A recent national survey has revealed that 42% of UK retail investors prefer to conduct their own research rather than rely on independent financial advisors (IFAs) or influential investors for trading inspiration.

UK Retail Investors Rely on Own Research over Advisors, Survey Finds

According to Capital.com findings, only 10% of traders and investors rely on financial advisors for investment direction, while 11% turn to social media platforms, influencers, or renowned investors like Warren Buffett for tips and inspiration.

When asked about their most frequently used trading and investment research resources, 21% of respondents cited news articles, while 28% relied on investing websites and platforms to generate trading ideas.

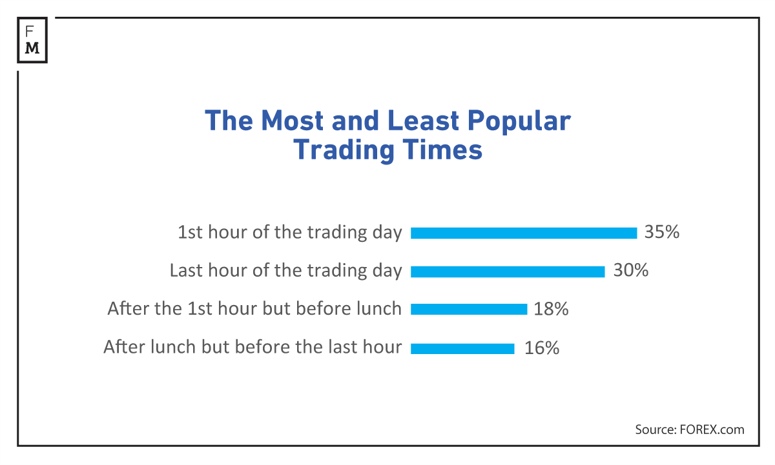

An earlier survey from last year examined when investors are most active. According to its findings, 35% of traders prefer the first hour of the trading day for executing trades. This is closely followed by 30% who favor the last hour. The least popular time is after lunch but before the last hour, with only 16% of traders opting for this period.

Growth and Tech Stocks in Focus

Despite the current high-interest rate environment and sluggish economic conditions, the survey indicates a strong interest in growth and tech stocks for the coming year. 28% of respondents plan to trade or invest in growth stocks, followed by tech (25%) and value stocks (22%).

Kyle Rodda, the Senior Market Analyst at Capital.com, attributed the interest in growth and tech stocks to the artificial intelligence boom, driving bullish sentiment and risk-taking among investors.

"In addition to the hype surrounding AI mania across the tech sector, investor interest in growth stocks was, for a while, also driven by rate cut expectations," Rodda added.

Notably, the survey suggests that UK traders and investors are losing interest in meme stocks, with only 4% of respondents likely to trade them this year.

Another study by Capital.com from last June revealed that traders who diversify their portfolios and hold positions for longer durations typically experience higher profitability. In contrast, those concentrating on a single market or close positions quickly often achieve less success.

Sectors to Watch in 2024

UK traders and investors closely monitor several sectors for potential investment or trading opportunities in 2024. These include technology (32%), energy (30%), financials (26%), metals and mining (15%), retail (11%), and automotive (8%).

Rodda explained that the focus on energy and mining sectors is due to heightened geopolitical risks, such as rising tensions in the Middle East and the ongoing Ukraine-Russia war, which have led traders to seek opportunities in volatile oil and natural gas markets.

“Investors and traders have also tapped into gold as a hedge against the escalating geopolitical tensions,” said Rodda.

In March, Capital.com announced that it was suspending the ability to create new accounts in the UK. A few weeks later, the company reported expanding its operations to the Middle East after obtaining a local license, which led to the opening of a regional office.

The survey, commissioned by trading platform Capital.com and conducted by Find Out Now, polled 19,451 UK adults, including 2,036 traders and investors, between November 21 and December 4, 2023. Investors and traders were defined as adults who had invested or traded in various financial instruments within the past 12 months.