In a financial landscape often characterized by caution and incremental change, Revolut’s performance in 2023 offers a compelling narrative of innovation-driven growth and strategic foresight. The fintech giant's leap to $2.2 billion in revenues and a pre-tax profit of $545 million underscores more than just its operational success; it signifies a transformative shift in how financial services are consumed and delivered in the digital age.

1. Disruption of Traditional Banking:

At the heart of Revolut’s success is its diversified revenue model, which mirrors broader industry trends towards integrated financial ecosystems. By not relying on any single product or market, the company has insulated itself against the volatility that plagues traditional financial institutions. This approach is particularly prescient in the context of increasing geopolitical tensions and regulatory uncertainties, which have posed significant challenges for conventional banks. Revolut’s model - spanning cards, interchange, foreign exchange, wealth management, and subscriptions - illustrates a shift towards a more resilient and adaptable financial architecture.

Furthermore, the substantial rise in interest income—from $102 million to $621 million—reflects not only favorable central bank rates but also the company's strategic expansion in treasury capabilities and customer deposits. This growth aligns with a broader industry movement towards leveraging balance sheet strength to enhance profitability. Traditional banks, which have long depended on interest income as a primary revenue source, are now seeing digital competitors like Revolut encroach on this space with innovative deposit products and higher interest offerings, driving a more competitive market environment.

2. Financial Inclusion:

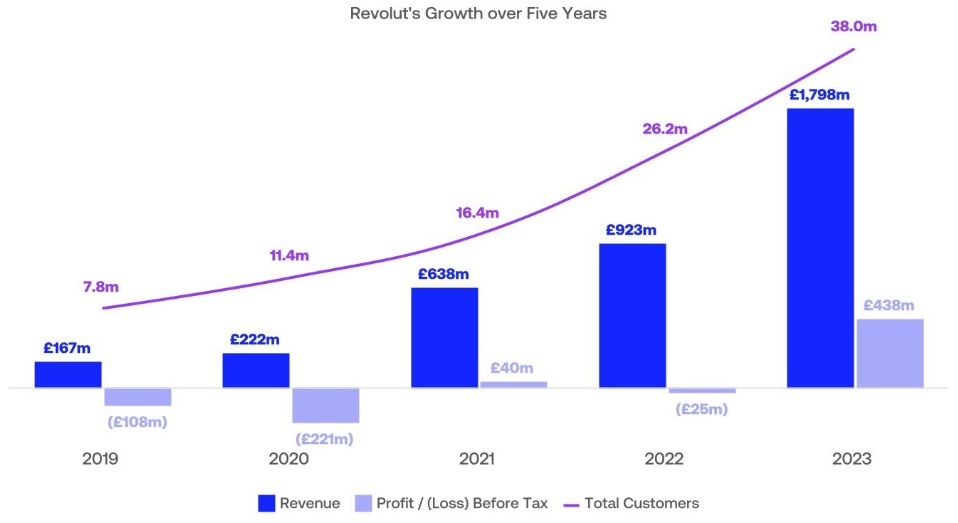

With its revenue doubling and customer base expanding to 38 million, Revolut is playing a crucial role in democratizing financial services. By providing affordable and accessible financial tools, especially in regions with limited banking infrastructure, it is driving financial inclusion. This not only promotes economic empowerment but also enhances financial literacy, fostering broader economic development.

3. Changing Consumer Expectations:

The dramatic increase in subscription revenue, which grew by 53% to $303 million, signals a deeper industry trend: consumers are willing to pay for premium, value-added services. This is a clear departure from the traditional banking model, where services are often bundled and offered for free. Revolut’s success in this arena indicates a consumer shift towards customization and perceived value, with users opting for services that offer tangible benefits such as travel insurance and cashback. This trend is likely to shape the future of financial services, pushing other players in the industry to innovate and offer more tailored solutions.

The addition of 12 million new customers in a year underscores a fundamental shift in consumer expectations. Today's users demand transparency, speed, and personalized service. Revolut’s ability to increase monthly transactions by 73% to 590 million by December 2023 highlights how it meets these demands, pushing the entire financial industry towards more customer-centric models.

4. Convergence of Finance and Technology:

Revolut’s diversified revenue model, which saw cards and interchange income rise to $605 million and foreign exchange and wealth management revenue climb to $491 million, exemplifies the merging of finance and technology. This convergence fosters innovation and creates new financial products, integrating finance into our daily lives in unprecedented ways, thus reshaping the financial landscape.

