Digital payments in the Middle East may soon undergo a significant transformation. This is all thanks to the latest collaboration between Mastercard and the local Egyptian bank, Al Baraka.

This collaboration aims to elevate the banking experience in Egypt by introducing new products and services focused on digital payments.

A New Mastercard Partnership for Digital Payments in Egypt

Through the collaboration with Mastercard, Al Baraka Bank aims to expand its financial services, attract new customer segments and meet diverse customer needs with tailored offerings.

According to Abdel Aziz Samir, the Deputy CEO of Consumer Banking at Al Baraka Bank, this partnership will advance digital transformation and financial inclusion in Egypt. It promotes electronic payments and can positively impact the economy.

“Through this collaboration, we aim to expand the range of financial services provided, attract diverse customer segments, and meet all their needs through services and products tailored specifically for them,” Samir added.

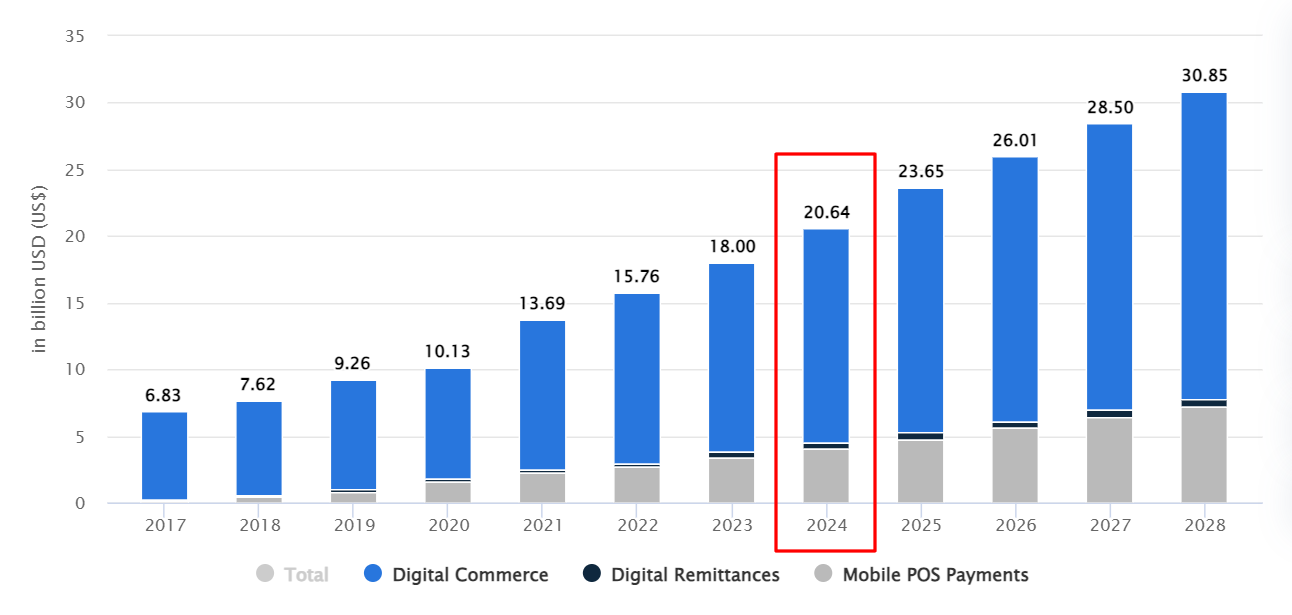

According to Statista, the digital payments industry in Egypt has been dynamically expanding in recent years and is projected to reach $20.6 billion this year. The estimates show that the industry is predicted to grow by almost 11% every year, ultimately reaching a value of $31 billion by 2028. For comparison, in the United Arab Emirates, considered the Middle East's financial hub, this value in 2024 is expected to be slightly higher, amounting to $30 billion.

The partnership is expected to redefine how people and companies handle finances in Egypt. By leveraging Mastercard's technology, Al Baraka Bank can set new standards for customer convenience, payment security and financial innovation.

“This collaboration will enable Al Baraka Bank to empower individuals and businesses with world-class innovative offerings and payment solutions to embrace the benefits of digital transactions by making transactions safe, seamless, convenient, and rewarding,” added Khalid Elgibali, the Division President at Mastercard for the MENA region.

TOP3 Digital Payment Trends for 2024

The shift towards digital payments is rapidly transforming the manner in which consumers and businesses conduct transactions. Predictions suggest that the total value of digital payments could exceed $14.78 trillion by 2027, driven by rapid advancements in financial technology and the emergence of innovative startups in key fintech centers like London. This evolution is expected to bring significant changes to the payment landscape by 2024, potentially disrupting the industry like never before.

