When fintech startups discuss disruption, much of the talk boils down to their ability to provide more efficient and lower cost services than banks and other long-established financial companies. Among areas where there is tangible evidence of this taking place is within currency Exchange and money transfers.

The sector includes startups focused on the remittance sector with its higher margins, but smaller sized average denominations, to firms operating non-bank online currency exchanges that can meet the demand of multi-million dollar transactions and appeal to larger businesses. The common denominator though is that by digitalizing the money transfer industry and limiting manual processes, these firms are able to provide expedited transactions and lower prices.

To build the world’s largest marketplace for currency transfers

Among the firms targeting the business market is Israel and UK based CurrencyTransfer.com. Speaking to Finance Magnates, Co-Founder and CEO Daniel Abrahams explained that the firm’s goal is to “build the world’s largest marketplace for currency transfers”.

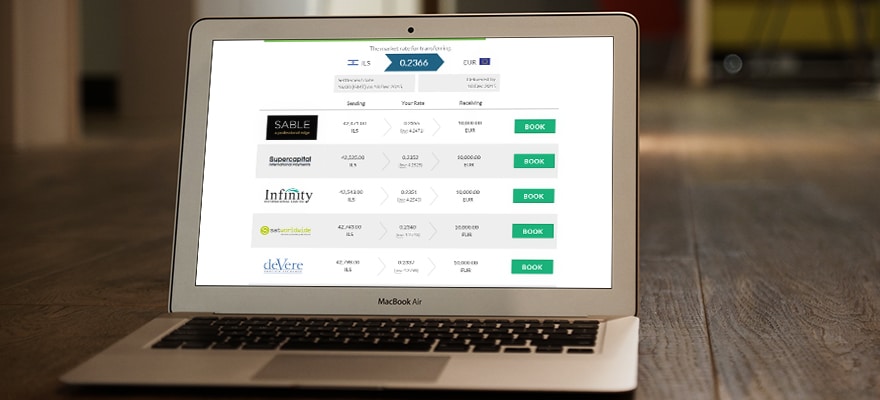

Their marketplace is based on connecting non-bank money transfer firms and foreign exchange Dealing Desks from around the world. As such, CurrencyTransfer itself doesn’t take risks and operate its own trading desk, but transactions are passed through to its marketplace partners. Customers enter the currency they want to sell and buy, and are provided with real-time quotes from numerous sources for the deal. Upon choosing a dealer, the platform gathers information to initiate and complete the trade

Dan Abrahams, CEO, and Co-Founder, CurrencyTransfer.com

Ending their first year of business, the firm revealed to Finance Magnates that they have achieved more than $40 million in currency transfers initiated on their platform, and last week hit the milestone of their 1,500th trade. According to the firm, this has resulted in 20% month over month revenue growth for the business.

As part of their latest updates, CurrencyTransfer has recently added local Israeli shekel settlement. The service was created to enable customers that are either based in or doing business in Israel, such as importers, exporters, overseas property buyers, and expatriates, to have a local bank account address for handling transfers in and out of the platform.

Abrahams explained that the shekel update is part of their larger marketplace model. He stated that money transfers are “more than just rates but also about ease of transfer”. He added that they are “building a global network of local points for settlement”. Through them, customers gain access to local accounts to facilitate the transfer or receipt of a currency transfer instead of having to rely on using a foreign firm to handle the bank to bank transfer.

Abrahams explained that his company’s view is that curation is a key part for any marketplace. This includes vetting participants and only accepting partners that can meet the need of customers. In the currency exchange market, Abrahams stated that one of the largest barriers of entrance is that their partners are required to have an API or other technology to distribute prices. Due to many firms lacking these solutions, CurrencyTransfer has created their own technology which can be used by third parties to distribute prices digitally.

According to Abrahams, CurrencyTransfer currently is partnered with 15 non-bank FX suppliers, with a goal to reach 30 to 40 suppliers while also growing their local access points. He added that the firm rejects about 90% of partners due to their curation requirements.

Convincing the masses

In terms of the future, affecting CurrencyTransfer as well as other fintech startups is the barrier of convincing customers to trust them with funds in replace of banks. Abrahams agreed that this is challenge for them as well as their peers. As such, he explained that part of the solution is building brand awareness for their firm as well as the overall alternative finance industry.

However, Abrahams cited surveys which show that banks themselves aren’t favored by the public. An example was a recent survey in the UK of which 85% of millennials would rather go to the dentist than enter a branch for a high street bank.

As such, Abrahams believes that as the public becomes more aware of non-bank financial alternatives, as well as publicizing their own track record, his industry is well positioned to grab market share from traditional currency exchange sources.