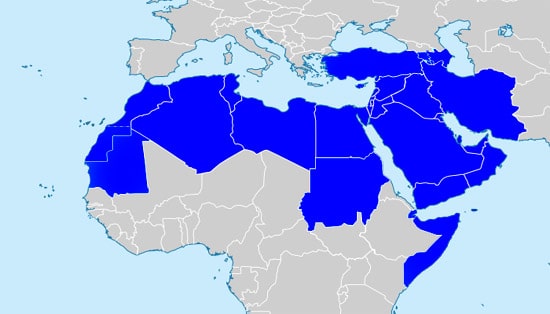

PayFort, an online payment service provider, and Wamda, an entrepreneurship platform in the Middle East and North Africa (MENA), have just released the “State of FinTech” report, which offers fresh data and insights on the region’s home-grown fintech industry.

According to the report, fintech start-ups in MENA now employ between 1,000-2,000 professionals, which is impressive for an industry that almost did not exist half a decade ago. In addition, the sector is set to quadruple in the next 5 years after the region has already seen a 43% rise in fintech investments from 2015 to 2016.

Specifically, the number of start-ups offering financial services in the region doubled from 46 to 105 in the last three years and the region could see a total of 250 start-ups launch by 2020, according to the study.

The latest report conducted by PayFort and Wamda also stated that 73 percent of all MENA fintech start-ups are based in Egypt, Jordan, Lebanon or the United Arab Emirates, with the latter accounting for half of these.

Omar Soudodi, Managing Director of PayFort, said that the UAE is the most dynamic hub with a four-year compound annual rate of almost 60 percent, and Payments are the most popular sector, accounting for half of all MENA-based fintech start-ups.

Mr. Soudodi added: “The rise of fintech in the region is driven by four opportunities — 86 per cent of adults don’t have a bank account, and SME lending stands at half of the global average; at the same time, the volume of eCommerce is set to quadruple over five years, and one in two bank customers is interested in new digital services.”

Fadi Ghandour, Chairman of Wamda, further elaborated: “The ecosystem in the region, in general, for tech entrepreneurship is happening and it is growing. Saudi Arabia is the biggest market in the region followed by the UAE. Fintech in the next three years is going to be the core of how the trade is going to happen.”

Abu Dhabi launches 'Regulatory Laboratory' initiative

The UAE in particular is already showing strong signs of support for fintech, as well as some early success stories.

In May 2016, Abu Dhabi’s Financial Services Regulatory Authority (FSRA) detailed its plans to create a sandbox environment for fintech in a bid to promote the development of Blockchain startups.

The new proposal from Abu Dhabi Global Market involves a structure for the so-called Regulatory Laboratory (RegLab) for fintech innovators. Instead of being subject to the full regulatory regime on ADGM, fintech companies will be able to use a lighter framework for up to two years to incubate their products. However, the unique initiative would seek to limit startups accepted into the program to those that promote significant growth, efficiency or competition in the financial sector.