miron Lulic, chief executive and founder of SuperMoney.com, to Finance Magnates.

Instead, “the key is to think about ways to create an interactive experience that flows naturally and takes into consideration emotion.”

This is especially important for fintech platforms that provide complex services that involve the intake and digestion of significant personal information. “For instance, if you have a consumer product that is offering financial advice, you can encode empathy or motivational messaging,” Lulic explained.

After all, personal finances are personal; fintech platforms that can demonstrate an understanding of the sensitive (and often emotional) nature of financial services have a competitive advantage over those that do not.

”Even If Your Target Audience Is Tech-Savvy, It Pays to Give Customers Access to Real Humans.”

The importance of engineered empathy is particularly important when doing business with people who do not have experience using fintech services, Lulic said.

On a practical level, this can mean having extensive human or humanoid troubleshooting services at the ready: “in such cases, it is often better to offer a hybrid system that combines AI with more traditional methods, such as a telephone helpline,” Lulic explained.

And “even if your target audience is tech-savvy, it pays to give customers access to real humans, regardless of what channel you use.

“Otherwise, you run the risk of displaying a lack of concern and empathy for your clients. No matter how much thought you put into a fintech platform, things will go wrong at some point. The last thing you want is for your frustrated customer to only have access to a robot.”

”Fintech Should Be Able to Empower a Better Customer Experience.”

Indeed, Kosta Ligris, cofounder of Boston-based remote notarization and mortgage fintech, Stavvy, told Finance Magnates that” there is no substitute for human interaction when it comes to certain transactions.”

Of course, “financial services, banking, and healthcare – all of these should be empowered and complemented by innovation and technology,” he said. “But a complete replacement of human interaction is not something I am bullish on.

Kosta Ligris, cofounder of Boston-based remote notarization and mortgage fintech Stavvy.

“I believe that fintech should be able to empower a better customer experience,” which may include “[creating] the interface to escalate certain interactions to a human.”

However, this may not be appropriate for every kind of fintech platform: “humanizing a product or a service is only applicable and appropriate for certain fintech products,” explained Miron Lulic.

Sometimes, the best solution is to keep it simple: for example, “Some of the most successful fintech consumer products, like Square Cash, do little to humanize the experience and instead focus on making their services easy to use.”

"A Second Wave Will Be Different for Fintech Companies, Primarily Because We’re All Equipped with Learnings from Wave One."

A great deal of this empathetic design seems to have already begun flourishing in the fintech sphere throughout this year: fintech platforms, banks, and other financial institutions have beefed up their customer service lines and re-oriented mobile platforms towards ease-of-use and empathetic engineering.

But if the first wave of stimulus payments and lockdowns were a catalyst for this kind of development, the second wave of corona lockdowns could be a big test on the effectiveness of the empathetic design features that have been implemented throughout the year.

“In crisis, the financing supply goes away, but demand does not,” said Greg Ott, chief executive of Nav, to Finance Magnates. Nav is a fintech firm that helps business owners manage their financial health and streamlines access to financing.

“The demand for capital hasn’t changed, but I do think a second wave will be different for fintech companies primarily because we’re all equipped with learnings from wave one,” he said.

In March, “when the Coronavirus really took hold in the U.S., it quickly became clear that banks couldn’t keep up with the demand for customer support,” Ott explained. For example, “no one could reach their bank with a paycheck protection program (PPP) question.”

Fintech companies that were able to help users problem-solve in a timely manner during the first wave of corona lockdowns and stimulus checks did well: “this presented another opportunity for fintech companies to connect with customers and strengthen community,” Ott said.

Greg Ott, chief executive of Nav.

Therefore, a second wave could present yet another opportunity for the fintech sphere: “I really believe that fintech companies that respond in a timely manner to customer questions will see their customer numbers go up.”

”There Are Huge Addressable Markets That Are Neglected by Big Banks.”

After all, there are still large swathes of the population with needs that were not addressed during the first round of stimulus payments. Additionally, as COVID-related financial hardship has taken hold of many families, businesses, and communities across the globe, forward-thinking fintech companies may have even more opportunities to build their user bases.

“[...] There are huge addressable markets that are neglected by big banks,” Ott said. “It’s now very clear to both fintech companies, and I think to business owners, too, that fintech can step up to fill that void.”

For example, as the second wave approaches in the United States, “the expectation will be there — more business owners will turn to fintech companies from the get-go, and the SBA is prepared to accept applications out the gate from these fintechs like it wasn’t before.”