The UK Financial Conduct Authority (FCA) has issued a warning against a clone pretending to be the authorized firm Admiral Markets UK Ltd., the operator of Admirals retail trading brand. Over the past few years, this is at least the fifth clone of a popular broker.

FCA Warns against Admiral Markets Clone Firm

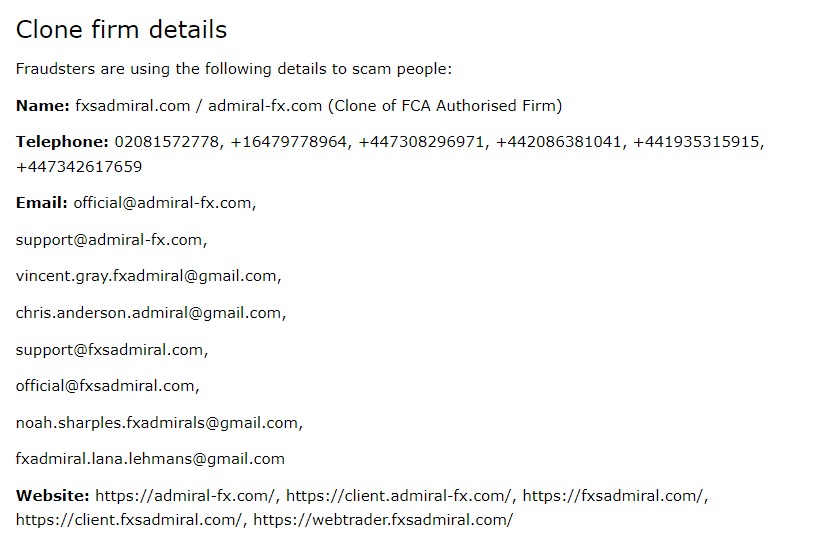

The FCA first published this warning on 17 October 2023 and updated it most recently on 4 January 2024. Fraudsters are using Admirals' details, including similar names, phone numbers and emails, to try to convince people their firm is legitimate when in fact it is not authorized by the FCA.

Scammers use a series of false email addresses and the websites admiral-fx.com and fxsadmiral.com, through which they offer retail investors from the UK and other parts of the world FX/CFD trading. However, the FCA has informed and warned that these have nothing to do with the official Admirals website available at admiralmarkets.com.

The scammers have been contacting people unexpectedly, pretending this clone of Admiral Markets is authorized, which the FCA calls it a "clone firm." Fxsadmiral.com and admiral-fx.com have no connection with the real Admiral Markets.

Although the clone sites differ from the original, unscrupulous players definitely want to mislead retail investors. They use the same logo as Admirals and claim to use the same London address and FCA license number 595450.

The regulator warns that scammers may change these details over time or mix them with Admiral Markets' real contact information to seem more legitimate.

How Many Clones a Charm?

It turns out this is not the first and certainly not the last clone of the Admirals. Admiral Markets is one of the companies most favored by dishonest actors. Finance Magnates has been reporting and warning about the firm's clones for at least seven years.

In 2017, the FCA cautioned about fraudsters impersonating the broker, and that same year, Admirals itself issued a similar warning. This alert was repeated the following year and then again in 2020.

In the meantime, the regulator from Malaysia has warned about a company impersonating Admiral Markets.

Other popular brands have fallen victim to copy-cats, too. In the last week of 2022, XTB and Hargreaves Lansdown were targeted, among others. The warnings were related to the British market.

Why Clone Companies Are Dangerous

Clone companies pose significant risks to retail traders for several reasons:

- Misrepresentation and fraud: Clone firms often impersonate legitimate companies, using their name, address, and Firm Reference number. This deception can lead retail traders to believe they are dealing with a reputable firm, making them more susceptible to fraud.

- Lack of regulation : Clone companies are not authorized or regulated by financial authorities.

- Increased risk of financial loss: Retail traders dealing with clone companies face a higher risk of financial loss. These firms may manipulate trading conditions, refuse withdrawals, or simply disappear with clients' funds.

- Exposure to high-risk products: Clone firms often promote high-risk trading products, like complex derivatives, without adequately explaining the risks. Retail traders, especially those inexperienced, may not fully understand the products they are trading, increasing the likelihood of significant losses.

- Personal data security: Engaging with clone firms risks personal data breaches. These companies might misuse personal information for other fraudulent activities or identity theft.

Retail traders should always verify the authenticity of a financial services firm before engaging in any trading activity. This includes checking the regulatory body's official register, confirming the firm's contact details, and being cautious of unsolicited offers or promises of high returns.