According to a complaint filed in a U.S. court in Chicago on January 7, 2014, thirty-one plaintiffs have alleged that on or before March 2, 2012, they were duped into converting loans made to Infinium Capital Holdings, LLC, an affiliate of their employer, Infinium Capital Management, LLC (Infinium) –and in some cases allegedly using their lifesavings – to participate in the Infinium Employee Capital Pool program also known as the Employee Equity Incentive Plan.

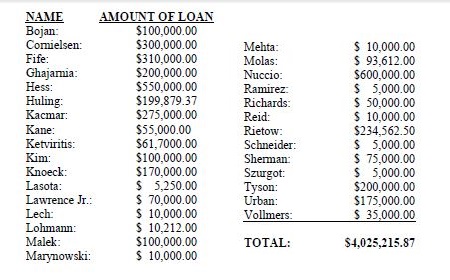

The plaintiffs accused the businesses and the individual defendants of securities fraud, breach of fiduciary duty and common law fraud, and seek $4,075,215.87, plus expenses, costs, prejudgment interest, and punitive damages, according to the case document titled Bojan v. Infinium Capital Holdings LLC, under index number 14-cv-00098, filed in the U.S. District Court in the Northern District of Illinois (Chicago).

Excerpt from the Case Document

Some of the Plaintiffs were later fired by Infinium, according to the description in the complaints' introductory paragraph.

Background, and Alleged Losses on Employee Capital Pool Plan

Forex Magnates has previously reported when online broker FXCM secured a $12M note to Infinium, and speculated that this may have been a means to acquire an ownership stake in Infinium and indirectly diversify into new markets and asset classes, if an equity ownership conversion rate was also included in the agreement.

Infinium is a well-known proprietary trading firm in Chicago's busy financial services community, known for its large number of commodity brokers close to the CME, CBOE, and CBOT commodity exchanges in downtown Chicago.

In November 2011, Infinium was ordered to pay $850,000 in total fines according to two case documents posted by the National Futures Association (NFA) which cited Trade Practice Cases at the CME and NYMEX.

NFA Fines Infinium on Same Day of Chicago Court Filed Complaint

Just three days ago, on the same day the above class action lawsuit was filed by the 31 defendants, the NFA imposed a fine of $5,000 on Infinium Capital Management Under NFA ID 0338588, with an effective date of January 7, 2014, and citing under Exchange Rule 22.22(b) regarding the submission of a Request for Quote (RFQ) while a Crossing Order in which Infinium was a party in transacting on the Electronic Trading System - on the ICE exchange

Described as a diversified alternative asset and Risk Management firm with offices in Chicago, Houston and London, according to its current website, Infinium was noted as a defendant along with Infinium Capital Holdings LLC, and Infinium Capital Management LLC, both Delaware limited liability companies, and George Hanley, Charles F. Whitman, Nathan Laurell, Gregory Eickbush, Brian Johnson, and Scott Rose.

An offer by the plaintiffs of 15 cents on the dollar to the defendants to settle, was unacceptable as told by the plaintiff's attorney Daniel Voelker to the Financial Times, as reported.

Reorganization Underway, Ongoing Negotiations With FXCM Continue

Reports by the Financial Times, said that Infinium’s Chief Executive Mark Palchak, who was not named as a defendant but mentioned by reference in the case document, had declined to comment, but how the company was undergoing a strategic reorganization and quoted Mr. Palchak as having said that his firm is in ongoing negotiations with FXCM about a potential transaction, and how it would not be appropriate to comment on specifics at this time other than to say that no formal offers have been made or rejected by stakeholders.

According to reports by Reuters, FXCM said that it has not yet made a formal offer for Infinium's assets, and how the lawsuit against Infinium, "Does not have a bearing on our transaction as it does not impact the assets we are proposing to acquire or the individuals who we would be hiring into our new entity," FXCM said, without specifying which assets it was interested in, as per coverage by Reuters.

According to public information on the Background Affiliation Status Information Center (BASIC) provided by the NFA, under the Commodity Pool Operator (CPO) registered for Infinium Asset Management LLC, which lists Infinium Capital Holdings LLC as a principal- amongst other key persons -the following 4.7 exempted funds have been filed:

P069759 INFINIUM CAPITAL GROUP LLC 4.7

P081892 INFINIUM CAPITAL MANAGEMENT LLC 4.7

P081895 INFINIUM CAPITAL MANAGEMENT LTD 4.7

P069777 INFINIUM GLOBAL OPPORTUNITIES FUND LLC 4.7

P069778 INFINIUM GLOBAL OPPORTUNITIES FUND LTD 4.7

HFT Under Pressure

On its corporate website, Infinium says its team is a mix of talent derived from over 70 universities, with traders accounting for slightly more than 50% of the firm, and how its market-making unit has grown into a significant industry presence by being the first to stream electronic quotes and provide Liquidity for Chicago Mercantile Exchange’s E-Mini S&P Options on the Globex platform, and the first to provide liquidity on several Dubai Gold and Commodity Exchange products, as well as on Dubai Mercantile Exchange’s Oman Crude product, and an early adopter of exchange cleared OTC energy products.

Infinium states that their algorithmic strategies trade momentary pricing anomalies (arbitrage) in the global marketplace and how advanced communication systems allow its traders to see market changes as they occur, while the use of sophisticated software adapts instantaneously to incorporate—and profit from—these changes.

In recent years the amounts of revenues that broker-dealers and proprietary trading firms have been able to extract on a volume-by-volume basis has dwindled for many firms -despite cheaper transaction costs, and even as volumes have picked up for some providers.

Pricing Models, Prop-Trading and Market-Making

The drop in revenue per contract or revenue per million has been attributed to the narrowing commissions and accompanying falling margins, and increased market efficiency causing once-effective strategies to be either obsolete or less productive (short-lived) as the market conditions have become more sophisticated/dynamic with regards to execution and price discovery (when looking at market-making operations). As far as pure proprietary trading using firm capital or a trader's own monies (that doesn't involve market-making) some trading strategies just fail to turn a net profit, even with lower transaction costs to save from eating away at any captured alpha.

In the end, HFT challenges, whether proprietary trading related or market-making related or both, also face regulatory pressures, with the latest concern being the mini flash-crash in the price of gold that was found to be due to an out of control algorithm, and not the fat-finger extra zero that was initially attributed to the large order of over 10,000 lots that wiped off nearly $30.00 within 60 seconds - only to almost fully recover within that time. The recent Volcker Rule that was passed, is also set to have an impact on proprietary trading and market-making for certain banks and dealers.

If FXCM decides to "buy the farm after the storm" - as the Nebraska-born investor Warren Buffett has been quoted as having said with regards to timing a buying opportunity during catastrophe - then it could be the catalyst to leverage its size and structure to compete on acquiring market share of the fiercely competitive US Commodity Futures and Derivatives Markets. Shares of FXCM closed down barely three-tenths of a percent in yesterday's trading session, following the news.