The UK’s financial technology landscape including its payment technology (paytech) sub-sector is catching up with its US counterpart, as per the latest research from Emerging Payments Association (EPA), a leading payments organization founded in 2004 and with over 80 members, whose latest report was sponsored by Bancorp and carried out by Accourt and published in early May.

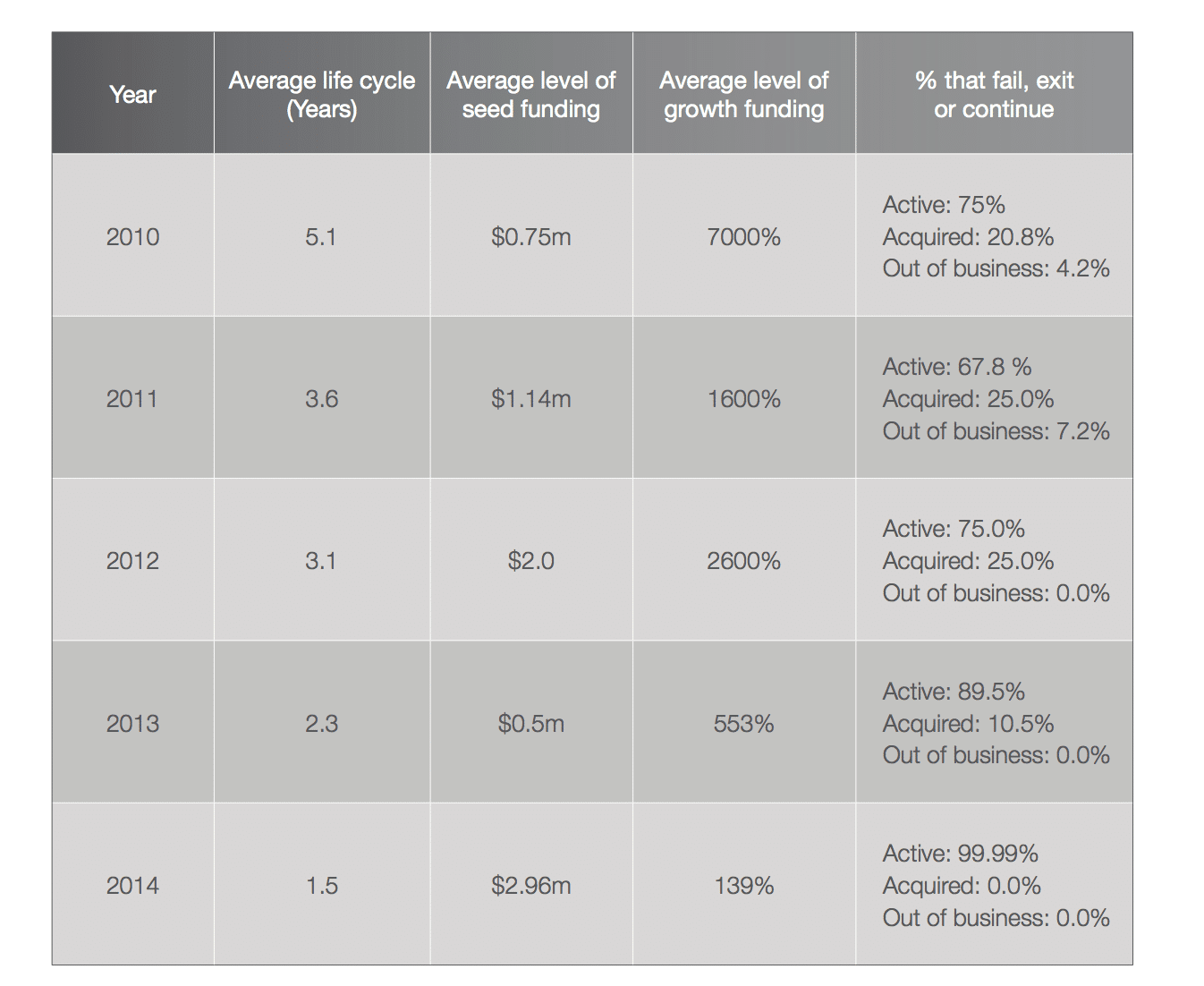

Details of the report were gathered after the researchers analyzed the investment lifecycles of over a hundred paytech companies that were founded in key Western markets including the US, the UK, France, Spain, Italy and Germany between the years 2010 and 2015. The report found that UK and US companies dominate the market, with 90% of startups originating from these places, and that the UK has been stepping up its share over the analyzed five-year span.

The new world of online trading, fintech and marketing – register now for the Finance Magnates Tel Aviv Conference, June 29th 2016.

UK stepping up

While the US leads the pack, the UK has been closing in after more than doubling from 13% in 2010 to represent 28% of startups as of 2015, whereas the percentage in the US in 2010 was 58% and only grew to 61% over the same period.

The report was titled ‘Investments in PayTech’ and also noted that the average round for a UK paytech firm was $1.8 million in seed funding during 2015, also more than double the $840,000 level from five years earlier, and the report noted that this figure is also on par with the seed funding average for US paytech firms.

Matt Harris

source: LinkedIn

Speaking with Matt Harris of Bain Capital Ventures, whose related firms have venture capital and private equity in some of the largest payments businesses in Europe, as well as numerous related companies in the US, he commented in response to questions by Finance Magnates regarding the report: “I view this research as very good news for the UK Fintech scene, and not surprising. We are seeing truly innovative companies, in a friendly regulatory environment and in a country with a truly global perspective - a compelling combination.”

Acquirers less certain

“It’s gratifying to see the UK PayTech sector punching well above its weight – not only creating new ideas that become new companies, but also creating businesses that thrive beyond the start-up phase to challenge the bigger players,” said Tony Craddock, Director General of the EPA, commenting in the report press release.

Mr. Craddock added: “While investors have recognised the potential in UK PayTech for some time now, it seems that prospective acquirers are less certain. PayTech companies and the broader payment industry needs to do a better job at showcasing the scale and scope of success in the UK.”

Brexit risks and synergies

The report followed barely a week after the EPA released another finding that showed that nearly a third of UK fintech firms may wish to leave the UK as uncertainties have arisen over a potential Brexit as the UK vote is slated to be held in less than two months from now on June 23rd 2016.

In similar news, UK-based moneycorp announced a partnership yesterday with US-based Tempus Inc, to offer a combined forex payments solution in the US. "The next five years will see a growth of global mobility in people and funds," added David Carrithers, Consumer General Manager at moneycorp Powered By Tempus, commenting in the press release regarding the synergy. "The old model of a local in-country bank as a consumer's only point of support on currency conversion and payment has shifted."

A table from within the EPA's latest report showed the shift over the five-year period analyzed, as can be seen below excerpted from the white paper:

Source: EPA PayTech Investments 2016 White Paper