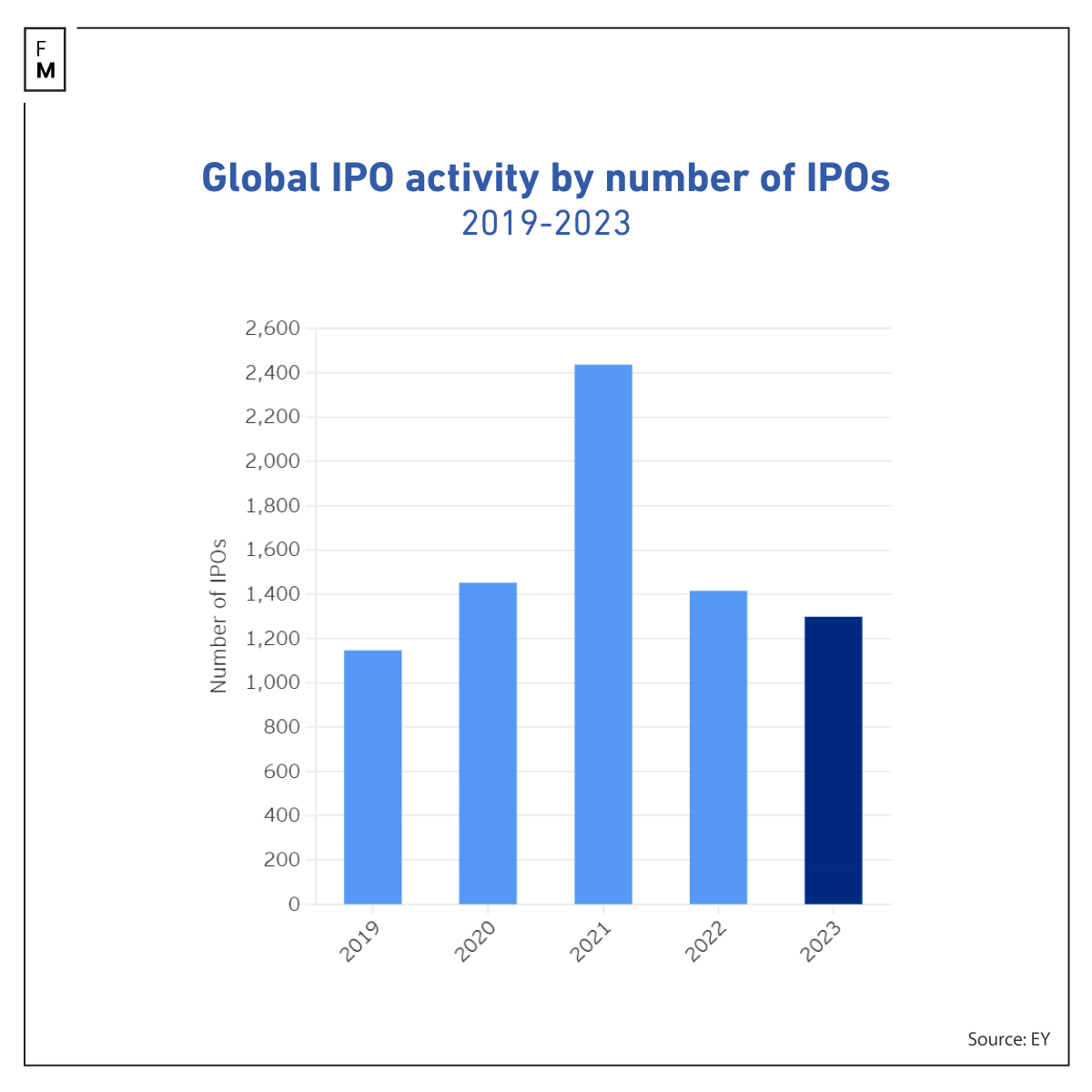

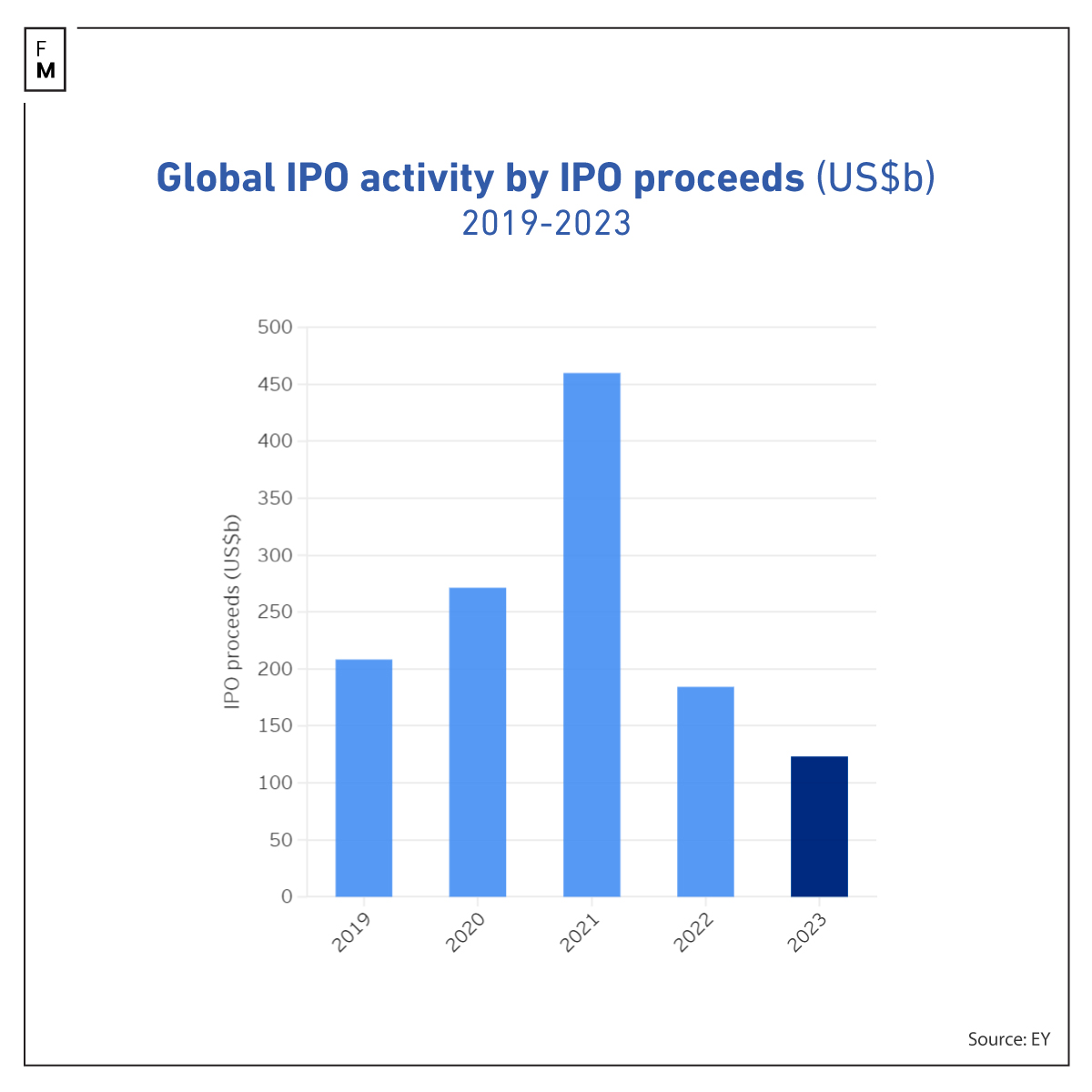

Global initial public offering (IPO) volumes fell 8% in 2023, while proceeds declined 33% compared to 2022, according to EY's Global IPO Trends 2023 report. A total of 1,298 IPOs raised $123.2 billion last year, compared to 1,415 offerings and $184.3 billion in capital in 2022.

Finance Magnates discussed the condition of the IPO market in the USA, Europe, and other parts of the world with George Chan, the Global IPO Leader at EY. Together, we sought answers to what companies planning to debut on the stock market in 2024 should do to achieve success.

