IFX Payments, a London-based payment and foreign exchange provider announced a record financial year, with a 59% increase in profits and a 25% rise in revenue.

The company's revenue for the 2023/2024 fiscal year reached £41 million, up from £33 million the previous year, while profits surged from £5.8 million to £9.2 million.

IFX Payments Reports Record Profits and Revenue

The strong performance comes as the demand for international payment solutions continues to grow. According to research from the Bank of England, the value of cross-border payments is expected to reach $250 billion (£197 billion) by 2027, a significant increase from $150 billion in 2017.

IFX Payments' flagship product, ibanq, a multi-currency virtual IBAN account, has been a key driver of the company's success. The platform integrates with IFX's foreign exchange services and global payments network, allowing clients to manage funds in 38 currencies.

“As a growing company with a global outlook we know the challenge of managing processes across multiple countries and have made it our mission to help deliver efficient and reliable international payments for our clients through ibanq,” commented Will Marwick, CEO at IFX Payments.

He also emphasized the company's commitment to expanding into new markets and territories to help more businesses streamline their payments.

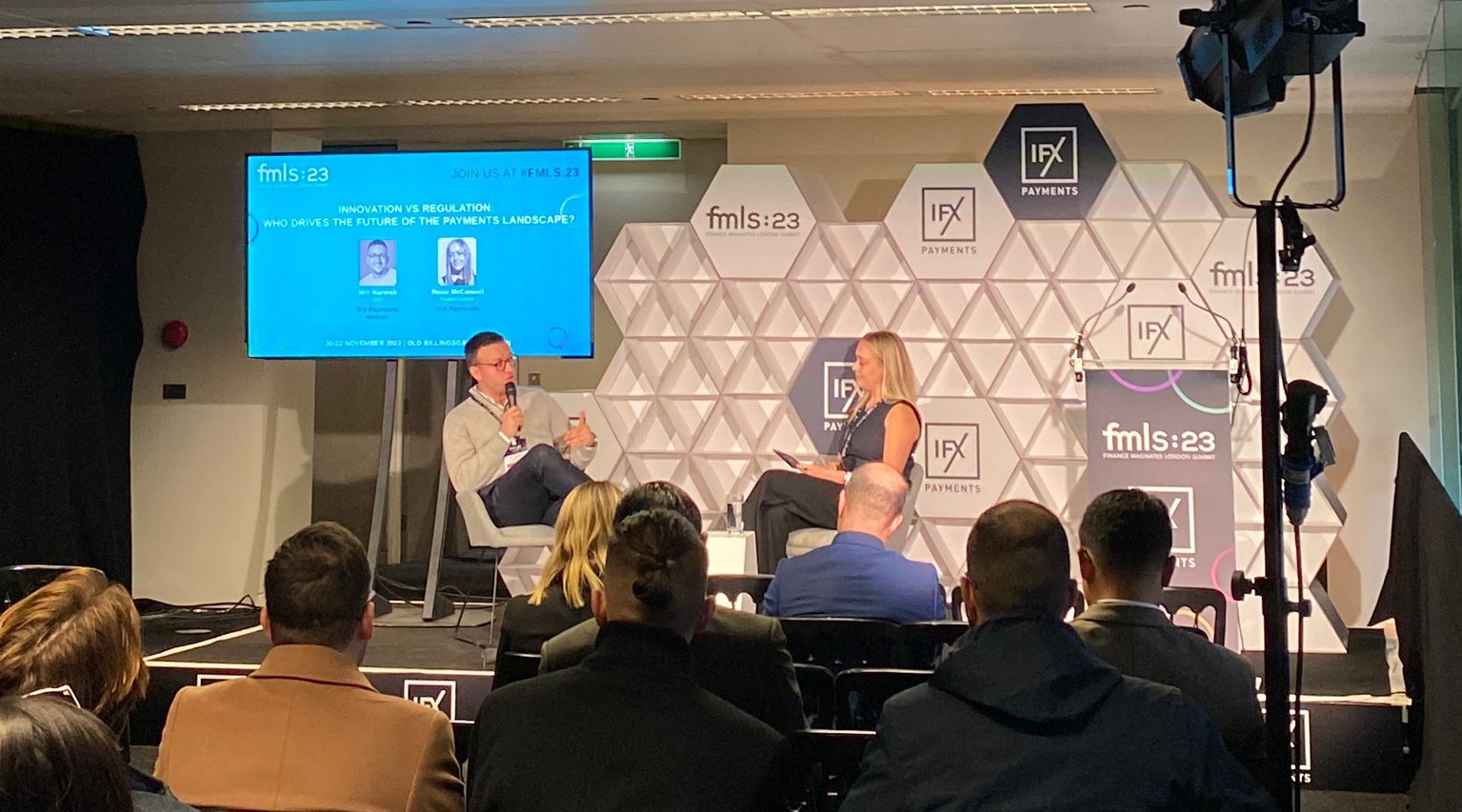

Warwick, along with Rosie McConnell, Product Director at IFX Payments, was one of the panelists during last year's FMLS:23 conference, where he discussed the factors driving the payments landscape.

New Hires and Partnerships

Over the past year, IFX Payments has strengthened its executive team with several key hires, including Sara Cass as Chief Compliance Officer and Graham Ridley, formerly of Barclays, as Strategy Director. Back in March, IFX Payments tapped Millie Richardson as a Non-Executive Director, to use her compliance experience in steering governance.

In the UK, IFX Payments has increased its visibility through partnerships with Premier League club Bournemouth, Scottish Premiership side Hibernian, and recent League One Playoff winners Oxford United.

The company has also expanded its global presence by acquiring a license to operate as a foreign money services business in Canada.