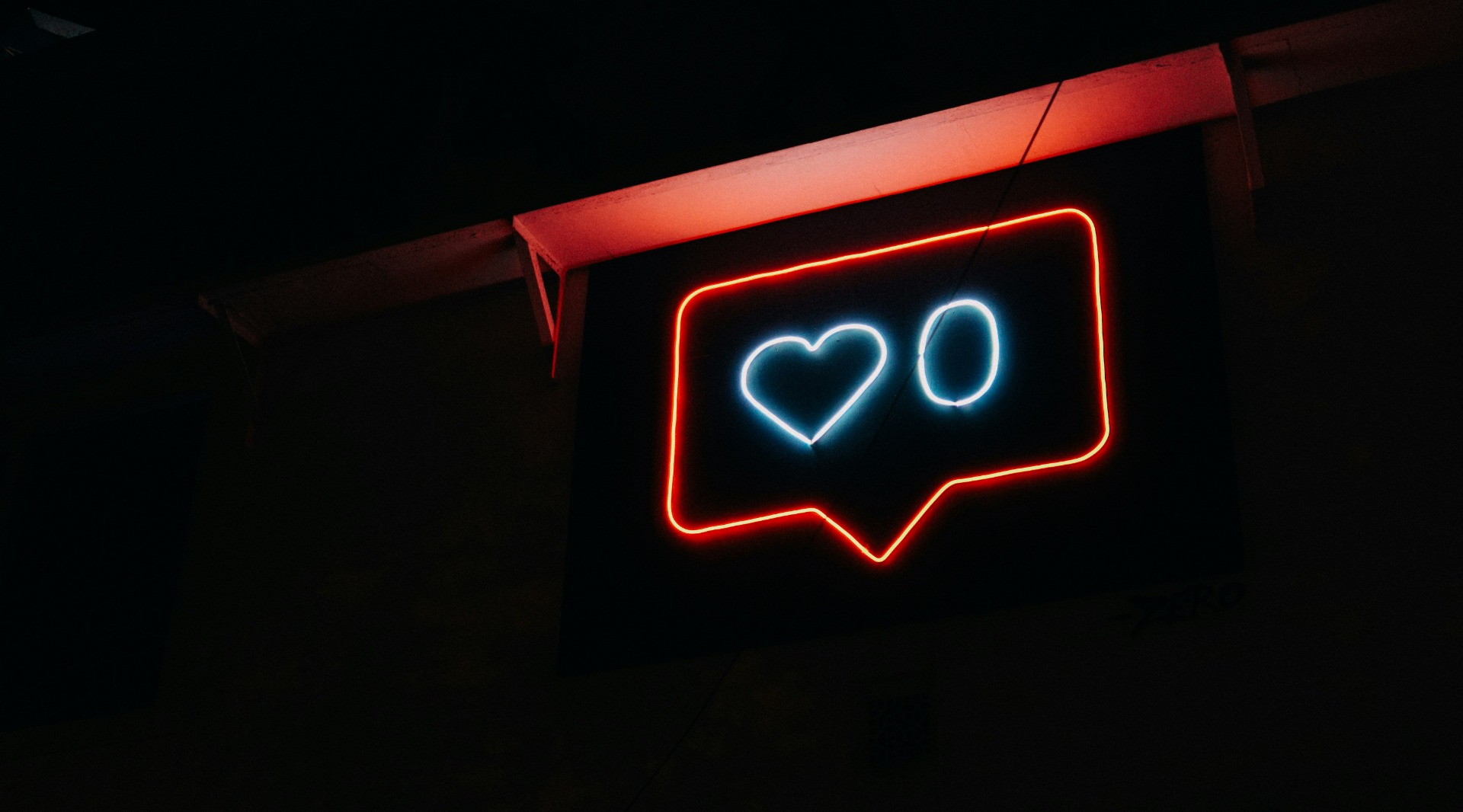

It sure seems like our wallets are feeling a bit chunky these days. Bulging with plastic and that forgotten loyalty card from that quirky vintage store on vacation. But what if your financial life could be as sleek and streamlined as your favorite social feed? Enter social media payments – the fintech revolution happening right under your nose, or rather, your thumb.

At its core, social media payments offer a seamless integration of social interaction and financial transactions. In short, people scroll through their feeds and with a few clicks they can buy what they see within the app or send a secure payment to contribute to one of their favorite influencers’ adventures.

That's the magic of social payments, a seamless blend of social interaction and financial transactions that's poised to redefine how we manage money in the digital age.

Going Global: Connecting the World, One Transaction at a Time

The days of wrestling with currency exchange rates at the airport are long gone. Social media payments, mirroring the interconnected nature of social media platforms themselves, can transcend borders as effortlessly as any viral travel blogger hopping continents.

And with billions using them, they have the potential to offer a global reach for financial transactions, meaning that sending money to friends or family abroad, supporting international charities, or even making a quick purchase from that Etsy seller in France, is all becoming as easy as double tapping a pic. This fosters financial inclusion, making financial tools accessible to a wider audience, even in regions with limited access to traditional banking services.

Disrupting the Status Quo: Social Payments as the Super App Springboard

So, things might not be just what the seem. Social media payments aren't just adding a "buy now" button to your feed; they're shaking the very foundation of traditional finance. It's a financial earthquake felt not just by clunky credit card companies, but by the entire payment ecosystem.

In the near future, your bank account might just live within your favorite social app. No more toggling between platforms as you will seamlessly pay your bills, split the dinner tab with friends (who you probably met on the same app), and even invest in that hot new crypto your feed keeps buzzing about. This is the future social media payments are hurtling us towards.

And this isn't some distant utopia either. WeChat in China has already achieved super app status, offering everything from social interaction to food delivery and, of course, payments, making it a one-stop shop for everything digital, and social payments being the glue holding it all together.

Western social media giants are taking notice. By integrating payments, they're not just offering convenience; they're building an empire of user data and spending habits. This goldmine of information will fuel targeted advertising on a hyper-personal level, blurring the lines between social interaction and persuasive marketing. Which brings us to Elon Musk’s recent moves.

X’s Strategy Going Forward

X (formerly known as Twitter) just received money transmitter licenses from Illinois and New Mexico, bringing their total to 23. The aggressive licensing push by the social media giant, now under the helm of Elon Musk, is a clear sign of their ambitions in the payments game. With a nationwide launch of a payments feature by mid-year being their stated goal, all eyes are on X to see if they can secure the remaining licenses and become a major player in this disruptive space.

So, are we in for a dystopian future controlled by like buttons and algorithmic suggestions?

Maybe. But social media payments also hold immense potential for democratization as they could very well bridge the financial inclusion gap, making financial tools accessible to the unbanked masses. In fact, there’s even a case to be made on how apps can take it further and make users go from passive scrolling to active participation by becoming platforms for civic engagement.

The disruption is upon us, and it's exciting, terrifying, and undeniably transformative. Whether social media payments become the springboard to a super app utopia or a platform for unparalleled social manipulation remains to be seen. But one thing's for sure: the way we pay, connect, and consume is about to get a major facelift. Buckle up, and get ready to redefine what it means to swipe right...on your finances.