Retail investors face a complex marketplace in 2024 due to economic uncertainty, artificial intelligence (AI) innovations, and the upcoming US election. While AI captures the media spotlight, retail investors seem more cautious about its long-term potential.

This is according to the latest retail investor report by Public.com, which also highlighted that diversification remains a primary focus among investors.

AI Hype Fails to Excite Retail Investors

Despite AI-related companies, such as NVIDIA and OpenAI, dominating the financial news cycle, retail investors are not rushing to invest in AI-driven stocks. According to the survey, only 35% of investors say that AI technology excites them. Although a slight majority, 52%, are bullish on AI company performance, only 30% of investors have purchased stocks based on AI capabilities.

Retail investors remain split on their outlook for the economy. When surveyed, 35% expressed pessimism, 26% were optimistic, and 39% remained neutral. These mixed feelings seem to reflect broader market uncertainties, such as fluctuating interest rates and Federal Reserve actions.

Interestingly, 50% of investors reported that the Federal Reserve's economic data directly impacts their decisions, while the other half said it did not. One key factor influencing investor sentiment is the Federal Reserve's decision to cut interest rates. Nearly 43% of retail investors believe that rate cuts will shape their future investing strategy.

Unlike AI, the upcoming 2024 election appears to have minimal impact on retail investors' strategies. A large majority, 63%, report that their investment plans will remain unchanged regardless of the election's outcome.

The Future of Research

While retail investors remain wary of AI-driven companies, they are increasingly looking to AI tools to aid their research. Many see AI as a valuable resource for analyzing market trends and processing large amounts of financial data quickly. 64% of retail investors believe that AI will become a standard tool in the near future, and 50% are likely to use AI to process financial information.

Currently, traditional tools such as Yahoo Finance and Google Search remain more popular than AI-driven platforms. However, as AI technology evolves, more investors may turn to these tools to help inform their decisions.

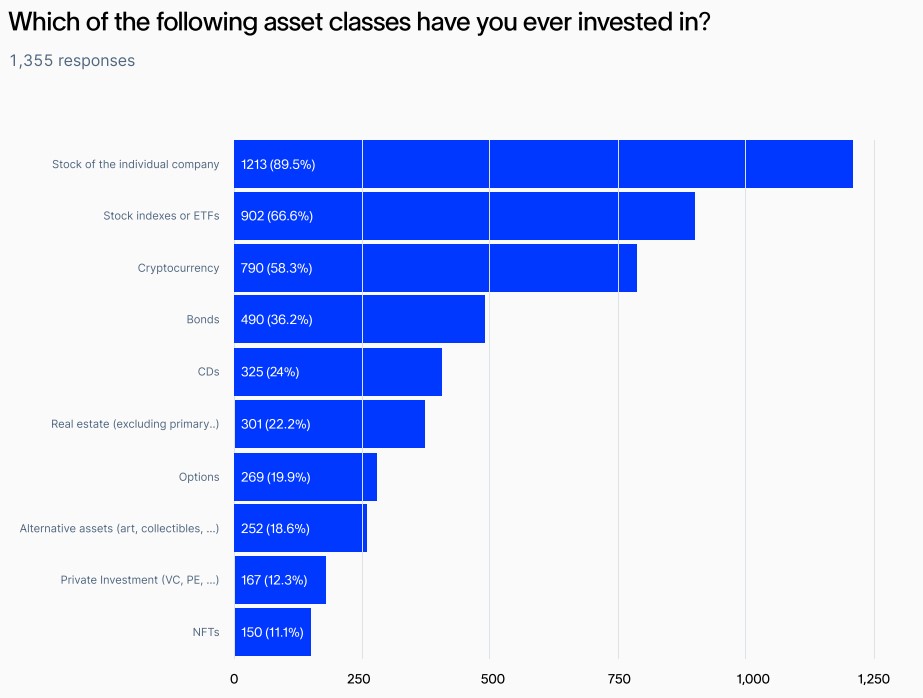

One of the most significant takeaways from the report is that retail investors continue to prioritize diversification. This trend remains a key strategy for 47% of investors, while only 18% said they were not diversifying. Fixed-income products have also gained popularity, with 22% of investors showing increased interest in this asset class, particularly as economic conditions fluctuate.