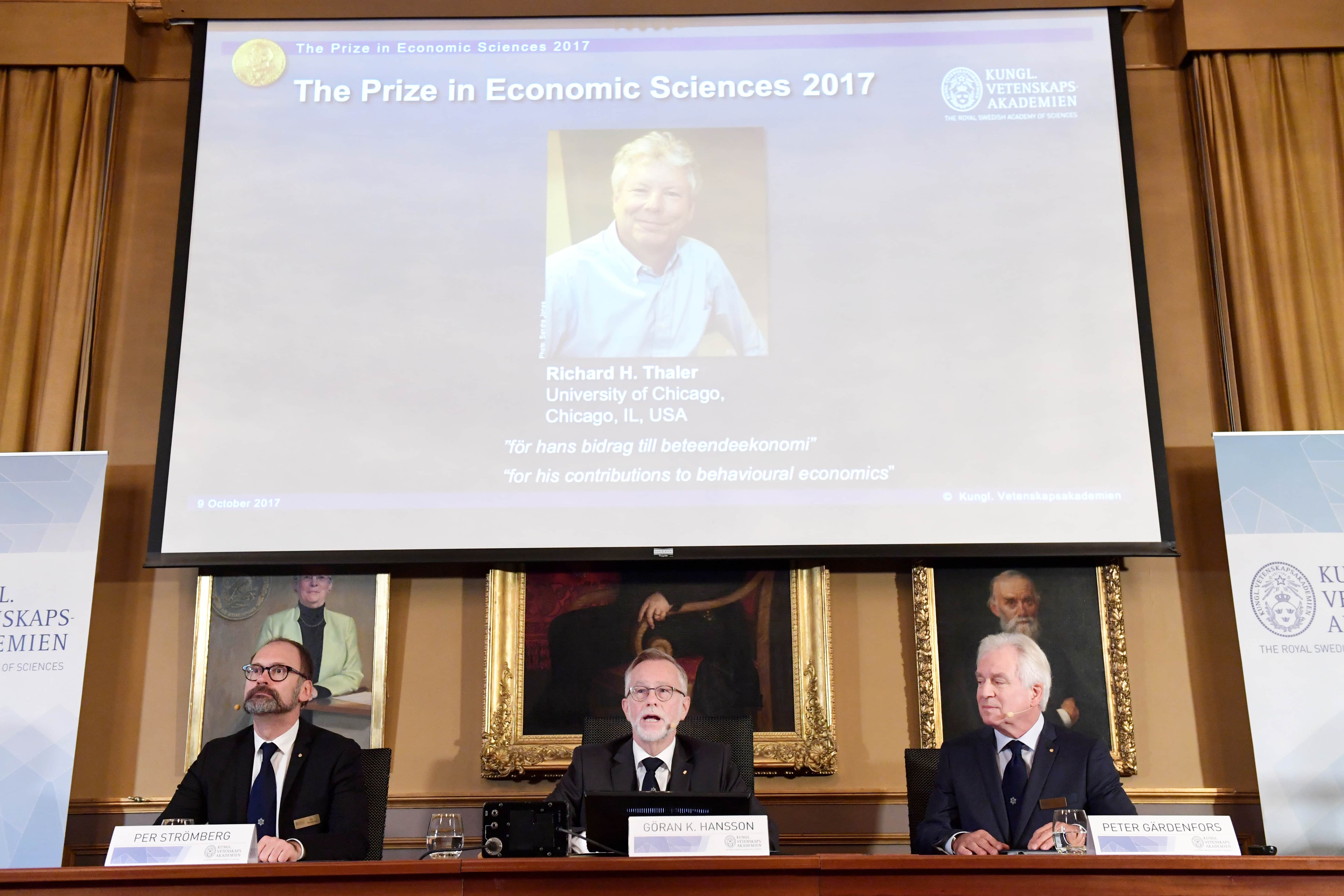

Professor Richard H. Thaler, from the University of Chicago, has been awarded the Nobel Prize for Economics for the year 2017. His works are of particular interest to the trading community as he is one of the founders of behavioural economics.

Richard Thaler

Thaler was responsible for explaining how human weaknesses such as lack of self-control and social preferences affect markets. He is well known for being co-author of the book “Nudge”, published in 2008.

The theory put forward in this book talks about how small incentives can push people into making certain decisions. This theory had far-reaching effects in the field of economics and has also given political leaders tools to influence voters.

Thaler also developed the theory of mental accounting, by which people try to simplify financial decision making by creating separate accounts in their minds. This causes them to consider the impact of their decisions on each account separately rather than understanding the overall impact.

Fairness Principle and Lack of Self-Control

He also did his research on the 'fairness principle', which made it difficult for companies to raise prices during periods of high demand but not during times of rising costs.

Thaler also shed light onto a common problem faced by traders, which is a lack of self-control. He showed how this can affect decision making, which would in turn affects market outcomes.

Thaler graduated from the Case Western Reserve University in 1967 with a bachelor’s degree and joined the University of Chicago’s Booth School of Business in 1995.

The Royal Swedish Academy of Sciences said that Thaler’s contributions have helped to build a Bridge between the economic and psychological analyses of individual decision-making, helping us to understand their impacts.