In an industry where innovation can be challenging, 26 Degrees Global Markets (previously Invast Global) has launched Pairs CFDs, which allow the trading of index vs. index, commodity vs. commodity, or equity vs. equity, similar to forex pairs.

A New Product in the Trading Industry

The company announced the product today (Tuesday), claiming it is unique and that 26 Degrees is the first to offer it. Although the concept of Pairs CFDs has been around for a while, companies have just now started to offer such products.

“No one else in the world is currently offering what we have developed,” said Gavin White, Group CEO at Invast Global. “Our extremely talented team has built the technology whereby brokers can potentially offer their clients 100’s of new and unique Pairs, traded as a single position.”

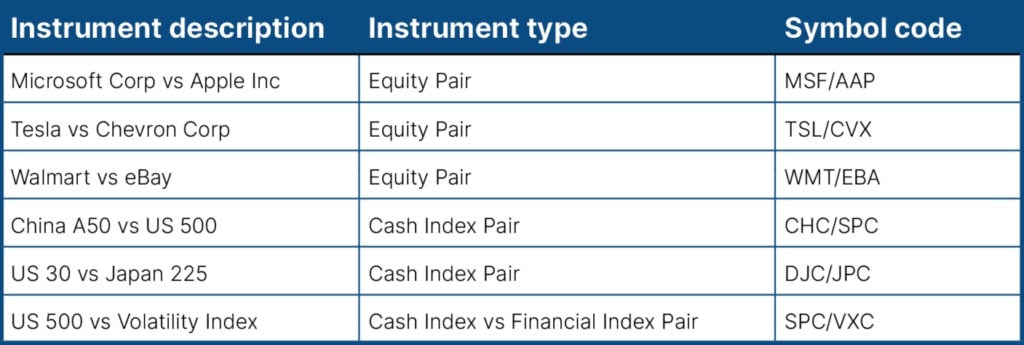

Developed in-house by 26 Degrees, the new products will be offered only to broker-dealers, who can then market them to retail traders. The company has launched the product with 20 Pair CFDs and plans to add new instruments in response to client feedback.

26 Degrees will provide the instrument via API from its trading servers in LD4, NY4, and TY3.

“Those initial discussions we have had with some of our key broker clients have been extremely positive and provided a lot of valuable insights,” Riana Chaili, 26 Degrees’ EMEA CEO, added. Specifically, the ability for brokers to request bespoke new Pairs and, within a short period, be able to show their clients a price in a unique instrument was well received and highlighted the sophistication and efficiency of the product build.”

Benefits Over Traditional Instruments

The company explained the advantages of Pairs CFDs, stating that these new products offer a simpler and more effective trading experience than traditional instruments. These products offer traders a single ratio of the two instrument prices, which move depending on the price fluctuations of the two separate legs, enabling them to manage risks with one trade instead of opening two separate positions.

These Pairs CFDs can be constructed to enhance or reduce volatility, depending on the instruments' correlation. Further, according to the company, these products offer greater margin efficiency than trading them separately with two positions.

“We believe this presents a significant opportunity for brokers to offer a bespoke suite of highly relevant Pairs instruments to their clients and stand out from their competitors,” White added.