UK-headquartered Payments provider, SafeCharge International Group Ltd., listed on the London Stock Exchange (LSE) under ticker SCH, today announced the sale of its minority stake in FinTech Group AG, according to regulatory filings with the LSE.

FinTech Group AG is traded on XETRA under ticker symbol FLA and based in Germany as a financial technology (fintech) company, and SafeCharge had originally purchased nearly 5% of the company for roughly 10m euro – and now realized a small profit by fully exiting its position in the firm.

Safecharge pursues payments synergies

SafeCharge intended to pursue synergies with FinTech Group AG as part of its initial stake, although its focused had since shifted due to subsequent developments with Saxo Payments – a division of Saxo Bank based in Denmark, according to people familiar with the developments and as the company noted in the filings.

The new world of Online Trading , fintech and marketing – register now for the Finance Magnates Tel Aviv Conference, June 29th 2016.

As the deal with Saxo Payments became more of a priority, this helped lead to the exit of SafeCharge’s position in FinTech Group – and which should help free up some cash for the company thanks to a net profit from the deal.

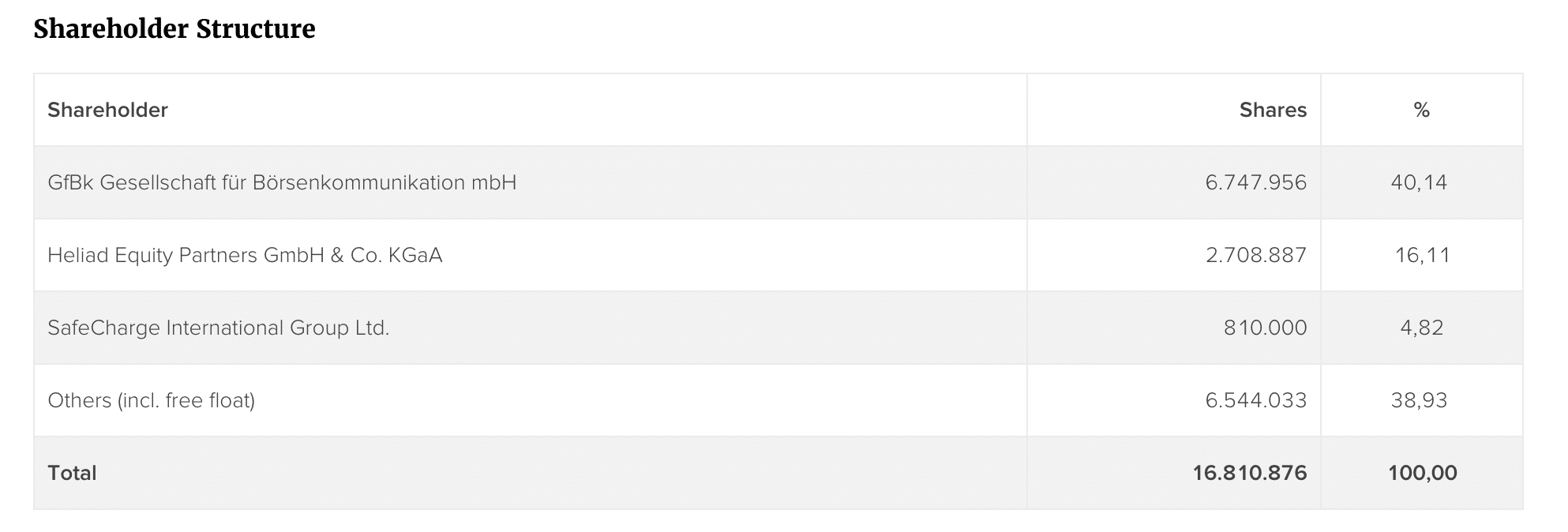

The major remaining shareholders in FinTech Group AG include GfBk Gesellschaft für Börsenkommunikation mbH with over 40%, and followed by Heliad Equity Partners GmbH & Co. KGaA with a just over 16% of the firms shares, as per data maintained on the company's website.

Small profit realized on deal

FinTech Group's market cap is roughly 235.5m Euros, indicating that the 4.8% stake that SafeCharge paid 10m for may have been sold for roughly 11.3m euros - using today's prices - and resulting in the small profit mentioned in the announcement.

It's not clear however whether SafeCharge sold all the FLA shares today or had slowly unwinded its position in recent months, as recent volume data for FLA doesn't reflect such large transactions yet. Nonetheless, SafeCharge did mention of a profit, which means its average take-profit level was above its initial purchase price, and was required to make the filing as the position has now been exited.

Safecharge had entered its 5% stake last year in the firm at roughly 12.45 euros per share, when FinTech Group AG had 16.2 million shares outstanding last year and its position was slightly diluted to just over 4.8% after FinTech Group AG had issued additional shares since the initial purchase. Shares of SafeCharge were little-changed around the time of the announcement today.

FinTech Group strikes deal with Finotek

The news follows days after FinTech Group AG struck a deal with Finotek for a cross-border fintech initiative with Korea, and after the firm was invited by the Korean government to ink the deal in the presence of Korea's president Park Geun-hye at the signing in Paris.

Shares of FinTech Group AG traded on XETRA hovered around 14 euros per share around time of the news, and the excerpt below shows that SafeCharge held 810,000 shares in the company as of yesterday.

FinTech Group AG Shareholders, as of June 13 2016.

Source: FinTech Group AG