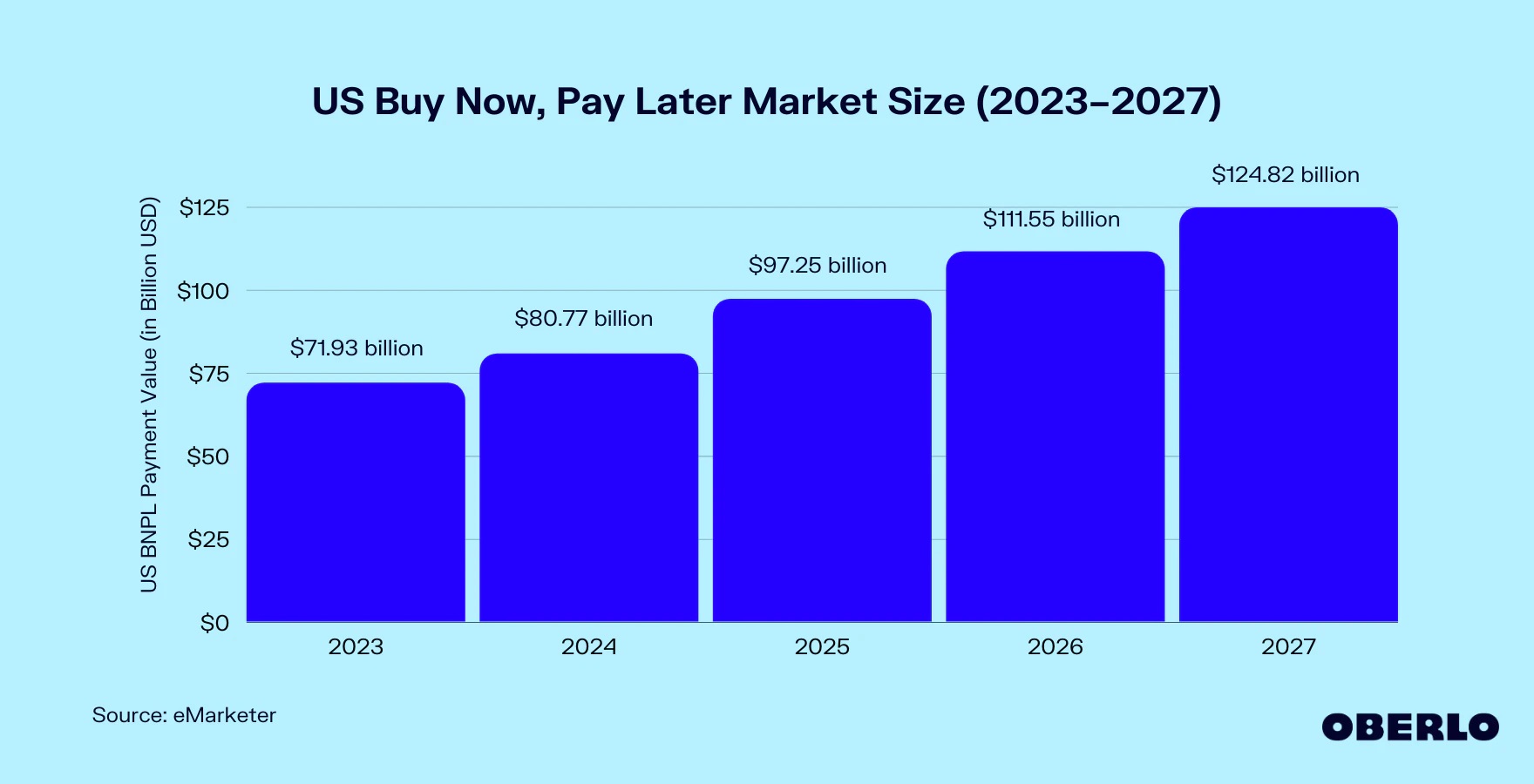

In an interview with Finance Magnates, Moshe Winegarten, the Chief Revenue Officer of Ecommpay, highlighted the three key trends impacting the sector. The popularity of Buy Now, Pay Later (BNPL) options saw a notable increase in 2023, helping consumers navigate financial pressures. Despite new regulatory measures boosting market confidence, there's a call for further regulation, with the BNPL sector projected to reach a value of $125 billion in the coming years.

Amidst the challenges of inflation and economic instability in 2023, businesses have been prioritizing expansion to tap into new markets and consumer bases, emphasizing the need for localized payment solutions. Additionally, the fifth anniversary of open banking in 2023 witnessed significant growth in its use and a trend towards market consolidation, reflecting its increasing adoption.

“This process has only just begun and we can expect to see this consolidation continue well into 2024, it’ll even extend to orchestration providers as merchants increasingly look for one solution that reduces friction, cost, and potential points of failure,” the CRO of Ecommpay forecasted.