Real-time payment is now an important factor in the global economic growth. According to the latest research, these instant transactions could increase global GDP by $285.8 billion by 2028 and create over 167 million new bank account holders worldwide.

Economic Impact

According to ACI Worldwide, real-time payments are improving economies by allowing money to flow between consumers and businesses in seconds instead of days. This efficiency cuts transaction costs and helps bring segments of the informal economy into the formal financial system.

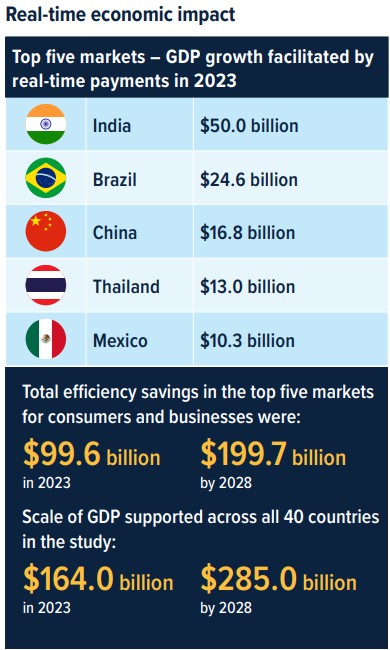

In 2023 alone, these transactions reportedly contributed $164 billion to global GDP, equivalent to the labor of 12 million workers. By 2028, this contribution is projected to jump to $285.8 billion, a 74.2% increase over five years.

The growth is driven by the fact that real-time payments save money. Consumers and businesses globally saved $116.9 billion in transaction costs in 2023, a figure expected to reach $245.8 billion by 2028. As the adoption of real-time payments grows, these savings could fuel economic productivity and create a ripple effect globally.

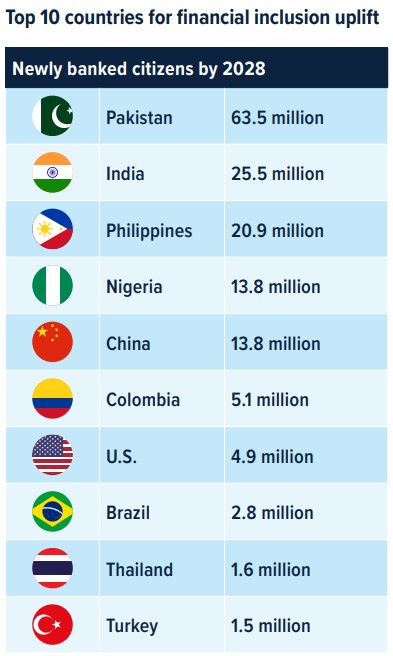

By 2028, over 167 million people who were previously unbanked are expected to have opened accounts in the 28 countries studied for financial inclusion. Emerging markets stand to gain the most. In countries like Pakistan, India, and the Philippines, the expansion of real-time payments is projected to create millions of new bank account holders, the report highlighted.

Pakistan leads with 63.5 million new accounts expected, followed by India with 25.5 million and the Philippines with 20.9 million. These newly banked citizens represent new opportunities for financial institutions.

Profitable Opportunities for Banks

Financial institutions stand to benefit enormously from the rise of real-time payments. The expansion of real-time payments, especially in emerging markets, creates a significant revenue opportunity for banks.

The profit potential from this transformation is estimated at $173 billion in Pakistan alone by 2028. Other countries such as Nigeria ($40.4 billion), the Philippines ($28.7 billion), and India ($24.6 billion) also present massive opportunities.

Banks are also benefiting from regulatory frameworks that promote real-time payments. For instance, Brazil’s central bank mandates real-time payment services for all banks through its PIX system. In India, real-time payments added $50 million to GDP in 2023, with forecasts predicting $3.6 billion in additional GDP by 2028 in Indonesia, one of the fastest-growing markets.

Nigeria, Africa’s largest real-time payments market, experienced $7 billion in GDP growth from these transactions in 2023. The country leads in profit potential for banks and is projected to generate $40.4 billion in profit opportunities by 2028.