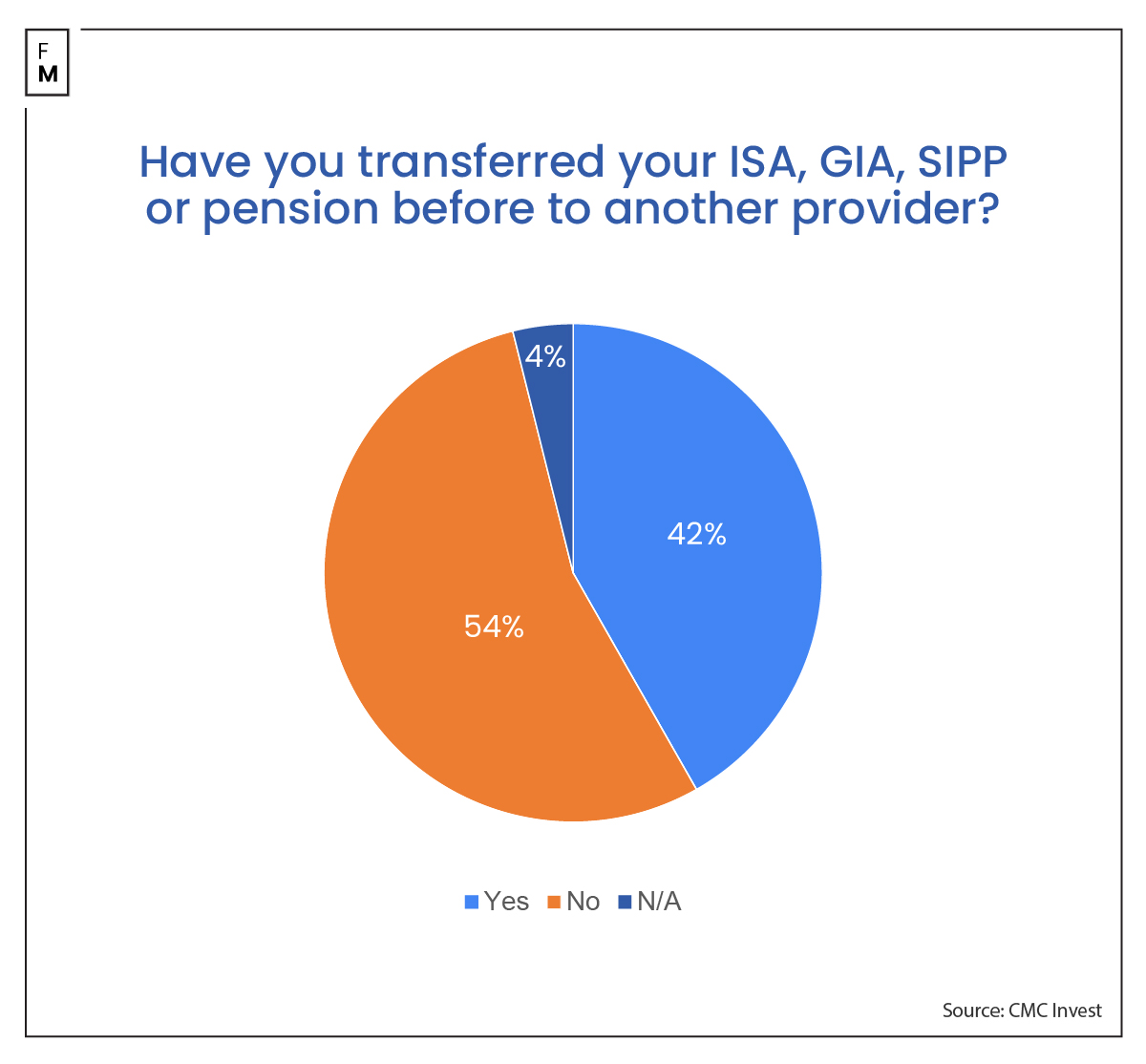

A concerning new report has revealed that the majority of UK investors face significant issues when attempting to transfer their assets between investment platforms and providers. The research by CMC Invest found that over half (54%) of investors surveyed have never switched providers. Of those who did transfer, around two-thirds (61%) experienced an issue.

Complicated Transfers Preventing Competition

The research found a quarter of investors with £10,000 or more investable assets who had not transferred before, said the complicated transfer process stops them from moving between providers of ISAs, GIAs, SIPPs and pension accounts. This could mean many long-term investors are missing out on lower fees, higher returns and improved features offered by newer investment platforms.

"The data points to an industry-wide issue. When moving money, investors shouldn’t have to accept that the process is going to be troubling or stressful,” Jason Law, the Investment Operations Manager at CMC Invest, commented.

The research also found a third (32%) of investors surveyed experienced increased stress about their money during a transfer process. An unsurprising finding when 32% cited delays when transferring. Issues contacting customer services (30%), poor communication (28%), and inability to track progress (25%) were also frequently cited by investors who had completed transfers previously.

The research highlights troublesome transfers as a systemic industry problem, with stress, delays and complexity putting investors off moving to potentially better platforms

Long-Term Investors Most Affected

Worryingly, the data showed investors who had been investing for over 10 years were least likely to have switched providers, with 63% never having transferred their assets before.

"It’s especially worrying if transfer woes are stopping people from moving platforms. To know that nearly two-thirds (63%) of those surveyed investing for longer than ten years have never moved platforms,” Law added.

This suggests those with the largest portfolios built up over many years have the most to potentially gain from moving platforms

Industry Collaboration Needed to Solve the Problem

Last year, CMC Invest launched an in-app transfer feature that allows moves to be completed digitally in 30 seconds. However, industry-wide collaboration is likely needed to solve this burning issue for investors fully.

"All providers need to address the issues investors are facing, otherwise we not only risk investors missing out on higher returns but potentially sacrifice industry innovation due to a lack of competition,” Law summarized the survey findings.

CMC Invest is a part of the publicly-listed CMC Group and was founded as the new stock trading platform back in October 2023. Since then, the company has expanded its offering adding Flexible ISAs and most recently opened its stock trading platform for Singaporean clients. The parent company currently estimates it will achieve a net income of £290-310 million in the fiscal year 2024.