Merchant Cash and Capital, a financing firm focused on the SME market, is rebranding to Bizfi as they reposition themselves as a marketplace lending Fintech firm. Launched in 2005, and according to the firm having facilitated over $1.3 billion in loans, Merchant Cash and Capital's business model was based on sourcing offers from numerous lenders to service their SME customers.

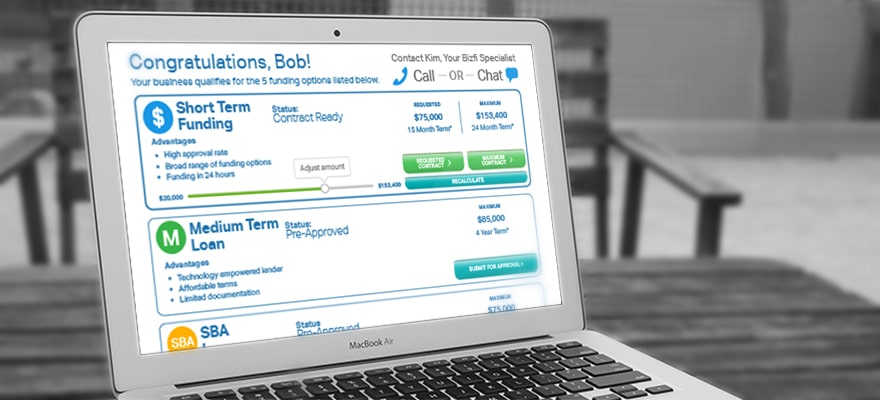

With this rebranding, Bizfi is embracing the evolving technology side of its operations. This includes the use of a front-end platform for customers to apply for loans as well as back-end solutions to aggregate funding options from numerous lenders for a quick turnaround of approval and loan terms. As Bizfi is positioning itself as a digital lender, the firm has partnered with many of the larger players in the marketplace lending sector including OnDeck, Funding Circle and Kabbage.

API and White Label

As part of their rebranding, Bizfi is also introducing today a new API and white label solution for their partners. Through the API, partners will be able to integrate funding Liquidity from Bizfi within their own solutions that they use to service SMEs. In addition, the white label is a branded solution for Bizfi’s partners to begin to market their own marketplace lending platform to SME customers. Like other marketplace lenders who have launched partnership products, BizFi will be looking to attract companies that already service SME such as accounting and consulting firms, with a new revenue source available through lending.

Regarding this strategy, Stephen Sheinbaum, Founder of Bizfi, commented about the release of the API and white label that “Companies that already serve the small business community are looking for ways to deepen their relationships with current customers. The Bizfi API and white label solutions will empower these service providers to offer a suite of financial services which will further cement the bond.”