You may either love or hate it, but despite its controversies, prop trading could be the future of the retail trading industry and the direction in which the FX/CFDs are evolving. As a broker, you cannot simply stand by during these significant changes. Especially, the first CFD brokers have already started to offer their services in this space.

Modern Prop Trading Takes Center Stage

Modern prop firms enable retail traders to leverage substantial company capital without risking their funds. Interestingly, most trading now occurs with virtual funds, yet the profits are entirely real.

To participate, traders typically pay a small fee to undergo an evaluation process in which they demonstrate their trading skills through simulations. Those who succeed are granted access to a funded account and retain a substantial share of their profits, often between 60% and 80%.

"Prop trading is an excellent opportunity for aspiring traders to see if trading suits them, or for seasoned traders, it offers the chance to trade with higher funding levels, advanced technologies, and extensive market data,” said Crystal Lok, the Head of Emerging Markets at OANDA. Prop trading also provides learning opportunities for traders at any level, as the cost is only the entry fee for the challenge.”

Brokers Join the Prop Trading Space

Currently, four brokers previously known in the FX/CFD sector are now offering dedicated prop trading services. OANDA launched OANDA Labs Trader, Hantec Markets introduced Hantec Trader, IC Markets created IC Funded, and Axi, the first in this space, offered Axi Select.

A separate article details their services, the size of funded accounts, and the fees charged.

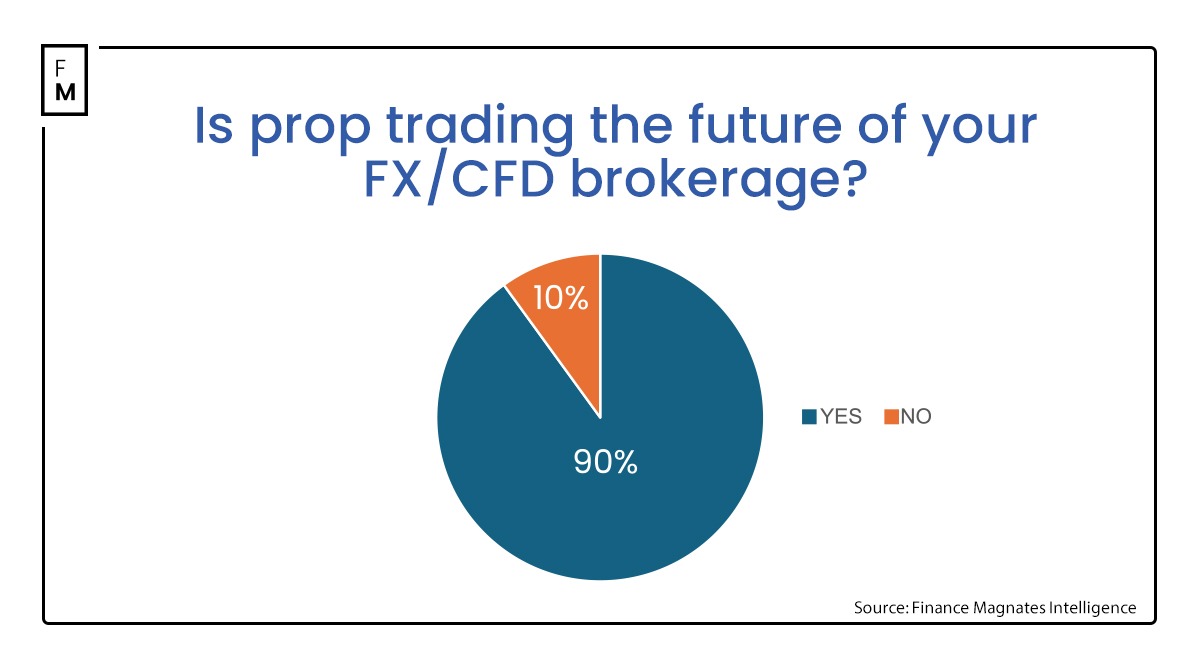

However, the most critical point is that according to discussions with industry representatives conducted by Finance Magnates, an overwhelming majority see prop trading as the future of retail trading .

"I believe this is evident," commented Maciej Wojciechowski, the Head of Business Development at OnEquity. "Brokers with a long-term, strategic approach to their business have identified a niche and promotional opportunity within the prop trading sector."

Prop Trading Emerges as the Future of FX/CFD Brokers

According to a survey by Finance Magnates, 90% of respondents believe that prop trading services will be the future for CFD brokers. By offering prop trading alongside traditional trading accounts, brokers can attract more clients.

"Over the past 18-24 months, this product has seen a significant increase in demand," observed Bashaar Gokal, the Operations Manager at Hantec Trader. "The recent industry disruptions have driven traders to seek out reputable institutions they can trust."

This development followed MetaQuotes' suspension of licenses for non-broker prop firms, which caused a wave of closures, service interruptions, and payment blockages.

Users of some of these prop firms have been waiting to access their funds for over three months.

This situation has allowed competing platforms and brokers to offer retail traders safer, regulated prop trading conditions, gaining entry into a new, unexplored market with lower client acquisition costs than in the CFD sector.

"Imagine you're a broker in a saturated market and you're offered a new product that lowers your client acquisition costs, increases the lifetime value of your traders, reduces entry barriers, KYC, and other regulatory admin, and boosts your ROI," highlighted Charlotte Day, the Creative Director at Contentworks Agency.

To learn more about how prop trading might change the FX/CFD landscape, we invite you to subscribe to our latest digital Quarterly Industry Report for Q1 2024. You will also find information on the trading volumes of the largest retail brokers.