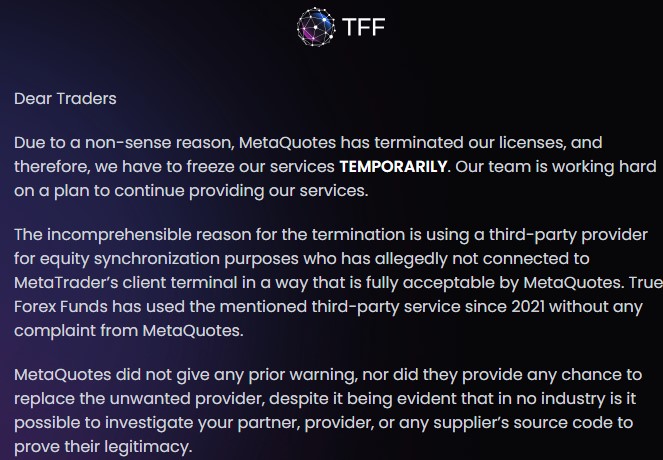

The prop trading firm True Forex Funds experienced a disruption after claiming that MetaQuotes, the operator of MT4 and MT5, terminated the licenses for its trading platform. This resulted in a temporary cessation of its services.

This development represents the second instance in recent months where a notable name in the proprietary trading sector for foreign exchange and contract for difference has faced disruption. It follows the shutdown of Canada's My Forex Funds by US and Canadian regulators last September.

True Forex Funds' CEO Pledges Resolution

In response to the disruption, True Forex Funds' CEO, Richard Nagy, expressed the team's commitment to finding a solution and continuing to serve its traders. Currently, the firm is persuading MetaQuotes to reconsider its decision while plans are being explored, including the potential migration of trading accounts to alternative brokers.

Despite the setback, True Forex Funds has reassured its traders that it will resume operations. The firm has urged traders to stay informed and prepare for potential developments, including the settlement of remaining payouts and the possibility of account migration.

Finance Magnates has contacted MetaQuotes and True Forex Funds for comments about the development, and this story will be updated as soon as we receive their feedback. Notably, True Forex Funds was flagged by the Commodity Futures Trading Commission last year.

The Proprietary Trading Paradigm

According to a recent post by Finance Magnates, proprietary trading firms operate on a fundamentally different model from Trader Funded Firms. They engage in active trading activities, leveraging their resources and expertise to capitalize on market opportunities. Besides that, the firms use quantitative strategies, act as market makers or liquidity providers, and are subject to regulatory oversight.

The misconception arises when trader funding programs are erroneously equated with proprietary trading firms. While both may share certain characteristics, such as evaluation processes and access to capital, the underlying business models and operational dynamics differ.

Last year, a US court partially granted the CEO of My Forex Funds' (Murtuza Kazmi) request, releasing approximately $100 million of his assets while retaining $12 million. This decision followed the submission of "first impression evidence" by the Commodity Futures Trading Commission against My Forex Funds, indicating deceptive practices within the company, Finance Magnates reported.

Additionally, the court discharged the temporary receiver earlier appointed, expressing confidence in the defendants' legal representation and compliance with court orders.