Before India Fintech Day 2016 which took place yesterday at the Grand Hyatt in Mumbai, Indian startup Accelerator NASSCOM partnered with KPMG to produce a report entitled 'Fintech in India' announced during the event and where the country's central bank regulator revealed related fintech plans.

NASSCOM has an initiative called ‘10000 Startups' which aims to incubate, fund and provide ambient support to help 10,000 technology startups in India by 2023, according to a description of the program.

The report was quite comprehensive, comparing the regulatory jurisdictions for mature fintech hubs with the prospects for India's emerging fintech potential and across a detailed scope of finance-related products.

RBI committee to study fintech impact

During the event yesterday, Reserve Bank of India (RBI) Executive Director N S Vishwanathan said: “RBI is in the process of setting up a multi-disciplinary committee with representatives from all financial regulators, stakeholders and banks to conduct an exploratory study of what kind of fintech is happening in the country, what can be allowed and create the right ecosystem for it."

Creating the 'right ecosystem' for fintech could be a hint of a regulatory sandbox or new guidelines and reforms to help support firms while having the right rules in place for relevant laws to be followed.

The news follows as the Reserve Bank of India (RBI) had referenced fintech in its June 2nd circular, which noted "the need to keep abreast of Fintech and digital innovations and peer-to-peer lending, the need to regulate credit guarantee schemes," as part of matters discussed during the 17th Meeting of the FSDC Sub-Committee in Mumbai.

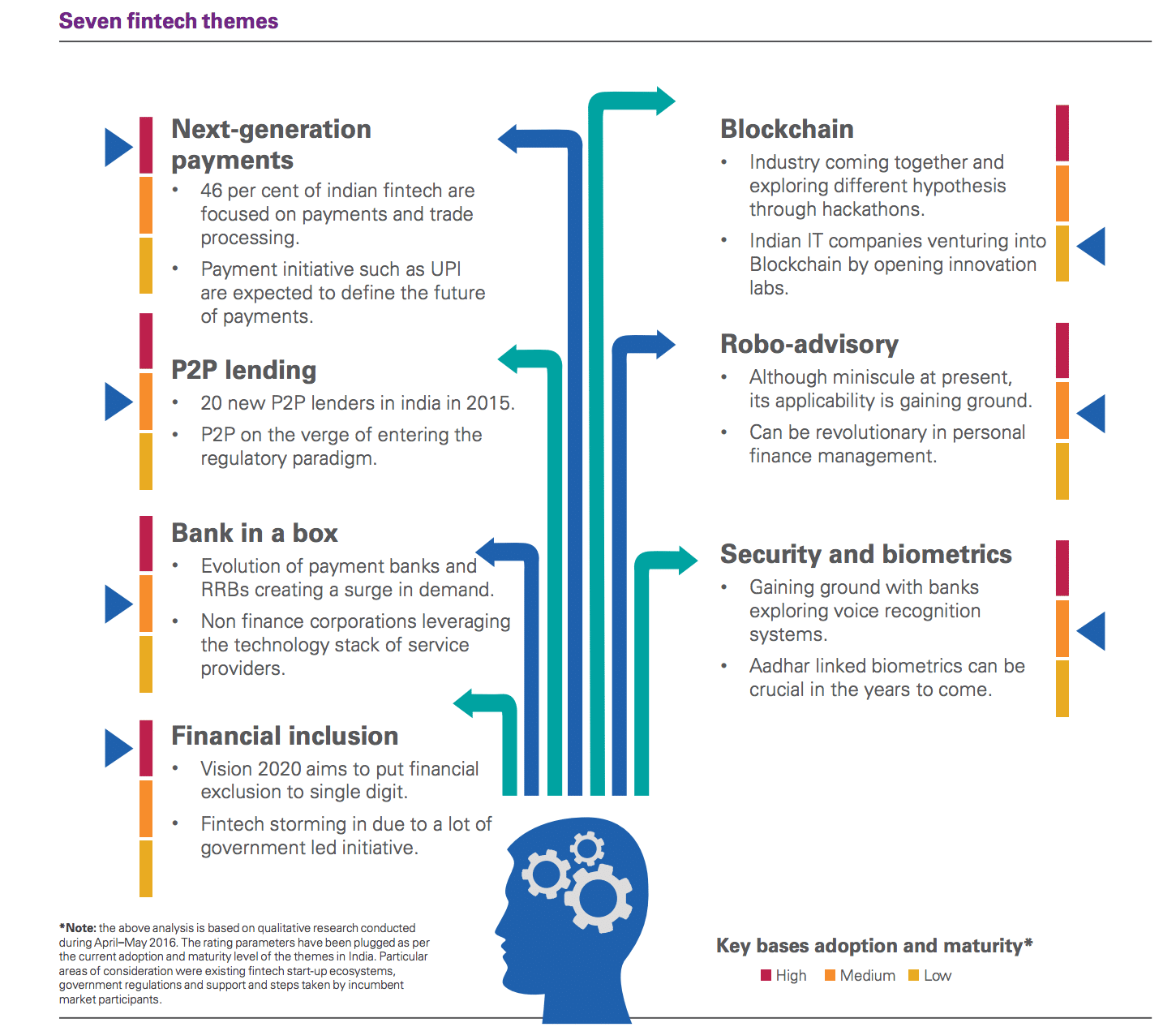

An excerpt of the joint report published by KPMG and NASSCOM can be seen below, highlighting the weightings of seven key themes in India, as the prospects for fintech in India appears to gain further momentum from its early stages of maturity across the Asia-Pacific (APAC) ) region and compared globally:

Source: KPMG/Nasscom 2016 Fintech in India report