The fintech’s giant leap in revenue and pre-tax profit symbolizes a transformative disruption in the financial sector. Traditional banks, with their legacy infrastructure and slow processes, are being challenged by the fintech giant's digital-first, customer-centric approach. This paradigm shift forces established institutions to innovate rapidly or face obsolescence in an increasingly digital world.

5. Global Expansion of Fintech:

Revolut’s geographical expansion into markets like Brazil and New Zealand, coupled with the introduction of localized products such as IBANs and personal loans, highlights another significant trend: the globalization of fintech services. As regulatory barriers gradually lower and technology enables more seamless cross-border transactions, fintech companies are no longer confined to their domestic markets. This global reach not only diversifies revenue streams but also spreads risk across different economic zones, providing a buffer against regional economic downturns.

Expanding into markets like Brazil and New Zealand, its reach now spans 38 countries. This globalization, supported by a dramatic 46% rise in foreign exchange and wealth management income, reflects the worldwide appetite for digital financial solutions. By bringing its innovative practices to new regions, Revolut enriches the global financial ecosystem and promotes resilience through diversity.

6. Agility and Resilience:

The fintech giant's impressive ability to adapt, reflected in its 95% revenue growth and 58% increase in transaction volume, showcases its agility. Amidst economic uncertainties, its nimble approach and diversified income streams allow it to thrive where traditional banks may falter, highlighting the importance of flexibility in modern financial services.

7. Strategic Investment in Talent and Marketing:

Revolut’s success story is also a testament to the potential of strategic investment in marketing and talent. The significant allocation of $300 million to advertising and the expansion of its workforce by 38% to over 8,000 employees demonstrate that growth in the fintech space requires not just technological innovation but also robust support systems and human capital. This holistic approach is likely to become a blueprint for other fintech companies aiming to scale rapidly while maintaining operational excellence.

These investments ensure high service quality and brand visibility, essential for sustaining growth in a competitive market, reflecting a broader trend where human capital and brand building are key to success.

8. Cultural Shift Towards Financial Autonomy:

In Singapore, Revolut’s performance is a microcosm of its global strategy. The 110% revenue growth and substantial increase in retail customers reflect the broader regional appetite for digital financial services. The success of products like the <18 app and Flexible Accounts indicates a demographic shift, with younger consumers becoming a key target market. This is in line with global trends where millennials and Gen Z are leading the charge towards digital adoption in financial services, driven by their preference for mobile-first, user-friendly platforms.

9. Reshaping the Competitive Landscape:

The surge in customer engagement, with the company adding nearly 12 million new users and seeing a 73% increase in monthly transactions, underscores the growing consumer preference for digital-first financial solutions. This trend is corroborated by the rise of neobanks and digital wallets worldwide, which are challenging the dominance of traditional banking institutions. As consumers increasingly demand convenience, transparency, and real-time service, companies that can deliver on these fronts, like Revolut, are well-positioned to capture significant market share.

Moreover, the company's ability to achieve a 19% net profit margin and attract substantial new customers organically illustrates how it is reshaping the competitive landscape. Traditional banks are now pressured to innovate and provide more value-driven, customer-focused solutions. This competitive pressure benefits consumers through improved services and diverse product offerings across the financial sector.

10. Future of Financial Services:

Looking ahead, Revolut’s trajectory suggests a continued redefinition of the financial services sector. As the fintech giant aims to surpass 50 million customers by the end of FY24 and continues to innovate with products like eSIMs, RevPoints, and Robo-Advisor tools, it signals a broader transformation in financial services. The company's trajectory, marked by substantial growth in all revenue streams, sets a new standard for the industry, driving digital integration and customer-centric models as the future of finance.

Unpacking Revolut Results: The Key Takeaways

The broader implications of Revolut’s achievements are manifold. Firstly, it signals a clear disruption of traditional banking paradigms, challenging incumbent banks to innovate or risk obsolescence. Secondly, it highlights the importance of scalability and efficiency in financial services. Thirdly, it underscores the potential of fintech to drive financial inclusion, particularly in underserved markets where traditional banking infrastructure is lacking.

Revolut’s 2023 performance signals a shift towards more resilient, adaptable, and customer-centric financial services, driven by digital innovation and strategic diversification. As traditional and digital banking converge, the lessons from Revolut’s success will likely inform the strategies of financial institutions worldwide, heralding a new era of fintech-driven growth and transformation.