The vast net of startups and influence of the PayPal mafia continues in the form of online marketplace lending to the under-banked. Part of the growing sector is PayPal co-founder Max Levchin who went on to become the CEO and co-founder of online lender Affirm in 2013. Aiming to provide services to an underserved market by banks, Affirm is creating services to offer small sized loans to borrowers with limited credit histories but who are financially responsible.

Gaining a boost to the endeavor, it has been revealed that Affirm has raised $275 million from investors Spark Capital Growth, Jefferies, Andreessen Horowitz, Khosla Ventures and Lightspeed Venture Partners. However, unlike typical venture-backed funding rounds, the capital comes in the form of debt and not equity, and will be used to lend to Affirm’s clients.

Unlike many of its online lending peers, Affirm is courting a target audience that has increasingly elected to shun the use of credit cards and limit their involvement with banks. This trend occurs as much of the US market has been moving from a credit-based one of the pre-financial crisis, to savings focus.

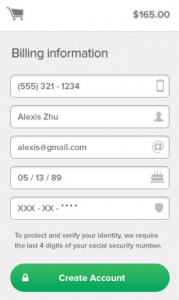

To provide an alternative to traditional credit cards and banking, Affirm provides services that are more in line with interests of the younger generation, such as using non-credit score criteria like social graphs to approve loans, as well as mobile account openings. Among the firm’s offerings are installment payment solutions that allow users to elect to apply for loans on specific purchases, but on the whole remain removed from relying on credit cards and banks.

Named ‘Buy with Affirm’, the online lender has partnered with numerous retails to integrate the payment option within its checkout process. In order to appeal to merchants, the firm markets the advantages of its services compared to other online payment options. As such, Affirm believes that due to reducing the amount of customer information needed to submit a ‘Buy with Affirm’ order versus credit cards, the payment option reduces online checkout friction and increases greater revenues and larger order sizes.