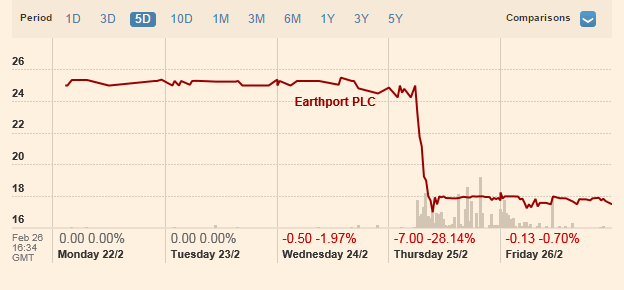

One of the largest open networks for global bank Payments , UK-listed Earthport Plc, traded under ticker EPO, saw its stock price fall almost 30% since Wednesday. The drop from just over 25 pence per share earlier this week, to 17.75 where it closed today, was related to a £5m potential loss that the company warned materialized from actions of a single corporate customer, yet was not connected with any client funds, according to a regulatory filing.

The AIM-listed company operates payment related business lines including a Multilateral Trading Facility (MTF) and said that amount referenced in the warning was attributed to potentially fraudulent activity that one of its corporate relationships may have allegedly “intentionally” carried out, thus leaving Earthport's FX payments subsidiary with the unpaid bill.

The Earthport payments subsidiary Baydonhill provides foreign exchange transactions on behalf of corporate customers, where the corporates settle trades made on their behalf by Baydonhill. The company is pursuing legal avenues in connection with the filing.

Core business not affected

The immediate impact of the news sent the stock lower, although the company noted in the filing that it has enough capital, citing the £24 million it reported at the end of 2015, and highlighted its recent interim update regarding the company’s growth plans and capital buffer.

The company noted it will seek all possible avenues to pursue recovering the funds, and alleged that the corporate client that caused the loss may have intentionally committed fraud and that the customer had started liquidation proceedings by seeking to appoint an administrator.

Earthport said it has contacted the relevant authorities as it seeks to recuperate the amount. Therefore, litigation or other legal action could follow.

Share price overreaction

The nearly 30% stock price drop since yesterday reflects more than 7 times the £5m potential loss figure as the change in stock price wiped off nearly £30 million in valuation, with 476 million shares now valuing the company at roughly £84m, whereas pre-news it had a market cap of £119m. It thus looks oversold.

Source: FT.com

UK Analyst Panmure added a buy recommendation and a 55 pence price target following the drop, while additional analysts revised earnings per share (EPS) outlook estimates for EPO lower for June 2016, and 2017 forecasts.

Analysts believe Earthport's disruptive potential in the nearly £30 billion cross-border payments market is substantial.

Seeking to recoup amount

This news prompted a sharp sell-off in the company’s stock, as it said in a regulatory filing that the amount may not be recovered. The incident was limited to this one corporate and doesn’t affect any of the firm’s other clients or relationships, as per the update.

Earthcore said that because of its own cleared-funds model (i.e. no payments are made until cleared funds are received from clients) there is no impact on its own core business where such exposure is mitigated (by waiting for funds to clear), when compared to its Baydonhill business.

Although this news appears to he a one-off, it’s not clear what steps will be taken to prevent future risks to the subsidiary from such reoccurrences. Finance Magnates reporters reached out to a company spokesperson but was unable to obtain comments, and as the case is now being looked into.

The company got the attention of cryptocurrency enthusiasts when Earthport partnered with Ripple over its XRP currency - as covered by Finance Magnates.