Today’s splits in Tesla and Apple stock shares could be a positive thing for investors who are willing to hold onto their stocks for the next twelve months, according to multi-asset investment platform eToro.

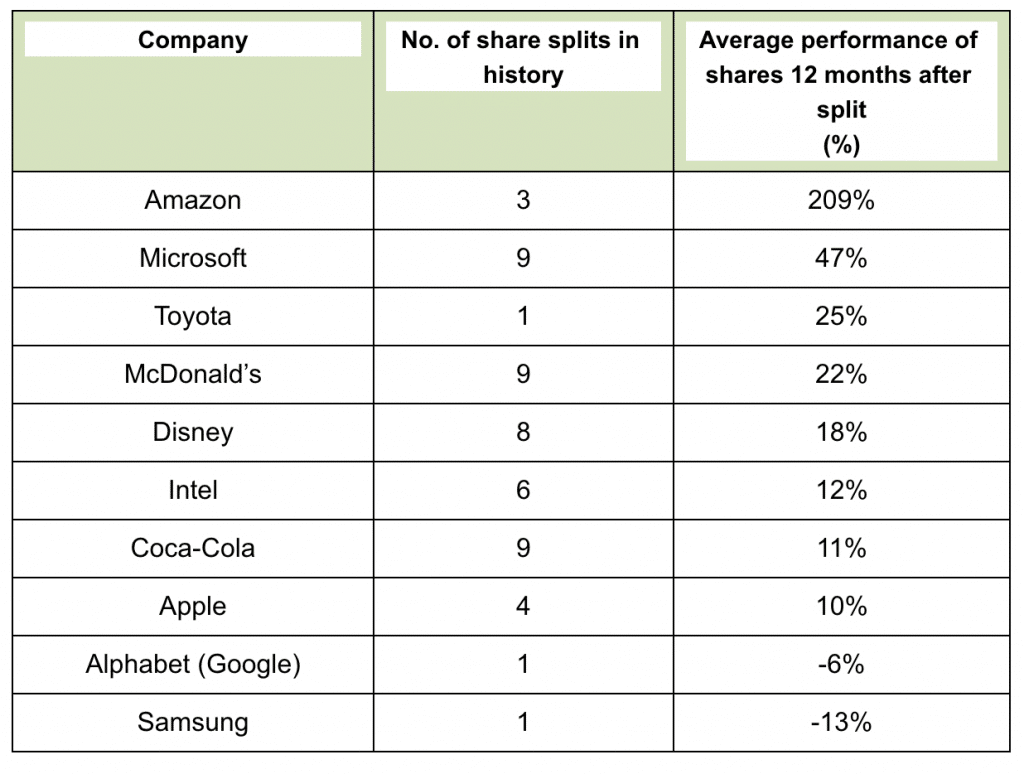

Specifically, eToro believes that the value of Tesla and Apple shares could surge by more than a third in the year following the split. The forecast is the result of an analysis that used 60 years’ worth of data to find that on average. Hence, the price shares of major brands climbed by more than 33 percent in the 12 months following the share split.

Stock splits are usually conducted in order to reduce the price of their shares, thereby making them more attractive to new investors. Later today, existing Tesla shareholders will get five shares for every share they own, while Apple shareholders will get four for every one they own.

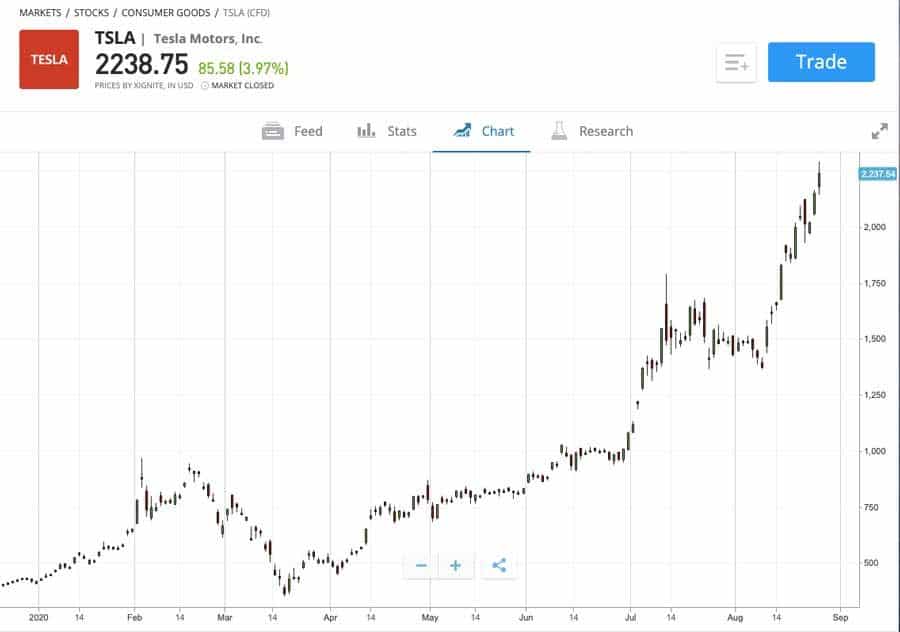

Through the movement of both Tesla and Apple’s stock prices rising this year, today’s split is not exactly a surprise. Tesla’s price has risen past $2,200 a share (up from $430 on January 2nd), while Apple’s share price had reached $500.

via eToro

Today Marks Tesla’s First-Ever Share Split, While Apple Is Splitting Its Stocks for the Fifth Time

While this is the first time that Tesla has split its shares, this is the fifth time that Apple has divided its stocks.

When Apple split its shares in the past, there were some eye-popping results: Apple’s share price respectively rose 36.4 percent and 58.2 percent in the 12 months after its June 2014 and February 2005 share splits.

On the other hand, Apple’s shares dove 61 percent in the 12 months after its June 2000 share split, making Apple’s average year-post-split price increase only 10.4 percent.

This time around, it seems as though the split will be a positive thing: eToro said that since Apple and Tesla announced their splits, both companies have seen surges in trading volume and rising prices: Tesla has climbed about 47 percent, while Apple has moved up 30 percent.

Open a Trading Account Today With These Recommended Brokers

While the splits themselves will not have any direct effects on the market caps of the companies, eToro says that stock splits can play an important emotional role for investors. “It is more of a psychological factor for retail investors,” a statement shared with Finance Magnates said.

For example, “going off current values, Tesla’s share price will be reduced to around $400, which may seem much more attractive to investors than its current price of $2000, as it may be viewed as more accessible for individual investors.”

via eToro.

The psychological role that numbers play has been observed across markets in the past. For example, some analysts contributed Bitcoin’s struggle to surpass $10,000 to psychological causes.