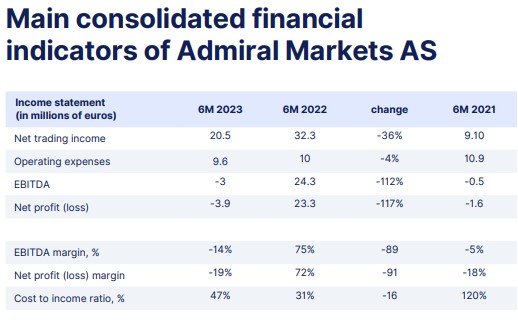

Admiral Markets has reported its financial results for the first six months of 2023, highlighting mixed performance during this period. Despite an increase in the number of active clients, the company posted a net loss of EUR 3.9 million.

A Surge in Active Clients

Admirals Markets experienced substantial growth in its client base, with active clients and accounts increasing 96% and 84% to 65,636 and 75,975, respectively. The number of new applications skyrocketed 222%. Besides that, Admirals' cost-to-income ratio rose 47%, reflecting the impact of reduced revenue on overall profitability.

Sergei Bogatenkov, Admirals Markets' CEO and Chairman of the Management Board, mentioned: "Our global team is open to new possibilities that the industry embodies. The creation of partnerships is crucial. Business-to-Business-to-Everything will be one of the keywords defining the future of value propositions, as it embodies the excellent potential for our business."

"We also believe mergers and acquisitions provide significant opportunities for Admirals to accelerate growth and extend our footprint in the industry."

In the first half of 2023, Admirals' commodity CFD products experienced a significant increase in contribution, accounting for 27% of total gross trading income. Conversely, the share of other products, such as stocks and ETFs, incurred losses.

Financial Position and Outlook

Admiral Markets AS has EUR 74.2 million in shareholders' equity. The firm's balance sheet comprises around 45% of liquid assets. During the first six months of 2023, the company's marketing expenses decreased 55%. Additionally, its value of trade dropped 4% to EUR 448 billion compared to the same period of 2022.

Currently, Admirals Group is undergoing a significant transition as Alexander Tsikhilov assumes the role of CEO, succeeding Sergei Bogatenkov, Finance Magnates reported.

As one of the brokerage's Co-Founders, Tsikhilov brings a wealth of experience to his role as the CEO, having previously served as the CEO and Chairman of the Supervisory Board. His return to the executive helm signifies continuity and a deep understanding of Admirals Group's trajectory.