In the wake of a disturbing incident involving AI-generated explicit images of Taylor Swift circulating online, the ramifications of deepfake technology extend beyond celebrity privacy concerns and into the realms of identity verification within the banking industry.

This unsettling episode underscores the potential threat posed by hyper-realistic deepfakes, capable of convincingly mimicking individuals, to financial institutions' identity verification processes.

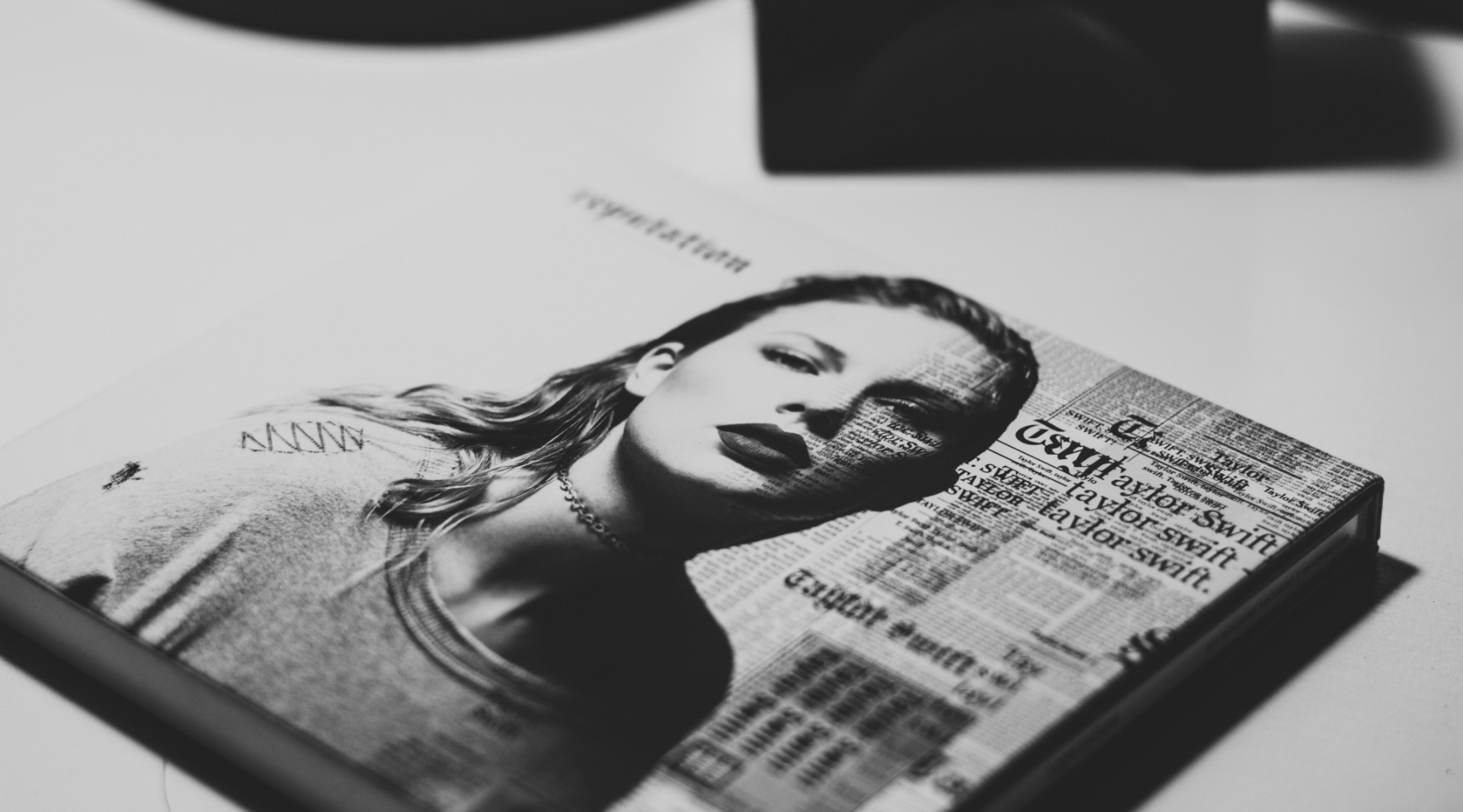

The Taylor Swift deepfake controversy unfolded on various social media platforms, raising questions about the security of personal information and the susceptibility of identity verification systems to advanced AI manipulation.

While the incident centered around explicit content, the implications for the banking industry are profound, given the potential for malicious actors to exploit deepfake technology for unauthorized fund transfers or fraudulent account access.

6 Ways of Mitigating the Deepfake Menace in Banking

Financial institutions must proactively address the looming threat of deepfakes by implementing robust mitigation strategies. Here are key measures to fortify identity verification processes and safeguard against the malicious use of AI-generated content:

- Advanced biometric authentication: Integrate advanced biometric authentication methods that go beyond traditional means. Utilize facial recognition technology, voice biometrics, and behavioral analytics to create a multi-layered authentication process that is more resistant to deepfake manipulation.

- Continuous monitoring for anomalies: Implement real-time monitoring systems capable of detecting anomalies in user behavior and interactions. Unusual patterns or sudden deviations from typical user activities could signal a potential deepfake attempt, prompting immediate investigation and action.

- AI-powered detection tools: Leverage AI itself to combat deepfake threats. Develop and deploy sophisticated AI-powered detection tools that can analyze patterns in audio and video content to identify signs of manipulation. Regularly update these tools to stay ahead of evolving deepfake techniques.

- Educate users on security awareness: Raise awareness among banking customers about the existence of deepfake threats and the importance of securing personal information. Provide guidance on recognizing potential phishing attempts or fraudulent activities, emphasizing the need for caution in online interactions.

- Stricter content policies: Collaborate with social media platforms and other online communities to enforce stricter content policies, especially regarding AI-generated content. Advocate for clear guidelines and prompt removal of potentially harmful deepfake material to prevent its dissemination.

- Regulatory compliance and collaboration: Work closely with regulatory bodies to ensure that identity verification processes align with evolving standards and guidelines. Collaborate with industry peers to share insights and best practices in combating deepfake threats, fostering a collective approach to security.

Conclusion

The integration of advanced technologies like AI brings immense benefits but also introduces new challenges. The specter of deepfakes highlights the critical importance of proactive measures to secure identity verification processes in banking, ensuring the trust and confidence of customers while mitigating the risks posed by malicious exploitation of AI-generated content.