Providing financing to firms backed by their outstanding invoices isn’t a new line of business. But, it is becoming much more efficient with the entrance of new Fintech startups that are introducing methods to automate the invoice review and risk profiling of customers. Like other alternative finance firms such as P2P lending where valuations are growing quickly, fintech startups involved with invoice based credit are also experiencing strong investor demand.

The latest example is an announcement today from Fundbox that they have closed $50 million in new financing. The funding was led by Spark Capital Growth and included participation from Jeff Bezos’s investment fund, Bezos Expeditions, Ashton Kutcher and Guy Oseary’s Sound Ventures, Entrée Capital and previous investors such as Khosla Ventures and Blumberg Capital.

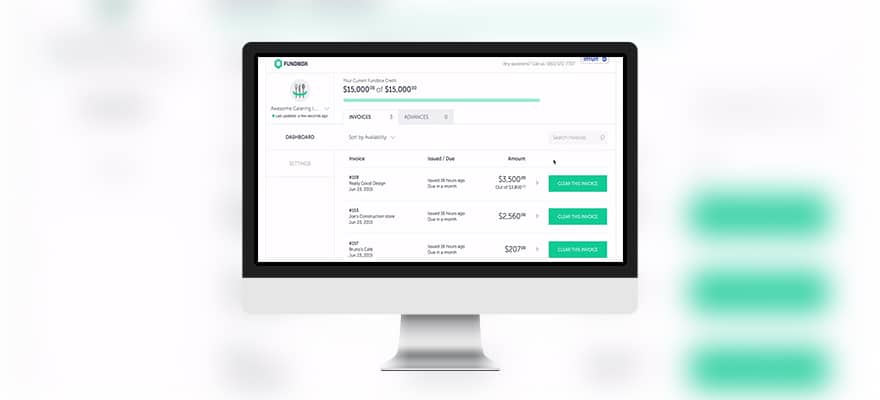

Like other invoice based lending startups, customers connect their accounting software to Fundbox's platform. Fundbox then reviews the firm’s cash flow history to determine their repayment risk and calculates terms for loans based on the outstanding invoices. According to Fundbox, the firm has recently underwritten its 15 millionth invoice and achieved 2x quarter-over-quarter growth for the past seven quarters.

The fast growth has enabled Fundbox to continue attracting new investors, even as the firm raised $40 million this past March. In total, Fundbox has raised $108 million from investors over the company’s lifetime. In regards to the current round, Fundbox has stated that it is targeting the funds to “further invest in innovation and product development” as well as expanding their headcount.

Commenting about the company’s fast growth and the current investment, Eyal Shinar, CEO of Fundbox stated, "The strong market demand for our product, coupled with the interest from the investment community, highlights that Fundbox is solving one of the most significant problems faced by the 29 million small businesses nationwide."