Dutch bank ABN AMRO has announced an agreement to acquire BUX, a European neobroker founded in 2013. Under the deal, ABN AMRO will purchase BUX to expand its presence in the retail investment sector and enhance its digital offerings.

ABN AMRO to Acquire BUX

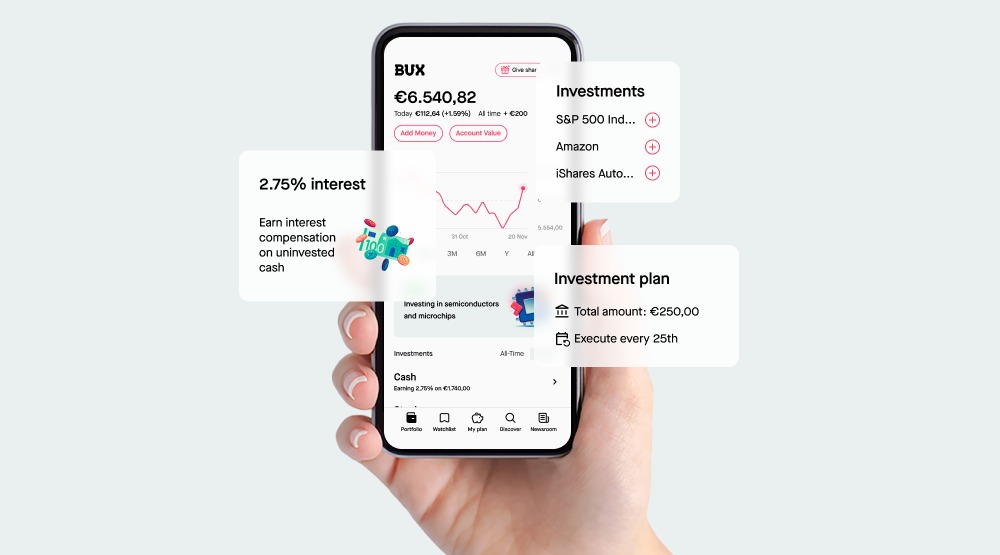

BUX currently serves over 500,000 clients across eight European markets. The company brings financial technology, an intuitive platform, and a brand that resonates with young investors to ABN AMRO. The acquisition will position the combined entity as the number one platform for new investors in the Netherlands.

ABN AMRO stated the deal supports its ambition to grow across Europe. Annerie Vreugdenhil, the Chief Commercial Officer, said the acquisition creates "a unique combination of innovative user-friendliness and financial strength, stability and expertise." This is seen as a foundation for future expansion in private investments for both clients and the bank.

“We believe that BUX’s speed, agility and drive for innovation, combined with ABN AMRO’s expertise in personal finance and reputation, is an unparalleled synergy in the investment sector,” Yorick Naeff, the CEO of BUX, commented.

The deal does not include BUX's cryptocurrency activities. It builds on an existing partnership between ABN AMRO and BUX that dates back to 2019. We also heard about the connections between BUX and ABN Amro in 2022, when the neobank hired former ABN executive, Niek van Rens as its COO. Also, in October 2023, the company revealed that it plans to sell its UK business, as it generates most of its revenue in the EU. At that time, the potential buyer's name was not disclosed, and it is unknown whether it referred to ABN Amro.

Completion of the acquisition depends on regulatory approval and is expected in 2024. ABN AMRO stated the transaction will have a minor impact on its CET1 capital ratio. The financial terms were not disclosed.

Recent Rebranding

Until May, the platform was known as BUX Zero, but a few months ago, it underwent a rebranding process. Additionally, last year, BUX rebranded its contracts for difference (CFDs) platform to Stryk, previously named BUX X. This move was part of the company's strategy to distinguish the brands of its CFDs platform and its zero-fee trading platform.

Regarding ABN Amro, we last wrote about the company sometime in the beginning of 2023. At that time, it announced that it had formed a partnership with Fireblocks to issue its first digital bond.