We all know that the internet is moving to mobile, but what about online orders of good, are they staying on the desktop or is the small screen grabbing consumer wallets as well?

Providing a glimpse of mobile commerce and what are the successful trends of app-based Payments , ECommPay, a provider of payment solutions for online commerce, published their findings on the ‘m-Commerce market’.

Some of the headline figures from their analysis:

- m-Commerce accounts for 1 out of 10 e-Commerce dollars spent

- 1 out of 3 customers access a retail website from a mobile platform

- 35% of major retailer’s audience are ‘mobile only’ consumers

- Apps drive smartphone purchases versus browsers on tablets

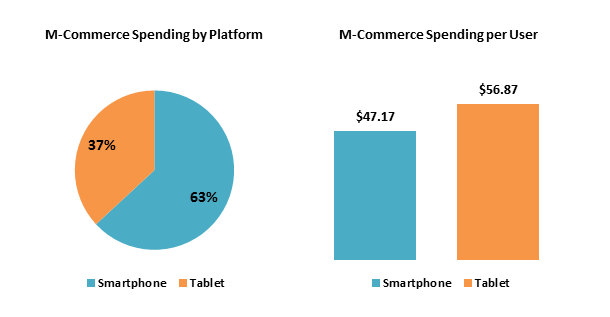

- Smartphones are 63% ($6.7B) of total m-Commerce spending but have smaller purchase sizes than tablets

- Average spending by smartphone user is $47 vs $57 for tablet users

App Optimization

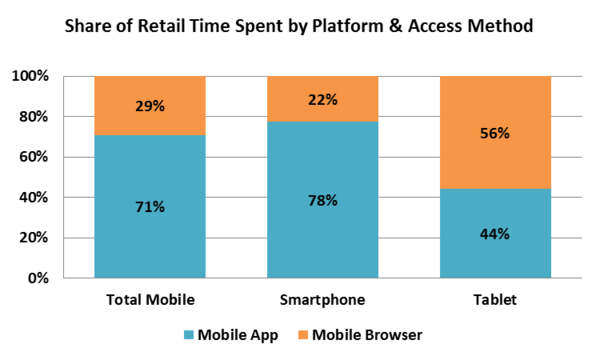

Among the data points, the one that is perhaps the most important for mobile payment developers is that smartphone purchases are more likely to take place on apps. According to the data from ECommPay, smartphone apps drove 78% of user traffic versus mobile browsers. However, the opposite was true of tablets with 56% of user engagement still taking place on mobile browsers compared to apps. The data fits well with user trends that have shown that typing and entering user information on smartphones entitles much more friction than larger devices. As such, mobile apps that store user payment details provide a more efficient process to checkout.

For firms in the payment space, the above trends should point towards greater demand from app developers for biometric verification products. Such features would allow mobile users greater feeling of security for information stored on their apps in the case of theft of their devices. In addition to Apple which introduced fingerprint identification to mobile devices, other firms such as American Express as well as startups like Jumio and OneVisage have been creating products that integrate facial recognition into app-based payments.

Retention

Among ECommPay’s takeaways from the analysis was that m-Commerce developers need to focus on retention. Knowing that retail user bases are migrating more towards mobile for not only discovery of products but purchases as well, means not only optimizing the checkout process, but also continued engagement. In this regard they cited that mobile shopping rates spike during the Q4 holiday season, but fall dramatically in the following two quarters. ECommPay suggested that retailers should use the lagging periods to target mobile shoppers to keep them engaged in preparation of Q3 and Q4 when mobile spending rates spike higher.

Fintech Spotlight is a new column on Finance Magnates devoted to reviewing innovative financial technology companies and sector trends.