Tal Miller is the founder of the Fibonatix Group and current CEO of Fibonatix (Israel). In the upcoming Finance Magnates London Summit, he will hold a seminar titled "Best Practices in Online Payment" on how to increase company revenues and enhance the customer experience. We sat down with Miller for this exclusive interview to learn from him about how he sees one of the most pressing matters in the online trading world - restrictions on binary options.

Tal Miller, CEO, Fibonatix (Israel).

The CEO of Fibonatix has been following the online FX and binary options industry since its inception. Miller had a consultancy firm in Austria that for years advised high risk companies on how to improve their Payments services and solve issues related to this. He specialized in Risk Management , as well as regulatory compliance with different countries, Visa and MasterCard. When he moved to Israel, local clients requested that he simply apply his knowledge directly for them and skip the consultation, and thus Fibonatix Israel was born as a payments provider.

Criminals in binary options

In the last year, we have seen regulators around the world target binary options – the reason for this is that a lot of people that entered the industry should not be part of any business because they are criminals, it’s as clear as that. They brought with them illegal practices that combined with the high sums that people deposit to binary options create a serious problem. In gambling people deposit around $500 per ticket, but in binary options it can go up to $100,000 per person so a scammer can seriously hurt someone and this attracts criminal investigators leading to regulatory attention.

Another thing that is drawing heat to the binary options industry is that it is successful. The industry clears about €2 to €2.5 billion a month – this is a very big business. Naturally, with such sums of money involved, countries ask themselves how do we get a piece of that action. ‘You are marketing to my citizens but I don’t see a dime from it, this bothers me.’ So, it’s easy for them to put on the consumer protection hat and enter the market under that pretense.

What about the countries that ban it instead of regulating?

This is very similar to the dynamic of the gambling industry ten years ago. Israel is a good example of this - you are told that building a casino is not allowed because we don’t want to get people addicted, but there are ads in the morning news for UK horse betting, but that’s ok because it’s controlled by the national lottery. My opinion might be extreme but I think that the state should interfere and make sure business is conducted properly, that they don’t target weak people, people that can’t make informed decisions – but as an adult, if I want to put my money into horse betting there should not be a monopoly. We see the same thing in Norway, the US and many other countries. In the US, online gambling is illegal and we can see that this is due to pressure from Las Vegas, because if you are free to gamble from home in your underwear, the chances that you will go all the way to Vegas decreases, and so it is made illegal in the name of protection.

Fibonatix

Another thing is that today no one will ever think about setting up a gambling operation without some type of regulation – and there are different levels of regulation depending on how much you can spend – and it is obvious you will only operate in markets where the law allows you to work. But in binary options this is not a given.

Years ago, around 2009, we had a project working for one of the bigger platform providers, checking why European banks are classifying binary options as gambling and not financial services (as forex is coded) with regard to their credit card codes. We got several answers: some said it is a simple product and therefore gambling, some said they are not familiar with the product so they classify it as gambling because if they do that they won’t get into trouble, while the opposite is not true. We solved this issue because this should not be the case. American cards for example can’t work with a gambling code and this is blocking whole markets needlessly.

Understanding the issue with Visa

Finance Magnates recently reported that Visa is tightening the screws on binary options. We asked Miller for the background to the move.

As this field is growing and accumulates a negative reputation, it creates a need for the regulators to interfere, and that is pushed forward on card companies. We said that the industry is big, but it is still small compared to the business of Visa and MasterCard (Visa cleared around $19 billion a day in 2015) so it’s not a top priority for them.

Until about April Visa was two separate companies, Visa Inc in North America and Visa Europe which handled the rest of the world. Despite having a similar name and logo they operated in totally different ways per different protocols and regulations. But earlier this year Visa Inc acquired Visa Europe and they are going over everything and streamlining it, either replacing Visa Europe’s protocols with those of Visa Inc or creating a new protocol all together.

This is an opportunity for Visa Inc to deal with issues it considered problematic for a long time. And every industry now thinks they are targeting them specifically. I had an interesting discussion with the owner of a porn-related PSP and he is sure that all these moves are meant to hurt that industry (because most porn sites are American and the clearing is all done in Europe).

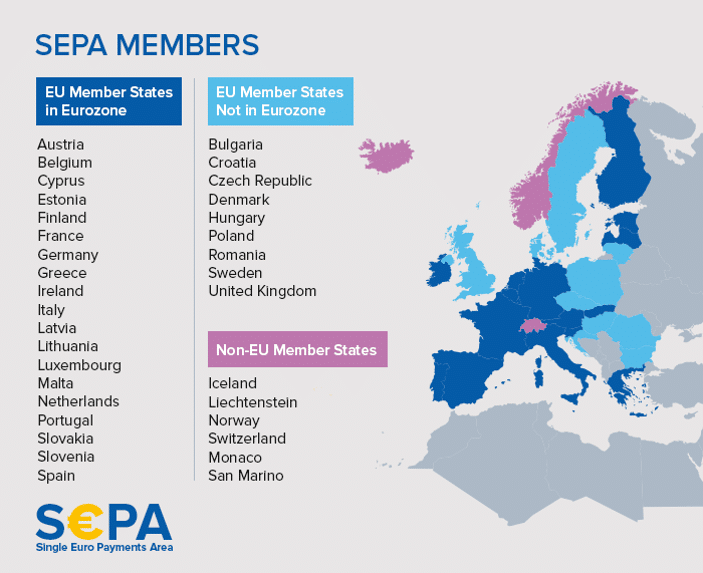

To satisfy Visa, you will need to show that you are really in Europe, meaning in SEPA

Other than e-commerce, most of the online world clears in Europe, especially in the more so-called complex industries. And Visa considers this a problem. They don’t want the whole world to clear at the same banks. So, they have a rule that a company most clear at a bank from the same country. Due to EU law, they had to consider all the EU member states as one country, which led to intense competition because there are so many of them which made the market very attractive to operate in. But the business was not actually done in Europe – they just open a shell company in the EU.

Now, they are going to look at where the business is being managed in order to determine your country of operation. So if the actual website is managed from the Marshal Islands, it doesn’t matter that you have a UK shell company any more. So if you are a Marshal Islands company you have to clear transactions in the Marshal Islands, and that’s a problem because there is no one to work with there. The lawyers that advise to open companies in such markets, because it is easier or cheaper, don’t know this.

People will need to adjust to the new situation. We hear about clearing companies that say that it does not affect them – which is like saying that the driving speed limit does not apply to me because I did not get a fine yet.

To satisfy Visa, you will need to show that you are really in Europe, meaning in SEPA. You need to have a real office address, not a mailbox or an address that they can see on Google street view is a parking lot or the middle of the river. You need to be registered in the country you say you are in. And you need to have a call center with an IP that is from that country as well. Companies that are regulated with CySEC usually follow these already.

Fibonatix

Getting results

In binary options, if on average about 65-85% of card deposits go through, this is considered good a performance. It varies greatly by the different markets. In Europe for example, the success rate is higher and in the developing world it is lower. As a clearing company, we offer payments optimization because this makes a big impact. We see clients that work with three banks and just divide the deposits among them equally without thinking about it. We see from our analyses that by simply sending each bank the transactions from the countries they are best suited to handle, a simple thing, we can improve sales revenue by 10%.