Global IPO Activity Slows in 2023 despite Select Pockets of Growth

The decline came despite a market rally and low volatility in developed markets for much of 2023. However, aggressive monetary policies and investor fixation on mega tech stocks limited appetite for new listings.

The US and Europe have experienced numerous rate hikes since 2022, leading to a decrease in IPO volumes in these mature markets. However, as global inflation shows signs of easing this year, there's an anticipation that interest rate reductions might renew investor confidence. This could lead to more stable returns on IPO investments, potentially increasing market activity.

“In 2023, both the Americas and European markets grappled with stubborn inflation and aggressive monetary tightening, which drowned listings appetite,” Chan commented. “Geopolitical unrest and regional conflicts further compounded IPO market sentiment, diminishing risk tolerance essential for buoyant IPO environments.”

The wave of significant IPOs that emerged in September 2023 demonstrated lackluster performance after their launch. This reflected a persistent disparity in valuation expectations between issuers and investors, causing some companies to reconsider their public offering timelines.

Regional Perspective

The Americas saw improved activity, with IPO volumes up 15% and proceeds more than doubling from 2022. The US accounted for over 85% of the 153 deals that raised $22.7 billion. Larger deals, including seven that topped $500 million, drove the increase in proceeds.

“However, when comparing with 5-year average levels, the US market is still 36% behind by number and 66% by proceeds. The market has obviously seen some glimmers of momentum surface this year, especially with the debut of high-profile technology firms in late September,” added Chan.

Asia-Pacific dealt with economic and geopolitical headwinds as volumes fell 18% and proceeds 44% versus 2022. Mainland China and Hong Kong IPO markets continued declining amid slower economic growth.

“ASEAN saw upticks in IPO volume, although proceeds are modest with activity highly concentrated in Indonesia, Thailand and Malaysia. Japan IPOs gained momentum as supportive policies and booming stocks offered ideal listing conditions,” Chan continued.

Europe, Middle East, India and Africa (EMEIA) showed signs of recovery with a rise of 7% in deal volume, albeit proceeds dropped 39% with fewer large deals. The total number of EMEIA IPOs was 413, raising $31.1 billion.

“Many parts of EMEIA had better IPO returns, showing further signs of recovery. Many regional companies are ready to execute IPOs, while previously postponed deals may also re-emerge,” EY’s Global IPO Leader explained.

IPO Perspectives for 2024

As monetary policies potentially ease in 2024, IPO markets could attract more investors. However, sustained global tensions may curb confidence. IPO-bound companies should focus on strong fundamentals and reasonable pricing expectations to capitalize on any openings, advises EY.

“Overall, the global IPO market could improve over this year’s levels on the back of moderate inflation and potential interest rate cuts while hoping for a faster recovery of the Chinese economy and a soft landing of the US economy. However, lingering geopolitical instability may undermine confidence,” Chan added.

IPO activity in Asia-Pacific is expected to increase in the 2nd half of 2024. Given an unpredictable market environment, the 1H 2024 outlook in EMEIA is optimistic but cautious.

“In various countries, governments and regulators are taking steps to stimulate capital markets, which is a tailwind to the IPO activity,” EY’s expert added.

IPO May Not Be Enough

Companies aspiring to launch their initial public offerings in 2024 must be thoroughly prepared, taking into account several crucial factors. These include the current state and future trends of inflation and interest rates, the impact of government policies and regulations, the pace and nature of economic recovery, ongoing geopolitical tensions and conflicts, the significance of environmental, social, and governance criteria, and the dynamics of the global supply chain.

Moreover, they should “prepare high-quality equity stories with strong working capital management and a clear path to profitability to show confidence in revenue growth and favorable post-listing prices,” explained Chan.

Additionally, they should evaluate all available avenues, ranging from alternative IPO methods such as direct listings or dual and secondary listings to other financing strategies like private capital, debt financing, or trade sales.

“Consider a dual- or multitrack approach, including IPO and other financing methods (private capital, debt or trade sale),” the Global IPO Leader at EY concluded.

An IPO is still a good way for a company to raise capital, but the conditions we observed in 2021 may not repeat quickly. And, if you're wondering what an IPO looks like from a broker's perspective, check out our article "Why FX Brokers Do not Go Public."