In a year that has been largely summarized by hardships and uncertainty, we have seen FinTech push to the forefront. In an industry that is typically characterized by adaptability and tenacity, start-ups and unicorns alike have recognized their opportunity to demonstrate the appeal of their products and services in an ever-digitalizing world.

So, here is what the world has brought us in terms of FinTech innovations, there are obvious winners here, we took the liberty to mention the earners of these times.

Throughout the ongoing quarantines, travel restrictions, work from home transitions and everything else 2020 has thrown at us, people have spent more time than ever online. While most businesses are still unsure of the total damage the global pandemic has ravaged on their current and future prospects, many FinTechs have accelerated their preceding growth trajectory.

From March until June this year, things moved somewhat slowly as the global economy nearly shut down and uncertainty was at its peak. However, CB Insights reported $10.2B of VC funding into FinTech during Q2, which is consistent with the original trends. Q3 also saw $10.6B of VC funding, which indicates steady growth and stability, even in difficult times, and the leaders of these rounds were Digital Banks such as Monzo, N26, Nubank Chime and Lili who tracked the attention of the investors and customers alike.

While the traditional retail banking approach suffered heavily, challenger banks have capitalized on people’s inability to bank conveniently in-person. Their greatest value proposition is the ability to control your finances

Nir Netzer

completely, from your phone or computer and this has never been more relevant. As a result, these services were able to severely increase their user bases and move towards a multiple product offering.

Chime and Varo have both grown significantly this year and now offer a full suite of financial services to their users; these include early pay access, high yield savings, cash advances and more. Another brilliant move in this space was made by Lili, which offers mobile banking services for freelancers in a vertical focused offering that cannot be ignored.

PayTech was already taking precedence in our globalized economy but adding a factor that makes transacting in cash a physical danger certainly has helped with adoption. Though at first consumers and businesses were the targets of PayTech, the pandemic has forced governments and central banks to utilize these services as well. With the valuation of Bitcoin hitting an all-time high of $19,834 USD lately, it is no wonder that PayPal announced that they will begin to allow users to buy, hold and sell cryptocurrency. They are even planning on making it available to their 26 million merchants worldwide, which means that cryptos are here to stay in the PayTech scene.

Major FinTech players like Square and Stripe are setting the trends and heavily influencing young PayTech start-ups. Building out the real-time Payments infrastructure is becoming a considerable priority in the modern world, and the benefits are endless. But, start-ups like Openblocks are the ones who are bringing the exciting news to the discussion. They normalize Cryptocurrencies for transaction purposes by bringing a universal payment solution for mass-market adoption, turning cryptocurrency into real usable money and transforming existing credit cards into 'digital currency' enabled cards.

Another FinTech company that is getting ahead is Amaryllis. They are an industry-leading, payment infrastructure platform which provides Enterprises, ISVs and SaaS companies with the power to define their unique business processes and the flexibility to support evolving commerce models. They provide full support for alternative payments, including PayPal, Wallet (stored value accounts), virtual currencies, and locally preferred payment methods. They also provide currency pricing and conversion with Dynamic Currency Conversion (DCC), which enables rapid global commerce.

Covid-19 has brought a new wave of retail investors, when they now make up 25% of the stock market, up from just 10% in 2019. With that being said, WealthTech and Trading start-ups have seen quite the resurgence from what looked like an overall sector slowdown before the pandemic. CB Insights reports indicate Q2 and Q3 of 2020 both had $1.36B and $1.49B of VC backed financing, respectively, which is a marketed improvement of just $275M and $477M in Q4 of 2019 and Q1 of 2020, respectively.

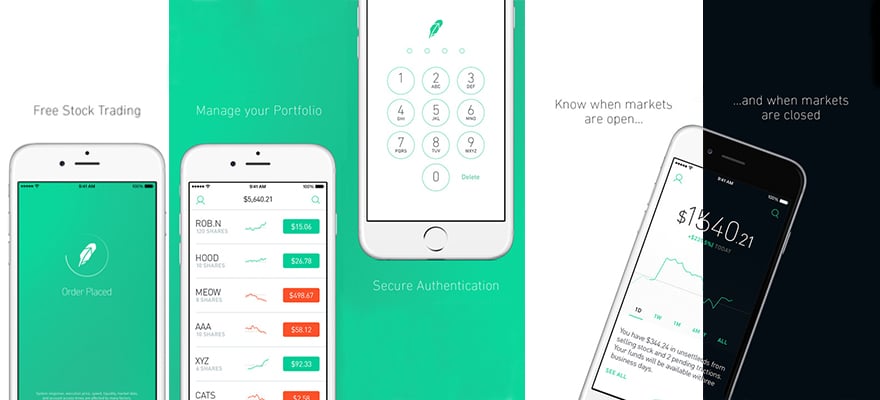

While the pioneering zero-commission trading platform and a very appealing fractional shares trading offer, Robinhood added 3 million users this year, many retirement planning start-ups have focused their attention on differentiating product offerings and specifying their target market. Whether you are an affluent working professional nearing retirement age or a young low-income earner, personal finance advice and education, as well as access to capital markets, is about to improve substantially.

Since the 2008 financial crisis, financial institutions have had to learn to comply with new regulations, which have created a massive boom in Compliance and Regulation Technologies over the last decade. This also encapsulates companies looking to minimize risks of fraud through cyber and biometric measures. Many of the top RegTech companies rely on big data and machine learning, coupled with intense algorithms to sniff out illicit financial activities like money-laundering, data breaches and cyber hacks.

Thetaray is one of the high-tech start-ups out there offering financial institutions easy implementation to their widely successful and proactive fraud prevention and AML technology. With more people and businesses participating in online marketplaces than ever before, this could not be more pressing.

InsurTech paints a similar picture of overall growth within FinTech but in a distinctive way. While CB Insights reports a near tripling of InsurTech funding from Q1 to Q3 ($978M to $2.56B), they also specifically cite five mega deals ($100M+) that contributed to this figure, accounting for just under half of the $2.56B in total funding. The biggest being Bright Health for $500M, and another super impressive round of $250M was made by Next Insurance in Q3.

This demonstrates that FinTech sectors are not immune to the habits of their overall market, as the insurance industry has always tended to favour more consolidation. This is especially apparent when we see big tech companies like Google and Amazon wriggle their way into the industry through subsidiaries and controlling partnerships.

While each sector within FinTech has had its own stories, the overall industry has thrived through innovation and creativity. We often see those tough circumstances bring out the best and the worst in people and true leaders emerge in a crisis.

As traditional finance faltered, FinTech companies came to the rescue and made valuable ground on collecting market share in their potential client bases. As new start-ups continue to emerge and FinTech evolves at this staggering pace, we have plenty to look forward to in 2021 and in the years to come.

Nir Netzer, CEO of Fintech Aviv